Gold And Gold Miners: A Long-Term Perspective

Gold is likely to appreciate at a steady pace. I do not expect a dramatic meltup.

Economic growth will remain challenged for many years in developed economies.

Inflation will remain low across the globe for the foreseeable future. Inflation will not be the powerhouse behind the rise of the gold price.

Carefully-selected gold miner's valuations will appreciate faster than physical gold.

This post is divided into 2 parts:

Part 1 - Gold

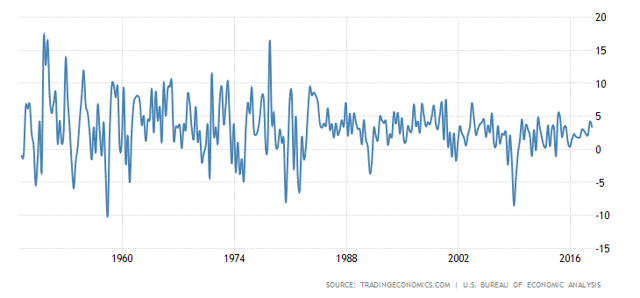

The 2 charts below sum up my positive view on gold. The first is the long-term chart of US nominal GDP growth.

US Nominal GDP

As you can see, nominal US GDP has been slowly falling since its post world war peak in 1973. The second is real US GDP, and this is falling faster than nominal GDP as inflation has been slowly falling.

As you can see, nominal US GDP has been slowly falling since its post world war peak in 1973. The second is real US GDP, and this is falling faster than nominal GDP as inflation has been slowly falling.

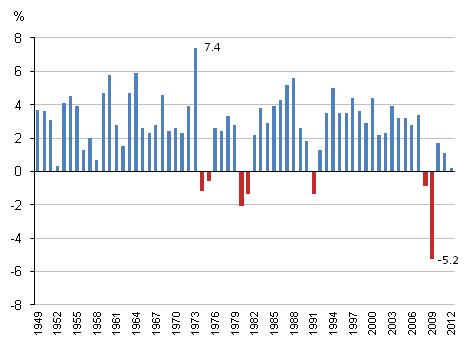

US Real GDP 1949-2012

The trend line of US growth is falling at approximately .7% of real GDP every decade since the 1973 peak. In the next decade, average GDP can be expected to fall by 0.7% as compared to the decade 2008-2018. Real GDP averaged 2.1% for the 2010s. If you include the recession of 2008, that figure comes down to 1.55%. However, the 2008 recession is a 'one-off' event, in my opinion, so I will use the 2010-2018 baseline. This means that GDP growth will average 2.1-0.7 = 1.4% for the decade 2019-2029. Such low rates of growth will mean low interest rates and large fiscal deficits for the next 10 years. This will cause the Federal Reserve to increase the size of its balance sheet over the decade (not reduce it). Money printing (as that is what Q.E. really is) rises all boats - stocks, real estate, commodities, collectibles, and gold. All of the above are now expensive, bar gold. Gold should, therefore, play catch up, and I would rather own it than any of the other assets.

The trend line of US growth is falling at approximately .7% of real GDP every decade since the 1973 peak. In the next decade, average GDP can be expected to fall by 0.7% as compared to the decade 2008-2018. Real GDP averaged 2.1% for the 2010s. If you include the recession of 2008, that figure comes down to 1.55%. However, the 2008 recession is a 'one-off' event, in my opinion, so I will use the 2010-2018 baseline. This means that GDP growth will average 2.1-0.7 = 1.4% for the decade 2019-2029. Such low rates of growth will mean low interest rates and large fiscal deficits for the next 10 years. This will cause the Federal Reserve to increase the size of its balance sheet over the decade (not reduce it). Money printing (as that is what Q.E. really is) rises all boats - stocks, real estate, commodities, collectibles, and gold. All of the above are now expensive, bar gold. Gold should, therefore, play catch up, and I would rather own it than any of the other assets.

Many commentators are predicting inflation to rise, with the Fed increasing the size of its balance sheet. I do not subscribe to this view. The world is following Japan's economic plan, delayed by approximately 10 years, and I do not expect the results to be any different. Here is the last decade of Japanese inflation,

| 2009 | 2010 | 2011 | 2012 | 2103 | 2014 | 2015 | 2016 | 2017 | 2018 |

| -1.4% | -0.7% | -0.3% | -0.1% | 0.3% | 2.8% | 0.8% | -0.1% | 0.5% | 1% |

This is the path that we are on. Many will argue that inflation this low will inhibit any rise in the gold price. This is partially true and is why I do not subscribe to the view that the gold price will rocket to unimaginable highs in the next 10 years. I think the uncertainty of low growth and the policies that governments will follow to try and counter this will cause a steady price rise. Goldman Sachs has an end 2019 prediction of $1,425 for gold. This seems about right to me, as it reflects a steady, if unspectacular, rise. If the present policies do not affect the path of real GDP, then confidence will eventually be lost, and that will cause a parabolic rise in the price of gold. I do not expect this phase to take hold in the next 10 years. Japan has been on this path for about 20 years, and confidence has not yet been lost. The US started Q.E. in November 2008, so there are another 10 years at least, if the Japanese model holds true. You may ask why I keep quoting Japan? To try and accurately predict the future, you need some lessons from history to go on. Japan is the only example of money printing on this scale in a stable, democratic country, that we have in our recorded history. It is our only source of the potential outcome of the present monetary experiment.

The implications of the above are that investors should not shun gold as an investment and should allocate some of their portfolio to owning gold. I am presently just as comfortable owning an ETF as physical gold. I do not think that physical gold will be required until confidence in governments is lost, and I do not expect this for many more years.

Part 2 - Gold mining shares

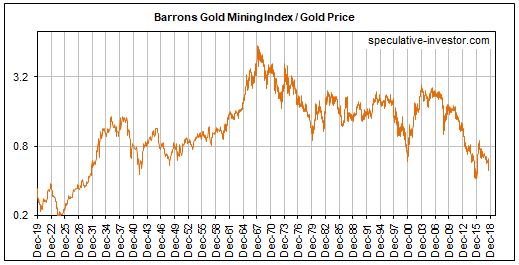

If gold appreciates over the next 10 years, then gold shares should appreciate by a greater percentage. This is the common wisdom, but it is not necessarily true. Below is a graph of the relationship between gold and gold mining stocks,

As you can see, there are large periods of time when gold outperformed the gold mining index. This highlights to me that you need to be very selective when choosing mining stocks. There have been 2 mergers of large mining companies in the last 6 months. Barrick Gold (NYSE:GOLD) merged with Randgold Resources and Newmont Mining (NYSE:NEM) merged with Goldcorp (NYSE:GG). This has created 2 very large gold mining groups. This is the Speculative Investor's take on large gold miners,

As you can see, there are large periods of time when gold outperformed the gold mining index. This highlights to me that you need to be very selective when choosing mining stocks. There have been 2 mergers of large mining companies in the last 6 months. Barrick Gold (NYSE:GOLD) merged with Randgold Resources and Newmont Mining (NYSE:NEM) merged with Goldcorp (NYSE:GG). This has created 2 very large gold mining groups. This is the Speculative Investor's take on large gold miners,

Gold, itself, is not afflicted by the rampant malinvestment that periodically occurs within the gold-mining sector. Regardless of what's happening in the world, an ounce of gold is always an ounce of gold. It is neither efficient nor inefficient; it just is.

I have steered clear of the large groups and do not see any value in their shares. I would expect that they will continue with the 'rampant malinvestment' mentioned in the article above. If the gold price continues to climb, they will be fine, but you might just as well hold gold and not take the mining risk. I, therefore, recommend selective miners with the following profile,

1. Low all-in sustaining costs.

2. An increasing production profile.

3. Healthy balance sheet.

4. Proven management.

5. Low price/book value and low prospective p/e (gold mining shares have been in a brutal bear market, and some have very attractive valuations).

Companies with this type of profile are hard to come by, and it is often the case that they are situated in areas with jurisdictional risk. This makes them more risky than the large miners stated above, but they are more likely to outperform, if the gold price is rising. SEMAFO (OTCPK:SEMFF), Alacer Gold (OTCPK:ALIAF), and Eldorado Gold (NYSE:EGO) fit most of the profile above. Kirkland Lake (NYSE:KL) fits the profile, but its present valuation is very high. Last, but not least, are the 2 gold mining ETFs, VanEck Vectors Gold Miners ETF (NYSEARCA:GDX) (the large gold miners) and VanEck Vectors Junior Gold Miners ETF (NYSEARCA:GDXJ) (the mid-sized gold miners). I would not buy the GDX for the reasons given above, but may in the future invest in GDXJ as it has some of the companies with the suggested profile.

Conclusion

Do not expect stellar gains in the price of gold but a steady price appreciation over several years. Any blowoff phase is many years away. Be selective in purchasing gold miners, and have a set of criteria that makes you believe that these companies will outperform gold. History shows that there were many periods where you were better to own gold, without the associated risk of mining failures and company mismanagement.

Disclaimer - This article is not intended as investment advice. Before taking any action, please do your own research. Do not rely on any opinions or facts included in this article for decision-making.

Disclosure: I am/we are long SEMFF, ALIAF, EGO, CGOOF, KGRSY. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Follow Jeremy Robson and get email alerts