Gold and Miners Are Not in Santa's Bag / Commodities / Gold and Silver Stocks 2020

Do you feel the Christmas spirit whenit comes to the yellow metal and miners? Because we don’t. Multiple signs overthe past few days point to bearish weeks ahead for gold and the gold miners.The VanEck Vectors Gold Miners ETF (GDX) - the most liquid vehicle forinvestors and traders to gain exposure to gold mining companies – is indicatingthat things are only about to go downhill from here and a lack of action fromoptions traders only serves to confirm that.

Despite rallying by 8.7% over a three-daystretch, the GDX traded sharply lower on Friday (Dec. 18), and yet again,failed to recapture its 50-day moving average (unlike gold). Moreover, GDX alsoclosed below its early-December intraday high, while the GLD ETF remained aboveits analogous price level.

The relative weakness (minersunderperforming gold) supports the following bearish thesis:

While gold corrected about 61.8% of itsNovember decline, gold miners declined only half thereof. In other words, theyunderperformed gold, which is bearish.

The GDX ETF moved to its 50-day movingaverage – the level that kept its rallies in check since early October. Canminers move above it? Sure, they did that in early November, but is it likelythat such a move would be confirmed or followed by more significant strength?Absolutely not. Let’s keep in mind two things:

Back in early November, the GDXmoved above the 50-day MA, when gold did the same thing, so if the GDX wantedto rally above this MA, it “should have” done so yesterday. It was too weak todo it.The early-November move abovethe 50-day MA was invalidated in just 2 days.Moreover, please note that theperformance of the GDX ETF from late-November to now looks like an ABCcorrection. This is not a bearish sign on its own, but it fits otherindications described today and this week in general. It increases the chancethat the top is already in or very, very close.

Another important development was thespike in volume during last Thursday’s (Dec. 17) upswing. It resulted in thelargest number of GDX shares traded since the November 6 top (on days when GDXis positive), and we all know what happened to GDX after November 6 (As a pointof reference, the four other highest volume days since the November 6 topcoincided with declines of 6.13%, 2.74%, 3.40% and 4.29%).

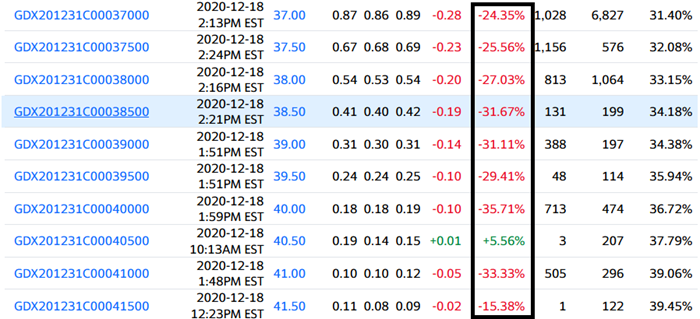

In addition, options traders aren’tbuying GDX’s rally. Despite put options (which profit when GDX declines)trading relatively flat, call options (which profit when GDX rallies) traded ata significant discount last Friday. Please take a look at the table below fordetails (courtesy of Yahoo! Finance)

The lack of demand among options tradersis another signal that last week’s rally is unlikely to continue.

Lastly, I’d like to share with you somethoughts on price targets.

How high could miners go? Perhaps only to the previous lows and by moving to them,they could verify them as resistance . The previous – October – low is at$36.01 in intraday terms and at $36.52 in terms of the daily closing prices. No matter which level we take, it’s notsignificantly above the pre-market price of $35.76, thus it seems thatadjusting the trading position in order to limit the exposure for therelatively small part of the correction is not a good idea from the risk toreward perspective – one might miss the sharp drop that follows. Please notehow sharp the mid-November decline was initially.

That’s almost exactly what happened – theGDX ETF rallied to $36.92 in intraday terms, and to $36.50 in terms of the daily closing prices. The breakdown wasverified in terms of the daily closing prices, which is more important thanwhat happened in intraday terms.

Consequently, the outlook is bearish asit seems that miners are ready for another move lower. There’s still a chancethat the precious metals sector would move higher based on a possibleshort-term decline in the USD Index, but this chance is slim, especially giventoday’s pre-market decline in both the USD Index and gold.

The next downside target for the GDX ETFis the February top in terms of the closing prices – $31.05.

Thank you for reading our free analysistoday. Please note that the above is just a small fraction of today’sall-encompassing Gold & Silver Trading Alert. The latter includes multiplepremium details such as the target for gold that could be reached in the nextfew weeks. If you’d like to read those premium details, we have good news foryou. As soon as you sign up for our free gold newsletter, you’ll get a free7-day no-obligation trial access to our premium Gold & Silver TradingAlerts. It’s really free – sign up today.

Thank you.

Przemyslaw Radomski, CFA

Founder, Editor-in-chief

Toolsfor Effective Gold & Silver Investments - SunshineProfits.com

Tools für EffektivesGold- und Silber-Investment - SunshineProfits.DE

* * * * *

About Sunshine Profits

SunshineProfits enables anyone to forecast market changes with a level of accuracy thatwas once only available to closed-door institutions. It provides free trialaccess to its best investment tools (including lists of best gold stocks and best silver stocks),proprietary gold & silver indicators, buy & sell signals, weekly newsletter, and more. Seeing is believing.

Disclaimer

All essays, research and information found aboverepresent analyses and opinions of Przemyslaw Radomski, CFA and SunshineProfits' associates only. As such, it may prove wrong and be a subject tochange without notice. Opinions and analyses were based on data available toauthors of respective essays at the time of writing. Although the informationprovided above is based on careful research and sources that are believed to beaccurate, Przemyslaw Radomski, CFA and his associates do not guarantee theaccuracy or thoroughness of the data or information reported. The opinionspublished above are neither an offer nor a recommendation to purchase or sell anysecurities. Mr. Radomski is not a Registered Securities Advisor. By readingPrzemyslaw Radomski's, CFA reports you fully agree that he will not be heldresponsible or liable for any decisions you make regarding any informationprovided in these reports. Investing, trading and speculation in any financialmarkets may involve high risk of loss. Przemyslaw Radomski, CFA, SunshineProfits' employees and affiliates as well as members of their families may havea short or long position in any securities, including those mentioned in any ofthe reports or essays, and may make additional purchases and/or sales of thosesecurities without notice.

Przemyslaw Radomski Archive |

© 2005-2019 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.