Gold and Silver Boosted by first Fedrate cut since Financial Crisis / Commodities / Gold & Silver 2019

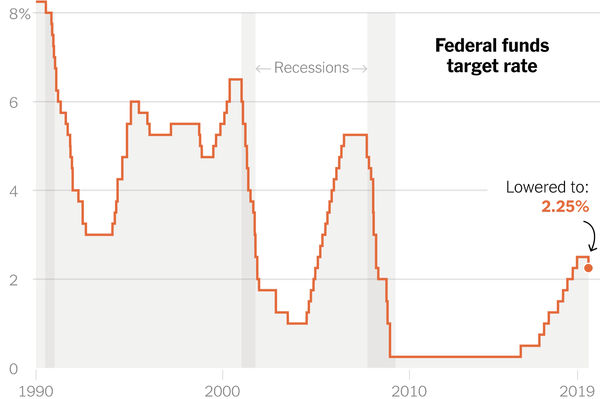

The Federal Reserve cut interest rates on Wednesday(July 31, 2019) for the first time in more than a decade.It was tryingto keep America’s record-long economic expansion going by insulating theeconomy from mounting global threats.

Source: US Federal Reserve

August 1, 2019, just a day after Fed rate cut.USPresident Donald Trump said the US would place a 10 per cent tariff on $300bn inadditional Chinese goods. This escalation of the trade war between Washingtonand Beijing is a new threat to the global economic outlook.The announcementunsettledfinancial markets continued on Friday and lead to a haven buying ofbonds and a broad equity sell-off.

Goldchart shows 6-year breakout above $1,380.Head and shoulder patternindicatesimminentreachingof $1,660

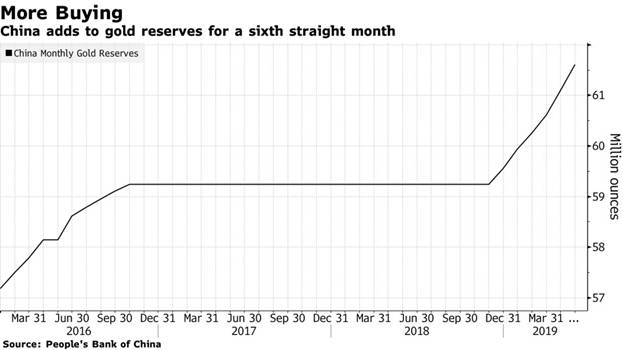

China isbuying more gold as the trade war drags on; Russia joins the party.

The rise China’s goldholdingreflects the Chinesegovernment’s “determined diversification” away fromdollar assets, according to Argonaut Securities (Asia) Ltd analyst Helen Lau.She added that retail demand has also picked up. At this rate of accumulation,China could buy 150 tons in 2019, she says.

“It’s a diversification away from the U.S. dollar,particularly given the trade tensions and the potential technology cold warthat’s evolving,” says Bart Melek, global head of commodity strategy at TDSecurities. “We have to remember that gold is nobody’s liability.”

Russia’s total gold reserves top $100 billion as central bankadds another 600K ounces in June

Russia bought 200,000ounces in May, 550,000 in April, 600,000in March, one million in February, and200,000 in January.

During the lastdecade, Russia’s gold reserves have gone from 2% to 19% (as of the end of 2018Q4), according to the World Gold Council.

Withcentral banks rushing tobuy gold,other institutions and retailers will surely follow.

Withreal estate crumbling, investors rush to gold and silver

Manhattan real estate had its worst first quartersince the financial crisis, according to a report from Douglas Elliman andMiller Samuel.Sales fell 3 percent in the first quarter, which markedsixth straight quarters of decline.That is the longest decline in the 30 years thatthe real estate appraisal firm has been keeping data.With the housing market toppling, it’s nosurprise investors are turning to gold and silver, the hard assets whose valuehas stood the test of time.

RayDalio says gold will be a top investment during the upcoming “paradigm shift”for global markets

Hedge fund multi-billionairekingpin Ray Dalio is seeing a case for gold as central banks (1) get moreaggressive with policies that devalue currencies and (2) are about to cause a“paradigm shift” in investing.

Dalio, the founderof the world’s largest hedge fund, wrote in a LinkedIn post that investors have beenpushed into stocks and other assets that have equity-like returns. As a result,too many people are holding these types of securitiesand are likely to face diminishing returns.

“I think theseare unlikely to be good real returning investments and that those that willmost likely do best will be those that do well when the value of money is beingdepreciated and domestic and international conflicts are significant, such asgold,” the Bridgewater Associates leader said.

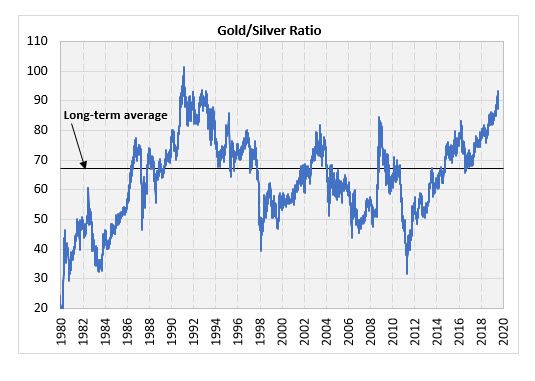

Silver issetto outperform gold based on gold/silver ratio, silver mining companies presentexcellent entry points.

At90, the gold/silver ratio is the highest it’s been in 25 years.The averagelevel since 1990 has been 67.

Source: Kitco.com

Silver outperforms after anextremely high gold/silver ratio reading. It averagesa gain of close to 10% overthe next year, when the gold/silver ratio is at the current level.

Source: Kitco.com

Silvercould hit $28 in the near term, catching up to gold.

With US presidential election coming in 2020 andthe Fed’s having little stomach for a market correction, analysts agree that thepath of least resistance for interest rates is down.

Rising silver price is bullish forsilver mining companies such as Prophecy Development CorpProphecy(TSX:PCY , OTCQX: PRPCF)

Prophecy’s Pulacayo-Paca project has30 millionindicated silver ounces, 21 millioninferred silver ounces; only 30% of theknown mineralization drilled. With 95 million Prophecy shares outstanding,investors are getting half an ounce of silver in the ground for every share ofProphecy.

Prophecy’s Pulacayo-Paca silver grades are at 256g/topen pit and 455g/t underground, rankingPulacayo near some of highest-gradesilver deposits in the world (silver resource and grade fromwww.prophecydev.com).

With past drill intercepts such as1,031 g/t Agover 25 meters (PUD 109), and 1,248 g/t Ag over 10 meters (PUD 118), Prophecyis preparing to drill Pulacayo-Pacain the fall; investors might justrediscoverthis silver giant sleeper in the midst of bullish silver run.

John Lee, CFA

jlee@prophecydev.com

August 5, 2019

John Lee, CFA is an accredited investor withover 2 decades of investing experience in metals and mining equities. Mr. Leeis the Chairman of Prophecy Development Corp (www.prophecydev.com).John Lee is a Rice University graduate with degrees in economics andengineering.

Disclaimer: The views expressed herein are those of theauthor and may not reflect those of Prophecy Platinum Corp. or Prophecy CoalCorp. The information herein is providedfor information purposes only, and is in no way to be construed as advice or solicitationto make any exchange in precious metal products, commodities, securities orother financial instruments. No warrantyexpressed or implied exists between the author of this article and the readeras to the accuracy of the information herein provided. The information contained herein is based onsources, which the author believes to be reliable, but is not guaranteed to beaccurate, and does not purport to be a complete statement or summary of theavailable information. Readers areencouraged to conduct their own research and due diligence, and/or obtainprofessional advice. Any opinionsexpressed are subject to change without notice. Prophecy Platinum Corp., Prophecy Coal Corp. andthe author of this article do not accept culpability for losses and/or damagesarising from the use of this article.

John Lee Archive |

© 2005-2019 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.