Gold and Silver Prepare For Another Price Advance / Commodities / Gold & Silver 2020

As we continue to near the November 3rd election day, Precious Metals have continued to trade within a narrow range suggesting price support is staying strong. It is my belief that potential downside risks for Gold and Silver will be relatively short-lived after the election. We believe the broad market decline witnessed on October 26, 2020, where the Dow Jones fell over 700 points, coupled with the fact Gold and Silver barely budged throughout the selloff, suggests support for Precious Metals has reached a “battle line”.

My research team has highlighted the current support and resistance price levels for both Gold and Silver on the charts below. We believe the initial support levels will hold up well throughout the pending election and that an upside breakout in both Gold and Silver are likely outcomes after the elections. Global traders and investors have already likely hedged their portfolios accordingly to attempt to eliminate risks, yet the fear of what is not known is one of the main drivers of appreciation in Precious Metals.

When the global markets become unsettled and traders/investors are unable to see clearly and identify a forward perspective, then Precious Metals start to shine. We explored this relationship last month in our article entitled Gold & Silver Follow Up & Future Predictions For 2020 &2021 Part I and Part II.

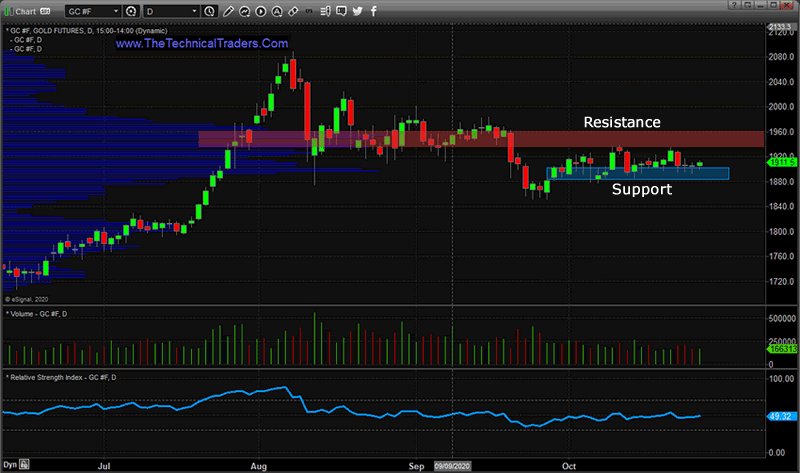

GOLD SUPPORT NEAR $1885 MAY LAUNCH NEW WAVE OF APPRECIATION

The Daily Gold Futures chart below highlights the current Support and Resistance areas. We believe the current Support level is rather solid and that Resistance will be tested and broken on or after the November 3rd election day. If this were to occur, we would expect this to prompt a rally back above $2050 or beyond. Ultimately, the recent lows near $1850 will attempt to act as a hard price floor for Gold, yet we believe the current price activity suggests major support near $1885 is quite strong and may propel an upward price advance soon.

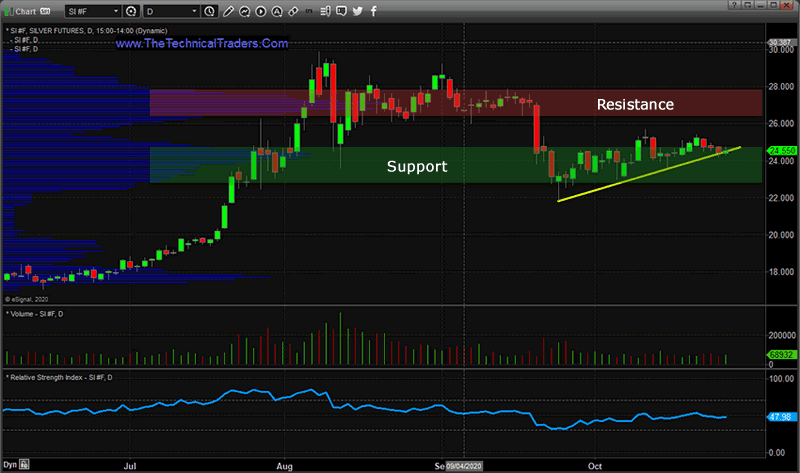

SILVER SUPPORT NEAR $22.50 MAY PROMPT STRONG RALLY

The following Daily Silver Futures chart also highlights the Support and Resistance levels we’ve identified for Silver. They are very similar to the levels on the Gold chart, yet the Silver chart has also set up an upward sloping lower price channel that suggests price appreciation is already taking place in Silver. It is important to understand how the relative price change between both Gold and Silver creates a “ratio” that is followed by many traders (see the last chart in this article). We believe the Gold to Silver ratio will likely fall below 60 fairly quickly after the elections in November – prompting both Gold and Silver to rise substantially.

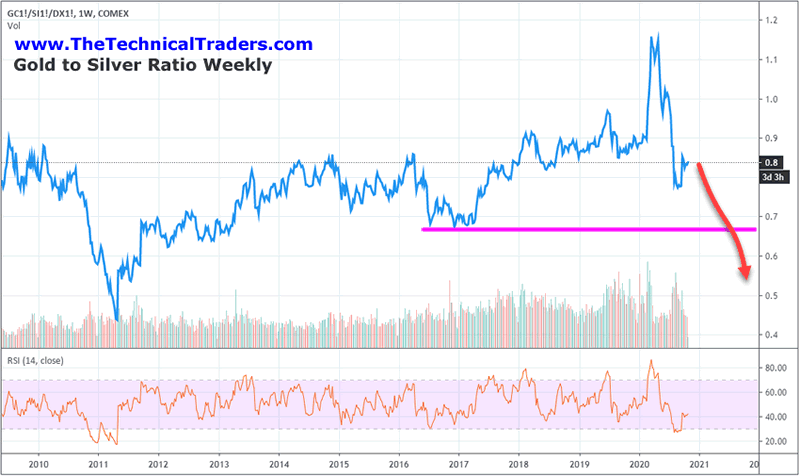

GOLD-TO-SILVER RATIO SHOWS UPSIDE POTENTIAL

This Weekly Gold-to-Silver Ratio chart highlights our expectations related to the advance of both Gold-to-Silver near and after the US elections. Check out our previous research on the Gold-to-Silver ratio that explains this important indicator in more detail. Pay attention to how the peak in Gold-to-Silver in 2011 drove the ratio level to a bottom near 43. We don’t believe that type of move is setting up quite yet, but we do believe a move below 60 in the ratio is likely after the November elections. This suggests that a $650+ rally in gold and a $16+ rally in Silver are very strong potentials if our modeling is accurate.

My team and I have already identified the trigger confirmation setups that we need to see before initiating any new trades in Precious Metals. We believe we already know how these future rallies will take place and the setups with the best entry points. The opportunities for traders after the elections are forming now if you know where to look for them. Join the Technical Trader research service today to get the pre-market video report delivered to your inbox every day, which will walk you through the charts of gold, silver, and other assets as well as potential trade setups.

Chris Vermeulen

www.TheTechnicalTraders.com

Chris Vermeulen has been involvedin the markets since 1997 and is the founder of Technical Traders Ltd. He is an internationally recognized technical analyst, trader,and is the author of the book: 7 Steps to Win With Logic

Through years ofresearch, trading and helping individual traders around the world. He learnedthat many traders have great trading ideas, but they lack one thing, theystruggle to execute trades in a systematic way for consistent results. Chrishelps educate traders with a three-hourvideo course that can change your trading results for the better.

His mission is to help hisclients boost their trading performance while reducing market exposure andportfolio volatility.

He is a regularspeaker on HoweStreet.com, and the FinancialSurvivorNetwork radio shows. Chriswas also featured on the cover of AmalgaTrader Magazine, and contributesarticles to several leading financial hubs like MarketOracle.co.uk

Disclaimer: Nothing in this report should be construed as a solicitation to buy or sell any securities mentioned. Technical Traders Ltd., its owners and the author of this report are not registered broker-dealers or financial advisors. Before investing in any securities, you should consult with your financial advisor and a registered broker-dealer. Never make an investment based solely on what you read in an online or printed report, including this report, especially if the investment involves a small, thinly-traded company that isn’t well known. Technical Traders Ltd. and the author of this report has been paid by Cardiff Energy Corp. In addition, the author owns shares of Cardiff Energy Corp. and would also benefit from volume and price appreciation of its stock. The information provided here within should not be construed as a financial analysis but rather as an advertisement. The author’s views and opinions regarding the companies featured in reports are his own views and are based on information that he has researched independently and has received, which the author assumes to be reliable. Technical Traders Ltd. and the author of this report do not guarantee the accuracy, completeness, or usefulness of any content of this report, nor its fitness for any particular purpose. Lastly, the author does not guarantee that any of the companies mentioned in the reports will perform as expected, and any comparisons made to other companies may not be valid or come into effect.

Chris Vermeulen Archive |

© 2005-2019 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.