Gold and Silver Reversals - Impossible Not to Notice / Commodities / Gold & Silver 2019

Whata remarkable day Friday has been! Going into the U.S. session open, we haveseen gold challenging its early-June highs. The barrage of geopolitical newshas been deafening and gold had literally nowhere to go but up. But something“unexpected” yet totally predictable happened to those who have jumped on thegold bandwagon. Friday’s U.S. session has sent gold lower. On huge volume. Andnot only gold, that is. Those looking at the charts’ bigger picture, thosefamiliar with our analyses, hadn’t been surprised. Now that the dust is settledand gold pushes lower, let’s examine the aftermath. And draw lessons for thedays ahead.

Whata remarkable day Friday has been! Going into the U.S. session open, we haveseen gold challenging its early-June highs. The barrage of geopolitical newshas been deafening and gold had literally nowhere to go but up. But something“unexpected” yet totally predictable happened to those who have jumped on thegold bandwagon. Friday’s U.S. session has sent gold lower. On huge volume. Andnot only gold, that is. Those looking at the charts’ bigger picture, thosefamiliar with our analyses, hadn’t been surprised. Now that the dust is settledand gold pushes lower, let’s examine the aftermath. And draw lessons for thedays ahead.

GoldReverses

Friday’sreversal was the most important development of the previous week. Initiallygold rallied on Iran-related note and went on to rise to its long-termresistance. Shortly after touching the resistance line, gold topped right inthe middle of the targetarea that we first mentionedto our subscribers on June 7, and then onJune 10 within the free gold article on our website.

Andit took place on huge volume.

Notonly that – the RSIindicator is very close to the 70 level and the reversal took place right before gold’scyclical turning point. What else happened? Gold movedto new 2019 highs but only in intraday terms. If we focus on the closingprices, which are more important in some ways, this was gold’s third highestclose of the year. From this perspective, the true high was formed in February,the early June high was a failed attempt to move above it, and we can say thesame thing about Friday’s price action. In fact, Friday’s movement, was – byitself – a failed attempt to close above the early-June highs.

Thecombination of gold’s reaching the very long-term resistance line, theimmediate invalidation of the breakout to new 2019 highs, huge volume,proximity of the cyclical turning point, and RSI almost at the 70 level allsuggest that the 2019 top for gold is in.

Didwe see anything similar in silver?

Youbet.

SilverReverses, Too

Thewhite metal declined on Friday, while having temporarily outperformed gold onthe upside. This is as bearish as it gets in case of the silver – golddynamics. Big reversal on huge volume is a bearish sign for all markets, butseeing the above-mentioned specific relative performance makes it extremelybearish.

Silveris likely to move to new 2019 lows relatively soon. Perhaps even this month.

Beforemoving to mining stocks and the USD Index, we would like to show you a silverprice prediction technique that you might not remember.After all, we previously commented on it many months ago.

Thereason is that we simply don’t comment too often on the things that don’treally change. For instance, we like gold’s and silver’s fundamental picturewith the long-term in mind and we expect goldto move much higher in the following years. But it doesn’tchange from day to day, week to week, or even month to month, so that’s notsomething that we’re going to discuss very frequently.

Thesame is the case with silver’s very long-term cycles. This is something that isuseful every 2 years or so, which means that there’s little reason to discussit in the meantime. Now it’s a good time to get back to this topic, as the nextvery long-term turning point is just around the corner.

Turningpoints can work in both ways: they can be tops and they can be bottoms. All inall, it means that volatility is likely to increase and that something big islikely to happen. Given that silver is on a verge of breaking below the 2018and 2015 lows, this “something big” could be a massive decline. Thus, Friday’spowerful reversal might have been the start of something epic.

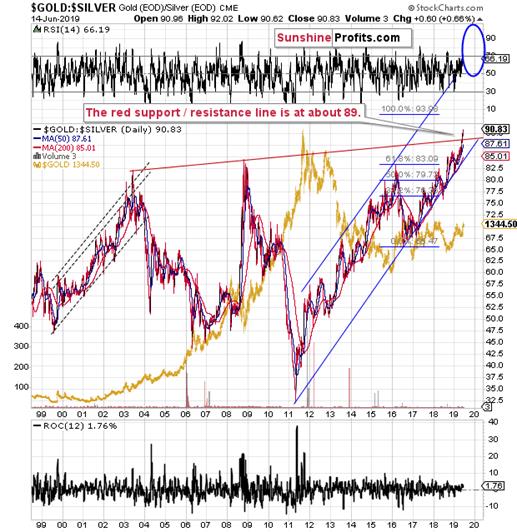

Whywould silver break lower instead of rallying? For instance, because gold istopping and the goldto silver ratio is after a major breakout.

Theratio is not only well above the 2003 and 2008 highs, but also above the risingline that is based on them.

Themassive moves in the precious metals market are characterized by bigmedium-term moves in the gold-silver ratio in the opposite direction. Forinstance, in 2008, the ratio soared as both precious metals declined, and in2011, the ratio plunged when both metals rallied. The current breakout pointsto a big, medium-term decline in the precious metals sector. Combining thisknowledge with silver and gold’sreversals and the looming silver long-term turning point suggests that we’re going to seea big decline in the price of silver in the following months, and - quitelikely - weeks.

Today's article is asmall sample of what our subscribers enjoy on a daily basis. They know aboutboth the market changes and our trading position changes exactly when theyhappen. Apart from the above, we've also shared with them the detailed analysisof the miners and the USD Index outlook. Check more of our free articles on our website, including this one – justdrop by and have a look. Weencourage you to sign up for our daily newsletter, too - it's free and if youdon't like it, you can unsubscribe with just 2 clicks. You'll also get 7 daysof free access to our premium daily Gold & Silver Trading Alerts to get ataste of all our care. Signup for the free newsletter today!

Thank you.

Przemyslaw Radomski, CFA

Founder, Editor-in-chief

Toolsfor Effective Gold & Silver Investments - SunshineProfits.com

Tools für EffektivesGold- und Silber-Investment - SunshineProfits.DE

* * * * *

About Sunshine Profits

SunshineProfits enables anyone to forecast market changes with a level of accuracy thatwas once only available to closed-door institutions. It provides free trialaccess to its best investment tools (including lists of best gold stocks and best silver stocks),proprietary gold & silver indicators, buy & sell signals, weekly newsletter, and more. Seeing is believing.

Disclaimer

All essays, research and information found aboverepresent analyses and opinions of Przemyslaw Radomski, CFA and SunshineProfits' associates only. As such, it may prove wrong and be a subject tochange without notice. Opinions and analyses were based on data available toauthors of respective essays at the time of writing. Although the informationprovided above is based on careful research and sources that are believed to beaccurate, Przemyslaw Radomski, CFA and his associates do not guarantee theaccuracy or thoroughness of the data or information reported. The opinionspublished above are neither an offer nor a recommendation to purchase or sell anysecurities. Mr. Radomski is not a Registered Securities Advisor. By readingPrzemyslaw Radomski's, CFA reports you fully agree that he will not be heldresponsible or liable for any decisions you make regarding any informationprovided in these reports. Investing, trading and speculation in any financialmarkets may involve high risk of loss. Przemyslaw Radomski, CFA, SunshineProfits' employees and affiliates as well as members of their families may havea short or long position in any securities, including those mentioned in any ofthe reports or essays, and may make additional purchases and/or sales of thosesecurities without notice.

Przemyslaw Radomski Archive |

© 2005-2019 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.