Gold and Silver Still Hungover After New Year's Eve / Commodities / Gold and Silver 2022

Gold, silver, and mining stocksstarted 2022 with a bang. However, this wasn’t the kind of fireworks investorswere hoping for.

While gold, silver, and mining stockspartied hard into year-end, the trio woke up to massive hangovers on Jan. 3.Although I’ve been warning for some time that mining stocks would stumble in2021, the New Year is still filled with old problems.

For example, the GDX ETF has been makinglower lows and lower highs for months, and when its RSI (Relative StrengthIndex) approaches 70, the seniorminers often run out of gas. For context, I highlighted the eventswith the blue vertical dashed lines below.

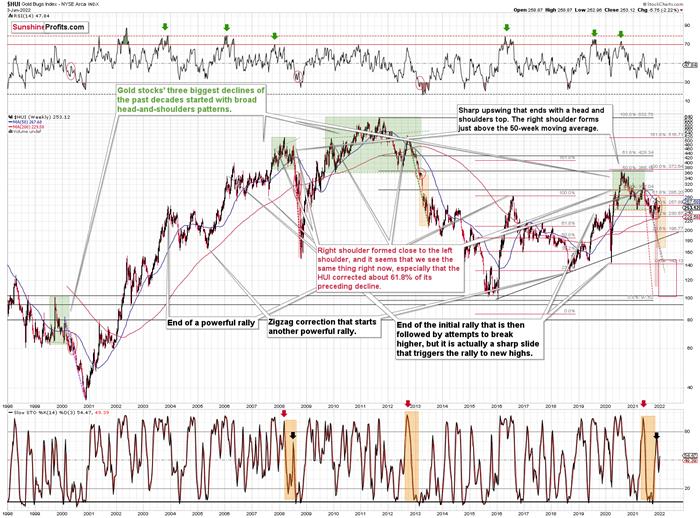

Moreover, with the senior miners’ currentprice action following the ominous paths of 2000, 2008, and 2013, and theirstochastic indicator still signaling overbought conditions, Monday’s weaknessmay be a sign of things to come.

Please see below:

Please also consider the implications ofyear-end tax-loss harvesting. With the general stock market rallying to startthe New Year, losing positions that were sold to offset capital gains near theend of 2021 were likely repurchased on Jan. 3. However, gold, silver, andmining stocks didn’t benefit from the phenomenon. As a result, while the GDXETF may have outperformed gold, the relative strength was immaterial within theoverall picture.

Turning to the HUI Index’s long-termchart, the same bearish forecast is present. For example, I marked the specific tops with red and black arrows.In the current situation, we saw yet another small move up, but that’s mostlikely because price moves are now less volatile. The areas marked with redellipses remain similar and show back-and-forth movement before the bigdecline.

As a result, we’ve entered aconsolidation phase, and the implications are not bullish, but bearish.

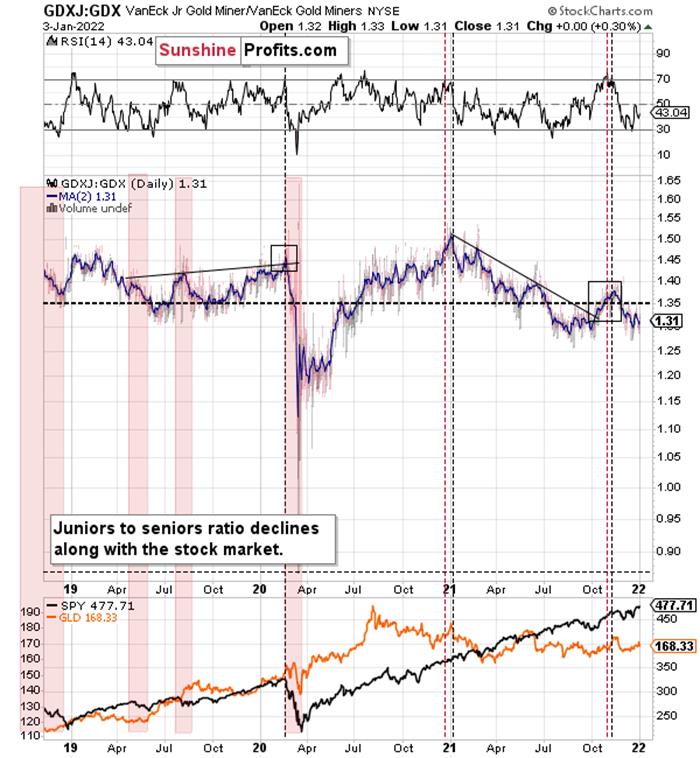

Making three of a kind, the GDXJ ETF’scorrective upswing has likely run its course. Interestingly, the junior miners’current rally mirrors the small correction that materialized in mid-2021. Backthen, the GDXJ ETF rallied on low volume and didn’t recapture its 50-day movingaverage. With the same tepid strength present today, the drawdown that followedin mid-2021 will likely commence once again.

On top of that, the behavior of the GDXJETF’s RSI is also similar – with the indicator moving from roughly 30 to 50.For context, I highlighted the similarities with green and purple ellipsesbelow. Also noteworthy, similar developments occurred in February/March 2020,before the profound plunge unfolded. As a result, the GDXJ ETF looks set foranother sharp drawdown over the medium term and predicting higher prices might be misleading.

Finally, while my short position in theGDXJ ETF proved quite prescient in 2021, the junior miners continue to underperformthe senior miners. With the GDX/GDXJ ratio likely to confront newlows in the coming months, the GDXJ ETF should remain a material laggard in2022.

In conclusion, gold, silver, and mining stocksstarted off 2022 with a bang. However, it wasn’t the kind of fireworks thatinvestors were hoping for. With each new celebration shorter in magnitude, it’slikely only a matter of time before their parties are canceled. As a result,the precious metals still confront the same bearish technical outlooks thatplagued them in 2021. While mean reversion remains undefeated over the longterm, the wait may prove longer than many expect.

Thank you for reading our free analysistoday. Please note that the above is just a small fraction of today’sall-encompassing Gold & Silver Trading Alert. The latter includes multiplepremium details such as the targets for gold and mining stocks that could be reached in the next few weeks. If you’dlike to read those premium details, we have good news for you. As soon as yousign up for our free gold newsletter, you’ll get a free 7-day no-obligationtrial access to our premium Gold & Silver Trading Alerts. It’s really free– sign up today.

Thank you.

Przemyslaw Radomski, CFA

Founder, Editor-in-chief

Toolsfor Effective Gold & Silver Investments - SunshineProfits.com

Tools für EffektivesGold- und Silber-Investment - SunshineProfits.DE

* * * * *

About Sunshine Profits

SunshineProfits enables anyone to forecast market changes with a level of accuracy thatwas once only available to closed-door institutions. It provides free trialaccess to its best investment tools (including lists of best gold stocks and best silver stocks),proprietary gold & silver indicators, buy & sell signals, weekly newsletter, and more. Seeing is believing.

Disclaimer

All essays, research and information found aboverepresent analyses and opinions of Przemyslaw Radomski, CFA and SunshineProfits' associates only. As such, it may prove wrong and be a subject tochange without notice. Opinions and analyses were based on data available toauthors of respective essays at the time of writing. Although the informationprovided above is based on careful research and sources that are believed to beaccurate, Przemyslaw Radomski, CFA and his associates do not guarantee theaccuracy or thoroughness of the data or information reported. The opinionspublished above are neither an offer nor a recommendation to purchase or sell anysecurities. Mr. Radomski is not a Registered Securities Advisor. By readingPrzemyslaw Radomski's, CFA reports you fully agree that he will not be heldresponsible or liable for any decisions you make regarding any informationprovided in these reports. Investing, trading and speculation in any financialmarkets may involve high risk of loss. Przemyslaw Radomski, CFA, SunshineProfits' employees and affiliates as well as members of their families may havea short or long position in any securities, including those mentioned in any ofthe reports or essays, and may make additional purchases and/or sales of thosesecurities without notice.

Przemyslaw Radomski Archive |

© 2005-2019 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.