Gold and the Coming Hyperinflation

Technical Analyst Clive Maund shares his opinion on where he believes the precious metals sector is headed in light of hyperinflation.

The crucial point for investors to grasp at this time is that we are in a "risk on" environment that looks set to continue indefinitely at least until the end of this year. The reason for this is simple. Faced with impossible debts, governments around the world are going to "take the line of least resistance," which is to continue to create money at an ever-increasing rate to "paper over the cracks" and keep things limping along.

This policy also facilitates a prime objective of the central banks, who are the true governments of the world, which is to continue to transfer wealth from the lower and middle classes up to the super-wealthy at the top of the pyramid it is the super-wealthy who benefit from the bond markets being propped up and from high and rising stock markets while the bill for this is passed on the Man in the Street via ever-increasing inflation.

Another key point to understand is that the stock market no longer has any connection with the real economy. There used to be a time when a falling stock market would presage a downturn in the economy or a depression. Now we have a situation where the economy is in freefall, yet stock markets continue to make new highs. The reason for this is simple the stock market is now dependent on liquidity creation by the Fed or other central banks and doesn't care about the economy.

Long-term, this, of course, is untenable you cannot have a situation where debt forever increases at an exponential rate as at some point it goes vertical because vast amounts of new debt have to be created just to service existing debt, and that's especially the case if rates are at anything other than zero (or negative) as is the case now. Debt expansion has already gone vertical, with the Fed creating a trillion dollars of new debt every 100 days. This means that unless they rein it in, and they won't and can't because if they attempt to do so, they will trigger the biggest collapse / implosion in the history of the world, we are well along the road to hyperinflation and we are already in an inflationary depression that will transform into a hyperinflationary depression. When this happens, all paper assets will become worthless, which is actually a great way to solve the debt problem make money worthless, print, say, 1000 trillion dollars, and then say, "Got some good news here's that money I owe you, shame it won't buy anything."

The powers that be know that this is going to happen and that not only is it inevitable, but they planned it this way. That's why the World Economic Forum (WEF) ran that infamous ad saying "You will own nothing and be happy."

So what is an investor to do? When the system finally blows up either through a deflationary black hole if they shut off the monetary spigot or via hyperinflation, the only way to preserve whatever assets and wealth you have will be via the ownership of tangibles or things with real intrinsic value, such as collectibles, land, and gold and silver and commodities generally.

Currency, debt instruments, and all money that is not in hard assets will become worthless. Laws have been changed so that the biggest players, such as the tier 1 Banks, will have first call on assets in the event of liquidations, and the rest of the creditors "can go whistle." This is described in detail in The Great Taking, which will be an integral part of The Great Reset, which seeks to impose a modern-day global feudal system.

As the expected hyperinflation nears, gold and silver will, of course, fly off the top of the charts, and they will certainly be the most favored asset. Cryptos may do well, too. However, until we arrive at that point, we are still in "risk on" mode, which means it's alright to continue to play the stock market, bearing in mind that it could use some sort of correction here after its recent big runup and still another important point to make is that although gold and silver may "play second fiddle" to favored AI or Tech stocks during this period, they are unlikely to perform poorly because there is now so much inflation baked into the system already that they will have to advance to reflect this and also, since markets discount many future developments months in advance, gold and silver and PM stocks can be expected to appreciate substantially ahead of the hyperinflation hitting.

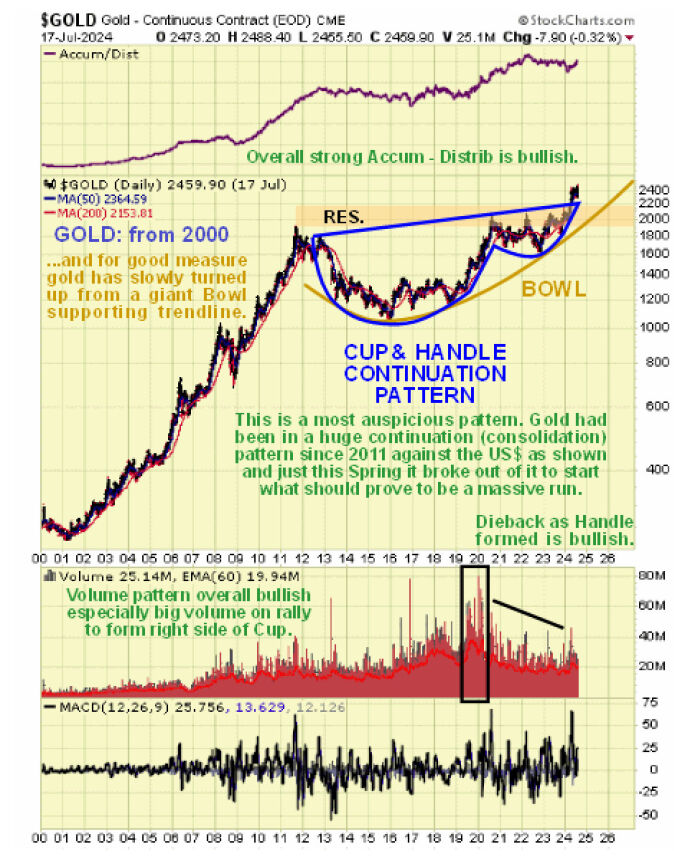

Now we will look at a very long-term gold chart which makes some very important points very clear. The chart below shows gold from the inception of its major 2000s bull market. The first big point to make is that it hardly made any progress from its 2011 peak to early this year because what was going on was that a giant consolidation pattern was forming following its big 2000s bull market that served to consolidate / correct that bull market and it is now evident that this consolidation has taken the form of a giant Cup and Handle consolidation pattern.

Some may call it a Head-and-Shoulders continuation pattern, and while it does also have some characteristics of such a pattern, the very strong volume on the rally to form the right side of the Cup is the classic signature of a Cup & Handle, especially as volume has eased as the Handle has formed. It is also interesting to observe how gold's trend has gradually changed from down to up over the course of many years above a giant bowl-supporting trendline, which is bullish.

The next big point to make is that a major breakout occurred this spring, and the increased volume of this breakout is a sign that it is genuine. We can see that this is so because the price broke out above the upsloping upper boundary of the Cup and Handle and, concurrently, the resistance at the upper boundary of the Handle.

We can, therefore, expect the sector to not just continue to advance but to accelerate to the upside, which, of course, makes sense if we are heading in the direction of hyperinflation. Investors in the sector can, therefore, maintain quiet confidence and remain unruffled by minor short-term fluctuations. Indeed, they welcome them as an opportunity to build positions further.

With the dollar having been, for some years, "the least ugly belle at the ball," it follows that gold has already fared a lot better in other currencies. A good example of this is its performance in Japanese Yen, which is shown below for the same period as gold in U.S. dollars above.

As we can see, gold has been in a steady uptrend against the Yen for years.

The conclusion is: stay long, better Precious Metal sector investments, and welcome any corrections (probably minor) as an opportunity to add to or adjust positions.

| Want to be the first to know about interestingSilver andGold investment ideas?Sign up to receive the FREE Streetwise Reports' newsletter. | Subscribe |

Important Disclosures:

Statements and opinions expressed are the opinions of the author and not of Streetwise Reports, Street Smart, or their officers. The author is wholly responsible for the accuracy of the statements. Streetwise Reports was not paid by the author to publish or syndicate this article. Streetwise Reports requires contributing authors to disclose any shareholdings in, or economic relationships with, companies that they write about. Any disclosures from the author can be found below. Streetwise Reports relies upon the authors to accurately provide this information and Streetwise Reports has no means of verifying its accuracy.

This article does not constitute investment advice and is not a solicitation for any investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Each reader is encouraged to consult with his or her personal financial adviser and perform their own comprehensive investment research. By opening this page, each reader accepts and agrees to Streetwise Reports' terms of use and full legal disclaimer. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company.For additional disclosures, please click here.

Clivemaund.com Disclosures

The above represents the opinion and analysis of Mr. Maund, based on data available to him, at the time of writing. Mr. Maund's opinions are his own, and are not a recommendation or an offer to buy or sell securities. As trading and investing in any financial markets may involve serious risk of loss, Mr. Maund recommends that you consult with a qualified investment advisor, one licensed by appropriate regulatory agencies in your legal jurisdiction, and do your own due diligence and research when making any kind of a transaction with financial ramifications. Although a qualified and experienced stock market analyst, Clive Maund is not a Registered Securities Advisor. Therefore Mr. Maund's opinions on the market and stocks cannot be construed as a recommendation or solicitation to buy and sell securities.