Gold and the Great Global Wealth Grab / Commodities / Gold & Silver 2019

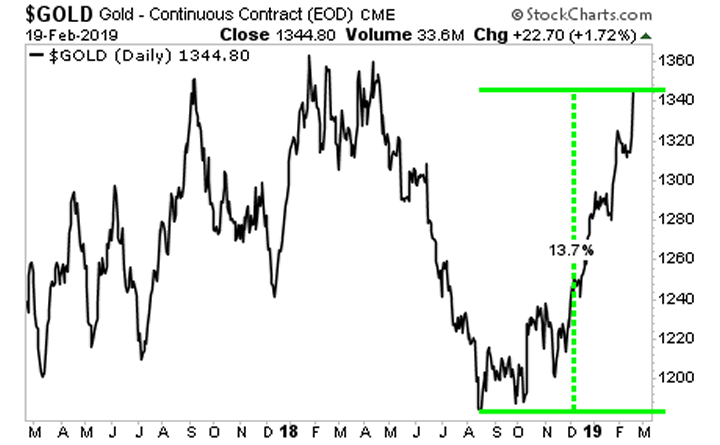

Gold continues to soar, up 14% in the last six months and now challenging its 2018 highs.

If you’re looking to understand why Gold continues to rally, you don’t have to look any further than the political arena where more and more politicians are calling for wealth taxes and cash grabs.

Gold knows that these folks are not going to limit their plans to the super wealthy… it knows that eventually the calls will be for a tax on NET wealth…which is why it continues to move higher.

Gold ALSO knows that Central Banks are trapped… and will be forced to turn on the money printing presses shortly.

In the last week, the Bank of Japan, the European Central Bank, and the Federal Reserve have ALL abandoned any pretense of normalizing policy.

While they have yet to start easing just yet, it’s now only a matter of time.

Gold is rallying as investors look for a safe haven that CANNOT be devalued by Central Bank or stolen by the political class. Gold knows that BOTH of those items (theft of capital and devaluation of currencies) is only going to get worse going forward.

Indeed, we’ve uncovered a secret document outlining how the Fed plans to both seize and STEAL savings during the next crisis/ recession.

We detail this paper and outline three investment strategies you can implement right now to protect your capital from the Fed’s sinister plan in our Special Report The Great Global Wealth Grab.

We are making just 100 copies available for FREE the general public.

You can pick up a FREE copy at:

http://phoenixcapitalmarketing.com/GWG.html

Best Regards

Graham Summers

Phoenix Capital Research

http://www.phoenixcapitalmarketing.com

Graham alsowrites Private Wealth Advisory, a monthly investment advisoryfocusing on the most lucrative investment opportunities the financial marketshave to offer. Graham understands the big picture from both a macro-economicand capital in/outflow perspective. He translates his understanding intofinding trends and unde74rvalued investment opportunities months before themarkets catch on: the Private Wealth Advisory portfoliohas outperformed the S&P 500 three of the last fiveyears, including a 7% return in 2008 vs. a 37% loss for the S&P 500.

Previously,Graham worked as a Senior Financial Analyst covering global markets for severalinvestment firms in the Mid-Atlantic region. He’s lived and performed researchin Europe, Asia, the Middle East, and the United States.

© 2018 Copyright GrahamSummers - All Rights Reserved Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

GrahamSummers Archive |

© 2005-2019 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.