Gold (BAR) Weekly: The Deceleration In Global Growth Momentum Calls For Caution

BAR is up around 1% since the start of October, after falling the most since June 2018 in September (-3%).

While we acknowledge that the speculative community is unlikely to fuel the rally in gold spot prices due to their already stretched positioning, investment demand for gold should continue to.

Macro investors are likely to seek safety in the current macro environment, characterized by a global slowdown in global economic growth, including in the US, and rising uncertainties around the.

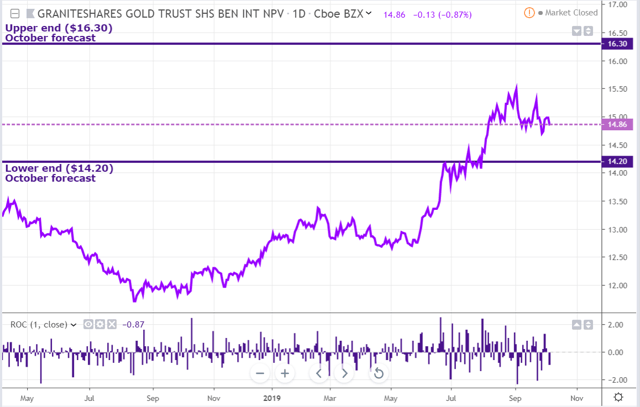

Our forecast for BAR is $14.20-$16.30 in October, suggesting that the skew for BAR is on the upside.

Introduction

Welcome to Orchid's Gold Weekly report. We discuss gold prices through the lenses of the GraniteShares Gold Trust ETF (BAR), which replicates the performance of gold prices by holding physically gold bars in a London vault in the custody of ICBC Standard Bank.

BAR is up around 1% since the start of October, after falling the most since June 2018 in September (-3%).

While we acknowledge that the speculative community is unlikely to fuel the rally in gold spot prices due to their already stretched positioning, the current macro environment, characterized by a global slowdown in global economic growth and rising uncertainties around the globe, is conducive to stronger investment demand for gold (e.g., via ETF buying).

We therefore think that BAR will push higher this month, forecasting a trading range of $14.20-$16.30.

Source: Trading View, Orchid Research

About BAR

BAR is directly impacted by the vagaries of gold spot prices because the Funds physically holds gold bars in a London vault and custodied by ICBC Standard Bank. The investment objective of the Fund is to replicate the performance of the price of gold, less trust expenses (0.20%), according to BAR's prospectus.

The physically-backed methodology prevents investors from getting hurt by the contango structure of the gold market, contrary to ETFs using futures contracts.

Also, the structure of a grantor trust protects investors since trustees cannot lend the gold bars.

BAR provides exposure which is identical to established competitors like GLD and IAU, which are nevertheless much more costly to hold over a long period of time. Indeed, BAR offers an expense ratio of just 0.20% while IAU and GLD have an expense ratio of 0.25% and 0.50%, respectively.

Macro

Gold spot prices have rebounded slightly since the start of October as a result of renewed weakness in the dollar.

This largely owing to more dovish Fed expectations following signs of a noticeable deceleration in US economic growth, evident in US private payrolls (rising at the slowest pace in three months) and the ISM manufacturing index (tumbling to its lowest since June 2009), in a context of a global slowdown wave hitting Europe and China.

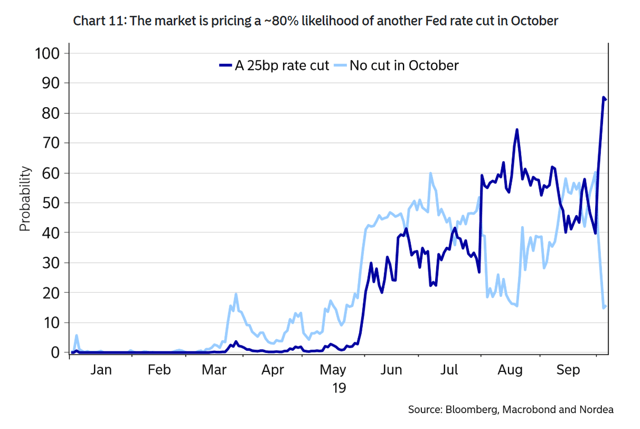

The market is now pricing an 80% probability of a 25bp rate cut at the forthcoming FOMC meeting on October 30.

Source: Nordea

Implications for BAR: The steeper path of the Fed easing cycle expected by market participants, caused by the increased softness in US economic data and rising tail risks to the economic outlook, has produced a friendly environment for gold, which in turn has benefited BAR so far this month.

Speculative positioning

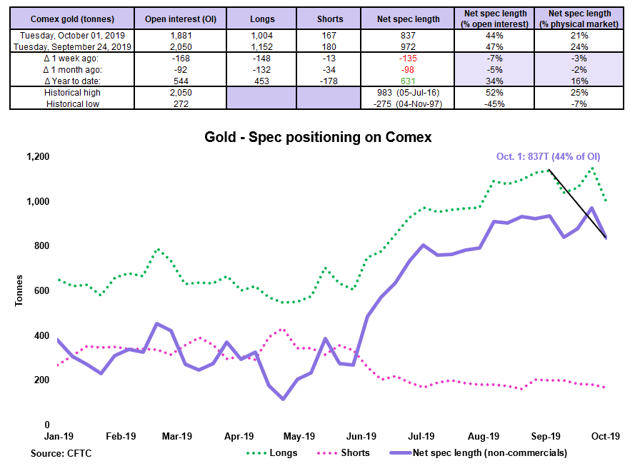

Source: CFTC, Orchid Research

The net long speculative position in Comex gold declined meaningfully in the week to October 1, after reaching its highest on the year at 972 tonnes on September 24.

Non-commercials reduced their gross long exposure by 148 tonnes over September 24-October 1, while the gross short exposure was reduced by a much smaller 13 tonnes, resulting in a decline of 135 tonnes in net long speculative positions over the latest reporting period.

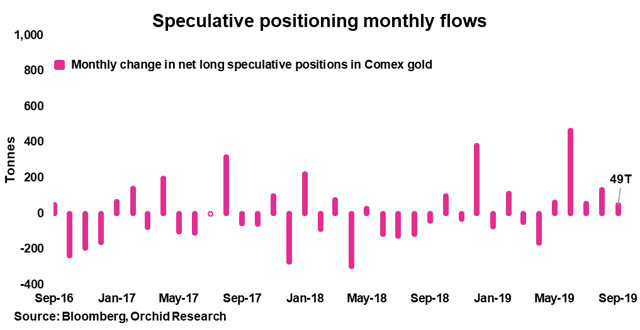

Last month, non-commercials lifted their net long positions in Comex gold by 49 tonnes, far below the monthly increase of 466 tonnes in June. This could suggest that the room for additional speculative buying will be limited in the short term.

Importantly, although the net spec length is down from its 2019 high, it remains elevated judging by historical standards. Indeed, at 44% of OI, the net long speculative position in gold is close to its historical high of 52% established in July 2016.

Implications for BAR: This could suggest more speculative profit-taking in Comex gold in the near term, pushing gold spot prices lower, thereby impacting negatively the performance of BAR.

Investment positioning

Source: Orchid Research

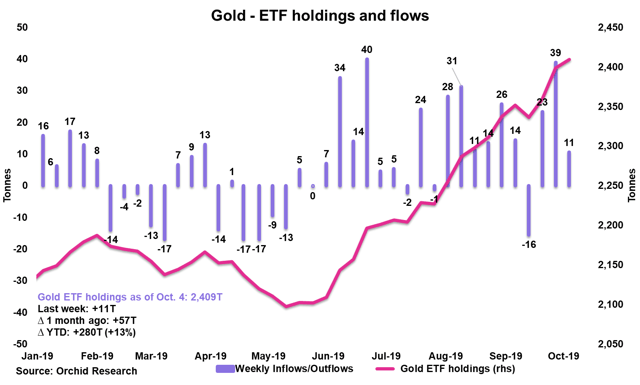

ETF investors were net buyers of gold in the week to October 4, for a third time in a row.

Over the September 27-October 4 period, ETF investors added 11 tonnes to their gold holdings, which was smaller than their net purchases of 39 tonnes in the prior week. Still, this shows a strong appetite for the yellow metal.

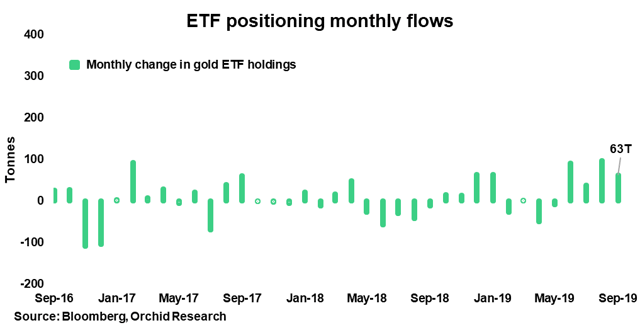

Last month, gold ETF holdings increased by 63 tonnes, at a smaller pace than in August (+97 tonnes) but at a stronger pace than the monthly average of 30 tonnes so far this year.

The strong increase in ETF demand for gold (+280 tonnes in the year to date) has tightened the supply/demand balance of the global gold market, pushing gold spot prices higher.

Implications for BAR: We believe that ETF investors will continue to lift their gold holdings in the coming months because the macro environment becomes increasingly uncertain, with the balance of risks to economic growth skewed the downside. This should therefore push gold spot prices higher, which in turn will affect positively the performance in BAR.

Physical trends

Indian physical demand for gold has picked up ahead of festivals, including Dhanteras (October 25th) and Diwali (October 27th), evident in the narrowing discount to loco London to $20-30 per oz.

This is encouraging after the 68% year-on-year contraction in domestic gold imports in September, to their lowest in over three years, largely caused by record domestic prices.

The recent aggressive buying from some jewelers bodes well for spot gold prices and thus BAR.

Closing thoughts

We think that gold spot prices will push higher in October, due to a steady increase in investment demand for the yellow metal as the current macro environment, characterized by a noticeable deceleration in global growth momentum, including in the world's largest economy, calls for caution, leading investors to lift their long exposure to risk-unfriendly positions like gold.

Our forecast for BAR is $14.20-$16.30 in October, suggesting that the skew for BAR is on the upside.

Did you like this?

Click the "Follow" button at the top of the article to receive notifications.

Disclosure: I/we have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Additional disclosure: Our research has not been prepared in accordance with the legal requirements designed to promote the independence of investment research. Therefore, this material cannot be considered as investment research, a research recommendation, nor a personal recommendation or advice, for regulatory purposes.

Follow Orchid Research and get email alerts