Gold: Bearish Development Just Around the Corner? / Commodities / Gold and Silver 2021

While we might see a small uptick ingold prices soon, it’s not likely to last long. We should be prepared to openour parachutes any time now.

The decline in gold continues, and whilewe might see a small pop-up higher here, it’s unlikely to last. And why couldgold move slightly higher and correct the recent declines?

Because it has just reached the risingsupport line based on its previous important lows. The possible rebound couldtake place based on this single development. However, just because it mighthappen doesn’t make it very likely, and it doesn’t mean that taking any actionnow is justified. The medium-term forecastfor gold remains bearish.

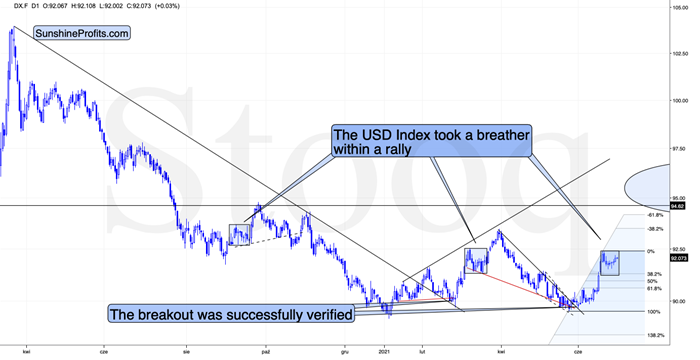

The situation in the USD Index is one ofthe reasons for this outlook:

We recently saw a breather that wassimilar in terms of time and price to the previous patterns which happenedafter quick short-term rallies. And now, the USDX is moving higher once again.As soon as it exceeds the previous June highs, it’s likely to rally moresubstantially, perhaps stopping temporarily at the late-March high or rallyingeven higher, to 95 or so.

Either way, gold is likely to get thebearish push off the cliff that will likely take it below the above-mentionedrising red line. Gold’s next support is at the previous 2021 lows – close to$1,670.

Besides, while gold bounced off therising red line visible on the first chart, the yellow metal actually brokevisibly below a much more important support line.

In fact, that was the first time whengold managed to break below this line and not rally back up. This time is already different.

Moreover, let’s keep in mind that goldstocks’ relative performance not only hasn’t stopped indicating the bearishoutlook recently but also provided a screaming sell sign once again on Monday.

Namely, the GDX ETF declined and closedbelow its previous monthly lows as well as below the late-April lows. Thisbreakdown took place without gold’s help, which makes it particularly bearish.

Please note that the volume thataccompanied this week’s declines is relatively low, and the declines tend toend on huge volume. Consequently, the low-volume readings imply that we’re notat the bottom yet. Also, silver hasn’t broken visibly lower, and it didn’t “catch up” with the miners, whichcould indicate that the bottom is in. So, it likely isn’t.

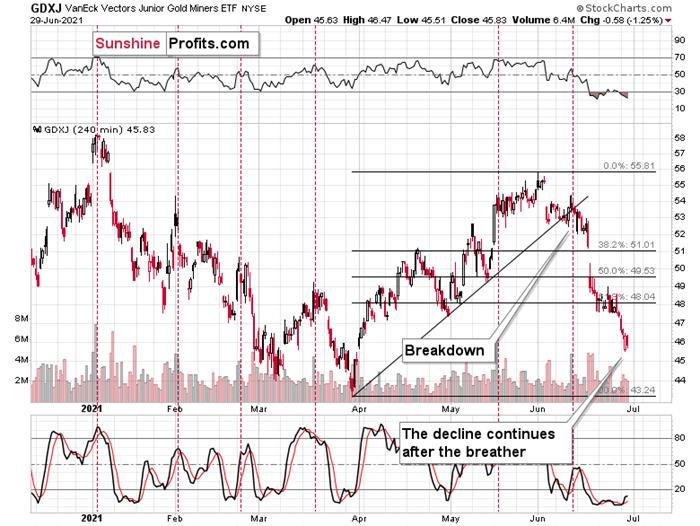

The above-mentioned breakdown was evenmore profound in the case of the GDXJ – a proxy for juniormining stocks .

The size of the recent “upswing” wascomparable to the mid-November 2020 one, so it confirms the analogy to thisperiod that I mentioned while discussing the gold’s chart yesterday .

The next short-term downside target is atabout $42 – a bit below the previous lows, as that’s where the 50% Fibonacciretracement line coincides with the previous highs and lows (and also with the2019 highs that are not visible on the above chart).

The 4-hour candlestick chart shows thatjunior miners moved slightly higher at the beginning of yesterday’s sessiononly to decline in its final hours. So, it’s not that we’re not seeing anycorrections – we do have them, but they are so tiny that they are barelynoticeable from the daily perspective.

All in all, it seems that the outlook forthe precious metals market – especially for the junior gold miners – is verybearish for the following weeks and months, and it seems that the profits onour current short position will grow much more quite soon.

Today's article is asmall sample of what our subscribers enjoy on a daily basis. They know aboutboth the market changes and our trading position changes exactly when theyhappen. Apart from the above, we've also shared with them the detailed analysisof the miners and the USD Index outlook. Check more of our free articles on our website, including this one – justdrop by and have a look. Weencourage you to sign up for our daily newsletter, too - it's free and if youdon't like it, you can unsubscribe with just 2 clicks. You'll also get 7 daysof free access to our premium daily Gold & Silver Trading Alerts to get ataste of all our care. Signup for the free newsletter today!

Thank you.

Przemyslaw Radomski, CFA

Founder, Editor-in-chief

Toolsfor Effective Gold & Silver Investments - SunshineProfits.com

Tools für EffektivesGold- und Silber-Investment - SunshineProfits.DE

* * * * *

About Sunshine Profits

SunshineProfits enables anyone to forecast market changes with a level of accuracy thatwas once only available to closed-door institutions. It provides free trialaccess to its best investment tools (including lists of best gold stocks and best silver stocks),proprietary gold & silver indicators, buy & sell signals, weekly newsletter, and more. Seeing is believing.

Disclaimer

All essays, research and information found aboverepresent analyses and opinions of Przemyslaw Radomski, CFA and SunshineProfits' associates only. As such, it may prove wrong and be a subject tochange without notice. Opinions and analyses were based on data available toauthors of respective essays at the time of writing. Although the informationprovided above is based on careful research and sources that are believed to beaccurate, Przemyslaw Radomski, CFA and his associates do not guarantee theaccuracy or thoroughness of the data or information reported. The opinionspublished above are neither an offer nor a recommendation to purchase or sell anysecurities. Mr. Radomski is not a Registered Securities Advisor. By readingPrzemyslaw Radomski's, CFA reports you fully agree that he will not be heldresponsible or liable for any decisions you make regarding any informationprovided in these reports. Investing, trading and speculation in any financialmarkets may involve high risk of loss. Przemyslaw Radomski, CFA, SunshineProfits' employees and affiliates as well as members of their families may havea short or long position in any securities, including those mentioned in any ofthe reports or essays, and may make additional purchases and/or sales of thosesecurities without notice.

Przemyslaw Radomski Archive |

© 2005-2019 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.