Gold Breaks Higher

Barry Dawes from Martin Place Securities shares his thoughts on the current state of gold.

Barry Dawes from Martin Place Securities shares his thoughts on the current state of gold.

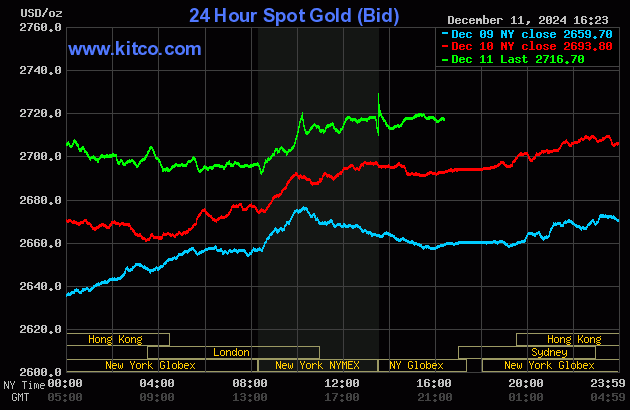

It seems that the pennant in the US$ gold price has indeed eventuated, and new highs are likely in 2024. Gold is above US$2700 again, and hopefully, it will be above US$3000 in March Qtr 2025. It is pleasing to see this happening with such strong US$.

Is it a warning about events in the Middle East or Ukraine? The Russian ruble is making new lows against the US$ and the Euro, Pound and Swiss France are looking very weak.

Whatever the reason or outcome, it is pleasing to see that gold stocks are indeed looking very good. That 145 level on the XAU held nicely as it bounced off that 2011 downtrend. Gold stocks are now starting to break out against general equities. The move will be a multi-year, and the gains are likely to be very great.

Gold is also breaking out against stocks. Note too that the gold stocks vs gold ratios are making that RHS of a H&S reversal pattern so gold stocks should become supercharged. The NST/DEG merger means portfolios are overweight NST (could this ever really be true!), so the time to move into the cheaper gold developers has arrived.

Ask me what to invest in!

Gold is moving above US$2700.

This move is too strong to be a B wave, so it must be another impulse move.

Gold has moved another US$23 since this chart from Tuesday's close.

It could resume its position above the parabola.

Gold is about to make a major break against general equities.

Gold up or stocks down?

Gold Stocks

The Xau has held that 145 very well indeed in the short term.

The longer term is very positive. Holding the 2011 downtrend has been very important.

A breakout through 165 again just