Gold Bull Market Ultimate Upside Target / Commodities / Gold & Silver 2019

Gold has been on a tear lately. This has lead to many of you asking me why the precious metal is breaking out and if this is the start of the next bull market.

Gold has been on a tear lately. This has lead to many of you asking me why the precious metal is breaking out and if this is the start of the next bull market.

Gold is rallying primarily due to central bank issuing forward guidance. What I mean by this is that globally central banks have made it clear that they are going to be cutting rates and launching new QE programs going forward.

This is resulting in bonds around the world rallying to the point of having NEGATIVE yields. What this means is that the person lending the money is PAYING the person borrowing the money for the right to lend!

It’s insanity, but because bonds move based on interest rate policy, if central banks cut rates to negative, many bonds are going to have negative yields.

How many?

Currently there are over $15 trillion in bonds with negative interest rates. Gold yields nothing. But if bonds are CHARGING you money, a yield of zero is actually quite attractive.

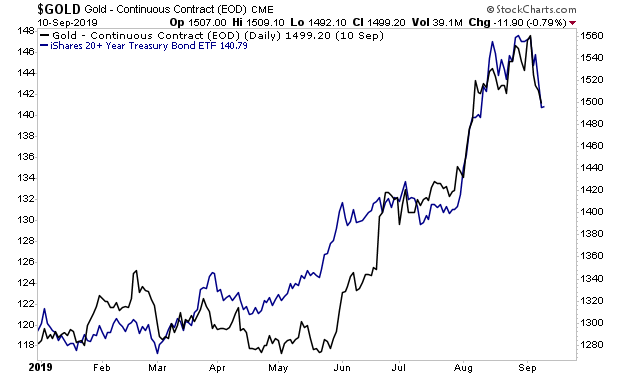

This is why gold is rallying alongside the long-term Treasury ETF.

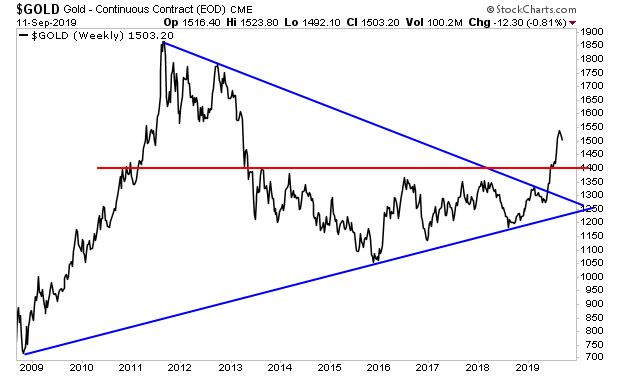

Of course nothing goes straight up or straight down, and it would be quite normal for gold to correct back to test former resistance (red line) after its recent breakout.

However, the long-term implication of that chart is that gold is going north of $3,000 per ounce.

This is going to lead to literal fortunes for those who invest properly with targeted picks.

On that note, we just published a Special Investment Report concerning a secret back-door play on Gold that gives you access to 25 million ounces of Gold that the market is currently valuing at just $273 per ounce.

The report is titled The Gold Mountain: How to Buy Gold at $273 Per Ounce

We are giving away just 100 copies for FREE to the public.

To pick up yours, swing by: https://www.phoenixcapitalmarketing.com/goldmountain.html

Graham Summers

Phoenix Capital Research

http://www.phoenixcapitalmarketing.com

Graham alsowrites Private Wealth Advisory, a monthly investment advisoryfocusing on the most lucrative investment opportunities the financial marketshave to offer. Graham understands the big picture from both a macro-economicand capital in/outflow perspective. He translates his understanding intofinding trends and unde74rvalued investment opportunities months before themarkets catch on: the Private Wealth Advisory portfoliohas outperformed the S&P 500 three of the last fiveyears, including a 7% return in 2008 vs. a 37% loss for the S&P 500.

Previously,Graham worked as a Senior Financial Analyst covering global markets for severalinvestment firms in the Mid-Atlantic region. He’s lived and performed researchin Europe, Asia, the Middle East, and the United States.

© 2019 Copyright GrahamSummers - All Rights Reserved Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

GrahamSummers Archive |

© 2005-2019 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.