Gold Can't Wait to Fall - Even Without USDX's Help / Commodities / Gold and Silver 2021

Gold started its decline withoutanyone’s assistance. And when the USDX takes off, that downhill tumble can onlyincrease.

The USDX declines and the precious metalssit by idly, twiddling their thumbs. If they had the strength that’s beingtalked about, they should be soaring by now, or getting ready to. So, what’stheir problem?

In the previous days, I discussed thesignals coming from the precious metals market or for the precious metalsmarket, as they kept on emerging, and we just received yet another round ofindications. And yes, they also confirm the bearish outlook for the followingweeks - or a few months.

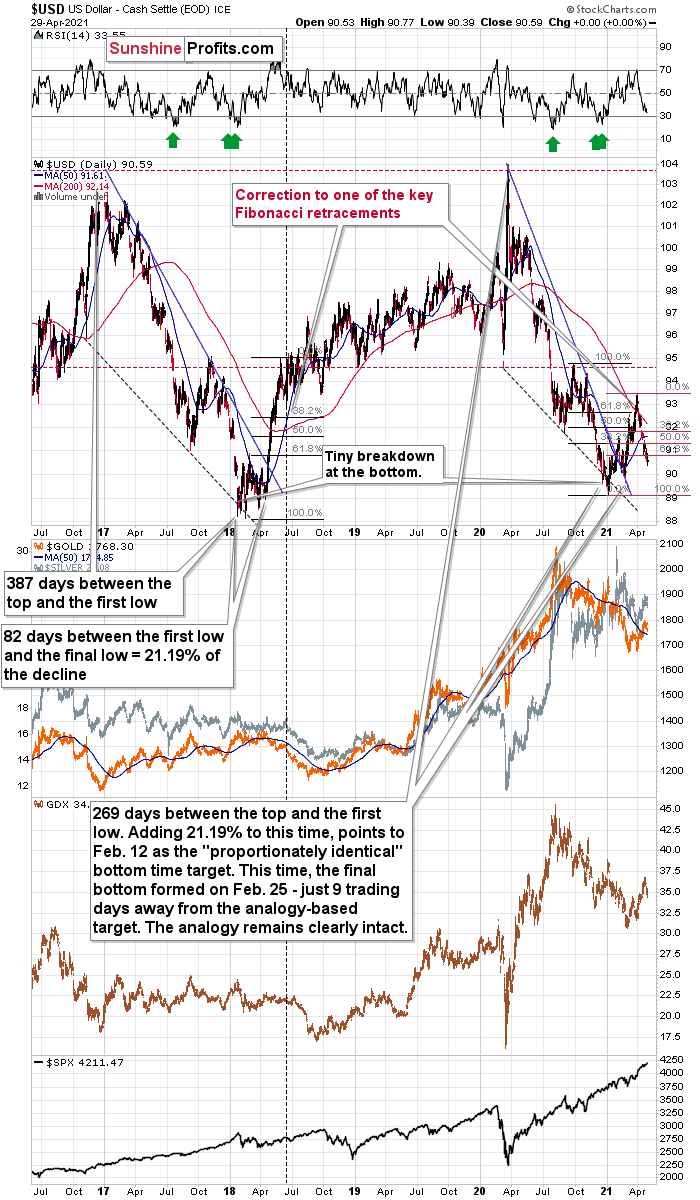

Let’s start by looking at the USD Index.

On the above chart you can see that thisweek, the USD Index broke to new monthly lows. And you can also see that golddidn’t move to a new monthly high. In fact, it was not even close to doing so –it just closed the day below $1,770. This is a clearly bearish sign for gold.

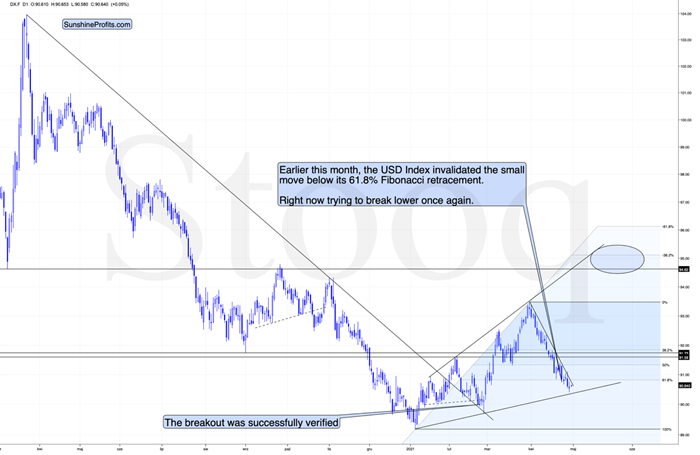

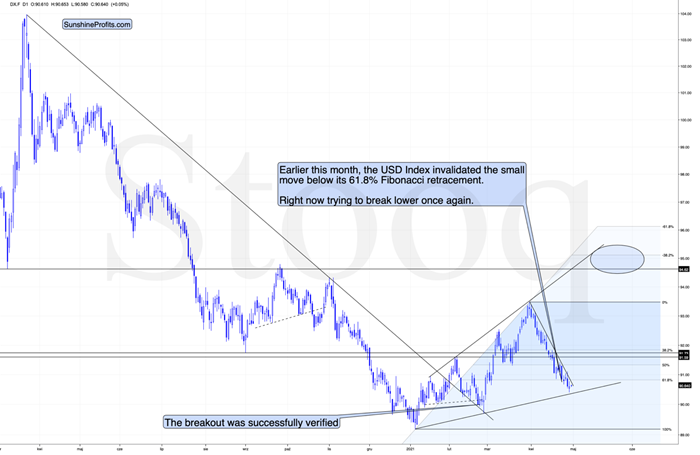

And what about the USD Index?

It’s making a second attempt to breakbelow its 61.8% Fibonacci retracement level. Will it be successful? It mightbe, but… Another support level is just around the corner. Perhaps the proximityto the rising support line based on the January and February lows was actuallyenough to trigger the rebound yesterday. In this case, the bottom in the USDXis already in. But, we’ll know with much greater certainty when the USDXfinally breaks above the declining resistance line and then confirms thisbreakout.

On the above 4-hour USD Index chart wesee that the previous short-term breakout was invalidated, which triggered asubstantial sell-off, but… Whatever was likely to happen based on thisinvalidation seems to have already happened. And it seems that we’re about tosee another attempt to break higher. Will the USD Index be successful thistime? That’s quite likely, but that’s not the most important thing from theprecious metals investors’ and traders’ point of view.

PMsPlay the Fiddle While USDX Burns

The key thing is that during the recentdeclines in the USDX (and during the move to new highs in case of the generalstock market), gold , silver, and mining stocks didn’t soar. They “should have” if the situationwas normal or bullish. They declined instead, which means it’s highly likelythat even if the USD Index doesn’t break out now (but a bit later), the declinein the PMs will not be avoided but only delayed.

In fact, to be more precise, it’sunlikely to be delayed as well – what might be delayed is the increase in thepace at which gold, silver, and miners are about to slide. After all, gold andgold stocks are already moving lower (while silver is trading sideways).

By the way, silver’s lack of movementrecently is perfectly normal in the early stage of a decline – the white metaltends to catch up big-time in the final part of a given move.

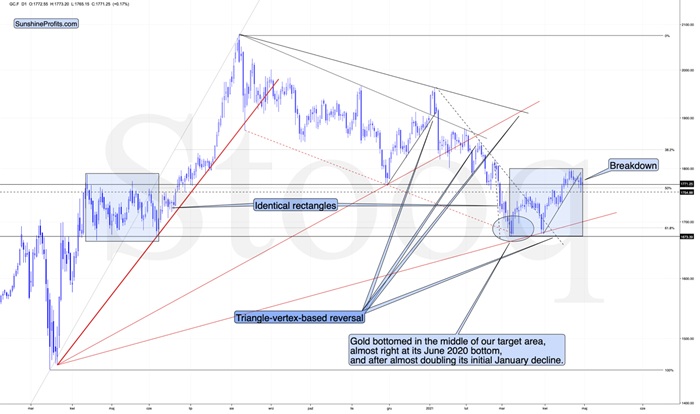

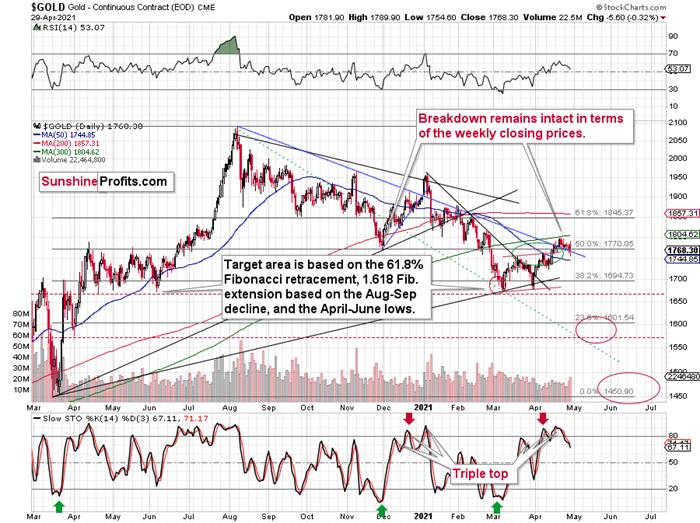

On the above gold chart, you can clearlysee how goldmoved back up to its rising short-term resistance line this week, and –instead of invalidating the breakdown – it bounced from it and declined onceagain. This is what verifications of breakdowns look like.

Also, let’s keep in mind that thesituation now seems to be a mirror image of what we saw in April – June 2020,and at the same time it’s somewhat similar to what we saw at the beginning ofthe year. You can see the former (the rectangles are identical) on the abovechart, and you can see the similarity to the early January action below.

Just as was the case in early January, wefirst saw a pause – a rebound – and the decline continued only thereafter. Itseems that the Jan. 7, 2021 price action is quite similar to what we sawyesterday (Apr. 29). Moreover, please note that both happened just above thedeclining blue support line. It was the final pause before the move higher wasinvalidated.

Having said the above, let’s move to goldstocks:

Miners:GDX and GDXJ ETFs

In yesterday’sanalysis, I described the GDX’s previous performance in the following way:

Goldstocks’ intraday recovery that we saw yesterday may seem profound, but not ifwe consider what happened in the USD Index and the general stock market. Theformer declined substantially while the latter was close to its all-time highs.This is a combination of factors that “should have” made gold miners move tonew highs – and a daily gain of less than half percent is a sign of weakness,not strength.

Intoday’s pre-market trading the S&P 500 futures moved to new highs, and goldminers showed gains in the London trading, but they are nothing to write homeabout – and more importantly, nothing that would change the bearish forecastfor gold I described more broadly previously .

The bearish interpretation of theprevious “strength” turned out to have been correct – the GDX ETF declinedyesterday.

The decline was even more visible andimportant in the case of the GDXJ ETF, where we have trading positions.

This ETF for juniorgold and silverminers ( goldminers have much bigger weight in it, though) moved and closed back belowits March 2021 highs.

Consequently, we have a situation inwhich:The USD Index is about toreverse and rally.Goldsignals that it just can’t wait for the USD Index to rally, and it’salready declining (the pace at which it declines is likely to greatly increaseonce the USD Index takes off).Gold miners behave relativelynormally, which in this case means that they are declining more than gold does(GLD just closed 1.14% below the highest daily close of April, while the GDXjust closed 5.59% below the highest daily close of April). Besides, theirrecent move back to the May 2020 highs and the subsequent decline furtherincreases the odds that the decline is going to shape the right shoulder of ahuge head and shoulders formation with extremely bearish implications (oncecompleted).GDXJ is underperforming GDXjust as I’ve been expecting it to. While GDX declined by 5.59% so far (in termsof the closing prices), GDXJ declined by 5.67%. This might seem an unimportantlevel of underperformance, but the perspective changes once one realizes thatGDXJ is more correlated with the general stock market than GDX is. Consequently, GDXJ should be showing strength here, and it isn’t.If stocks don’t decline, GDXJ is likely to underperform by just a bit, but when(not if) stocks slide, GDXJ is likely to plunge visibly more than GDX.

The above combination tells me that weare very well positioned in case of our short position in the GDXJ.

Besides, as an analytical cherry on thebearish GDXJ cake, please note that we just saw a sell signal from the MACD indicator (lower part of the chart) while it was visibly above 0, and after a relativelybig short-term rally. We saw this kind of performance only several times in theprevious year, and it meant declines in almost all cases. We saw it only oncebefore this year – in early January, and a sizable decline followed.

Thank you for reading our free analysistoday. Please note that the above is just a small fraction of today’sall-encompassing Gold & Silver Trading Alert. The latter includes multiplepremium details such as the target for gold that could be reached in the nextfew weeks. If you’d like to read those premium details, we have good news foryou. As soon as you sign up for our free gold newsletter, you’ll get a free7-day no-obligation trial access to our premium Gold & Silver TradingAlerts. It’s really free – sign up today.

Przemyslaw Radomski, CFA

Founder, Editor-in-chief

Toolsfor Effective Gold & Silver Investments - SunshineProfits.com

Tools für EffektivesGold- und Silber-Investment - SunshineProfits.DE

* * * * *

About Sunshine Profits

SunshineProfits enables anyone to forecast market changes with a level of accuracy thatwas once only available to closed-door institutions. It provides free trialaccess to its best investment tools (including lists of best gold stocks and best silver stocks),proprietary gold & silver indicators, buy & sell signals, weekly newsletter, and more. Seeing is believing.

Disclaimer

All essays, research and information found aboverepresent analyses and opinions of Przemyslaw Radomski, CFA and SunshineProfits' associates only. As such, it may prove wrong and be a subject tochange without notice. Opinions and analyses were based on data available toauthors of respective essays at the time of writing. Although the informationprovided above is based on careful research and sources that are believed to beaccurate, Przemyslaw Radomski, CFA and his associates do not guarantee theaccuracy or thoroughness of the data or information reported. The opinionspublished above are neither an offer nor a recommendation to purchase or sell anysecurities. Mr. Radomski is not a Registered Securities Advisor. By readingPrzemyslaw Radomski's, CFA reports you fully agree that he will not be heldresponsible or liable for any decisions you make regarding any informationprovided in these reports. Investing, trading and speculation in any financialmarkets may involve high risk of loss. Przemyslaw Radomski, CFA, SunshineProfits' employees and affiliates as well as members of their families may havea short or long position in any securities, including those mentioned in any ofthe reports or essays, and may make additional purchases and/or sales of thosesecurities without notice.

Przemyslaw Radomski Archive |

© 2005-2019 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.