Gold Co.'s PEA Expected Shortly

Michael Ballanger of GGM Advisory Inc. shares his thoughts on current movements in the market and one gold stock he believes is a Buy.

Michael Ballanger of GGM Advisory Inc. shares his thoughts on current movements in the market and one gold stock he believes is a Buy.

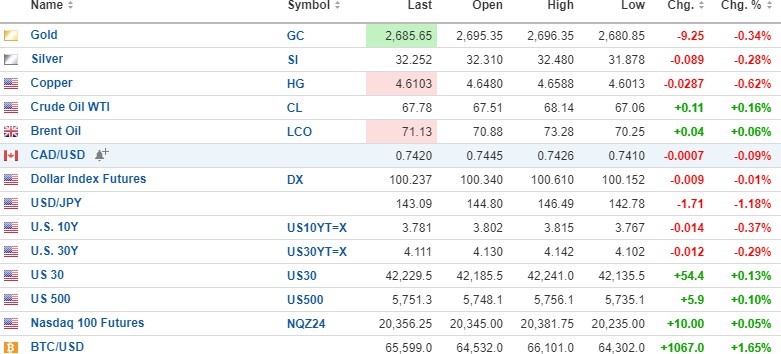

The USD index futures are down 0.01% today with 10-yr. (-0.32%) and 30-yr. (-0.29%) yields finally having modestly lower sessions.

December, gold (-0.34%), silver (-0.62%), and copper (-0.45%) are lower, while oil is up (+0.16%).

Stocks are again higher, but with the PCE coming out at 8:30 am, that could change. Risk barometer Bitcoin is up 1.65% to $65,999.

Freeport-McMoRan

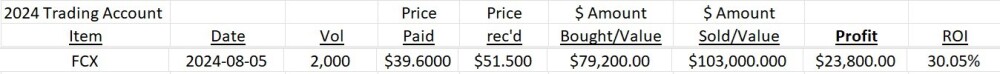

I recently sold 50% (1,000 shares) Freeport-McMoRan Inc. (FCX:NYSE) at $51.50.

I took a 30% gain on the position from the August 6 entry point at $39.60, which leaves a paltry 1,000 share position as a token holding of a truly great company.

It is one thing to call the bottom in copper last month literally to the day but it a totally different ball of wax when any market moves from gradual to vertical, as is the current copper chart. While we are working a bullish MACD crossover and "buy signal," RSI in the high 70's, and MFI stretched to over 90, I see the potential for a sharp, short pullback in copper prices and in FCX.

In fact, this week, we have seen two big gaps in the price pattern for FCX, and in my experience as a trader, all gaps eventually get filled by a retrenchment, so a pullback to under $45 would be no surprise and would serve to work off the overbought condition.

I am not going to sell the remaining 1,000 shares because I will wind up fretting about being "flat" but I have reduced the position substantially and with it the risk.

Getchell Gold

Yesterday, Getchell Gold Corp. (GTCH:CSE; GGLDF:OTCQB) put out a press release that served as a prequel to the upcoming preliminary economic assessment ("PEA") for the Fondaway Canyon gold project in Nevada. I have had a number of inquiries in recent days as to the reason why investors have orphaned a company with 2.3mm ounces of gold in one of the best mining jurisdictions on the planet despite a move in gold of over $600 per ounce in 2024 alone.

While there is no easy answer, I had a conversation this week with an investor relations executive who works with a number of the junior miners, and she echoed the same complaints that many GTCH shareholders have voiced.

What is it going to take to lure investors back into the exploration and development space?

Back in the day, it usually took a new discovery to turn the juniors back up. I recall in the winter of 1995, with the junior diamond scene in full disrepair after a number of disappointing testing results and the Kettle River scam sent investors running for the hills, a new NWT diamond discovery by Mountain Province sent that stock screaming northward while dragging the rest along with it. Even further back was the Hemlo discovery of 1981, which arrived in the middle of one of the worst bear markets I have ever witnessed (1981-1982). The shares of Golden Sceptre and Goliath Gold, as well as International Corona, saved clients from a losing year and rescued the juniors for the next five years.

Here in 2024, there have been few new discoveries to excite the retail crowd, and unless the space can demonstrate the ability to deliver capital gains, they will continue to flood to technology and crypto and "special situations" such as biotech as their vehicles of choice. In Getchell's case, the upcoming PEA may not excite the retail crowd, but depending on how "robust" the numbers are, it could quickly attract an intermediate-sized producer in the hunt for a "growable" deposit in a favorable jurisdiction with unlimited blue-sky potential by way of additional drilling. I cannot see anyone taking a run at Fondaway Canyon for less than $50/ounce, which would be a fivefold increase in the stock from current levels.'

The PEA is expected "in the fall," which means it is "close." I look forward to seeing the numbers, which will once and for all put to rest any doubts about metallurgy or, more importantly, the economic viability of the Fondaway Canyon asset. It will be the catalyst required that brings new investors "over the wall."

Getchell Gold Corp. is a Buy.

| Want to be the first to know about interestingGold,Base Metals andCritical Metals investment ideas?Sign up to receive the FREE Streetwise Reports' newsletter. | Subscribe |

Important Disclosures:

As of the date of this article, officers and/or employees of Streetwise Reports LLC (including members of their household) own securities of Getchell Gold Corp.Michael Ballanger: I, or members of my immediate household or family, own securities of: All. I determined which companies would be included in this article based on my research and understanding of the sector.Statements and opinions expressed are the opinions of the author and not of Streetwise Reports, Street Smart, or their officers. The author is wholly responsible for the accuracy of the statements. Streetwise Reports was not paid by the author to publish or syndicate this article. Streetwise Reports requires contributing authors to disclose any shareholdings in, or economic relationships with, companies that they write about. Any disclosures from the author can be found below. Streetwise Reports relies upon the authors to accurately provide this information and Streetwise Reports has no means of verifying its accuracy. This article does not constitute investment advice and is not a solicitation for any investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Each reader is encouraged to consult with his or her personal financial adviser and perform their own comprehensive investment research. By opening this page, each reader accepts and agrees to Streetwise Reports' terms of use and full legal disclaimer. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company.For additional disclosures, please click here.

Michael Ballanger Disclosures

This letter makes no guarantee or warranty on the accuracy or completeness of the data provided. Nothing contained herein is intended or shall be deemed to be investment advice, implied or otherwise. This letter represents my views and replicates trades that I am making but nothing more than that. Always consult your registered advisor to assist you with your investments. I accept no liability for any loss arising from the use of the data contained on this letter. Options and junior mining stocks contain a high level of risk that may result in the loss of part or all invested capital and therefore are suitable for experienced and professional investors and traders only. One should be familiar with the risks involved in junior mining and options trading and we recommend consulting a financial adviser if you feel you do not understand the risks involved.