Gold, Copper and Silver are Must-own Metals / Commodities / Gold & Silver 2020

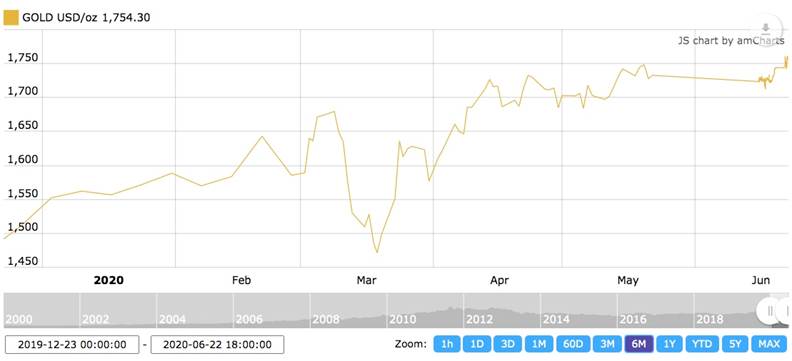

Gold surged on Mondayafter a spike in coronavirus cases worldwide dashed hopes of a quick economicrecovery. Within 24-hours the number of infections globally rose 183,020, a newrecord, the World Health Organization reported, Reuters said the US saw a25% increase in new COVID-19 cases over the week ending June 21st.

Spot prices tradedsharply higher, reaching a five-week high, before closing at $1,756.10/oz inNew York. Gold futures for August delivery were last up $13.20 at $1,766.60/oz,while July silver futures traded flat at $17.86/oz.

Economic Times of Indiareported two US Federal Reserve officials sounding increasinglypessimistic of a fast return to growth, in the country worst hit by covid-19.The officials warned that unemployment could rise again if the disease is notbrought under control. In April the jobless rate hit 14.7%, the highest sincethe Great Depression, and while it dropped in May, to 13.3%, more than 45million Americans have filed for benefits since covid-19 shutdowns began in mid-March.

Kitco’s technical analyst Jim Wyckoff wrote that gold prices areprobably pricing in the likelihood of inflation, given the trillions of stimulusbeing pumped into economies by central banks and governments worldwide to dealwith covid fallout:

Importantly, thesense of the marketplace is that major central banks of the world will continueto print money if global economies show further signs of sputtering. Thisinflux of cash into the global financial system is also supporting stock marketgains despite the still seriously hobbled major economies. Many are wonderinghow long it will take for the negative consequences of all that easy money toshow up in economies. Very likely, this notion is also prompting some newbuying in the gold market.

The US government andpolicymakers around the world have no choice but to unleash massive stimulusprograms to help their citizenries to deal with the worst recession since WorldWar II.

The $2.2 trillion reliefpackage Trump signed into law on March 27 is just the beginning, with theTreasury Department now seeking $250 billion more for small business loans. IfHouse Democrats and the president can agree on a Phase 4 spending deal,targeting infrastructure, that would mean another $2 trillion.

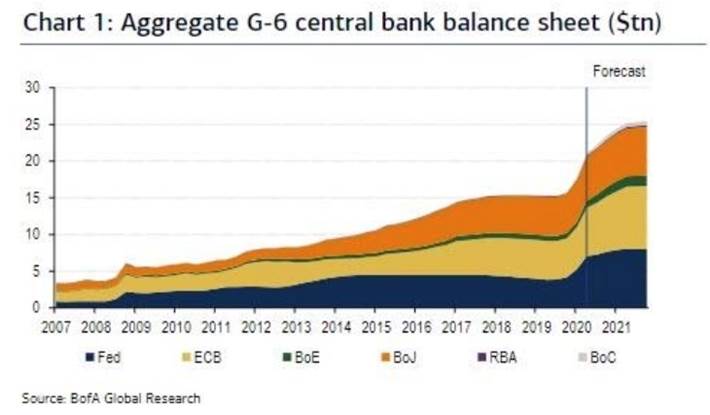

According to Bank ofAmerica, via Zero Hedge, the amount of globalfiscal and monetary stimulus has already reached an astronomical US$18.4trillion in 2020, consisting of $10.4 trillion in government spending and $7.9trillion in central bank asset purchases, “for a grand total of 20.8% of globalGDP, injected mostly in just the past 3 months!”

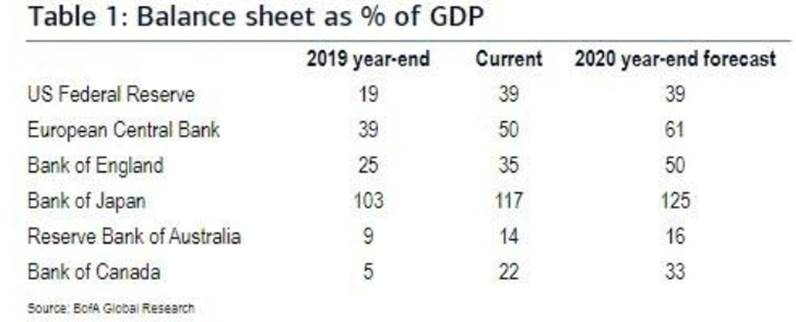

As an example ofexplosive monetary stimulus via money printing, consider: at the end of 2019,the Fed’s balance sheet as a percentage of GDP was 19%; six months into 2020,it has already doubled, to 39%.

Inflation-hedge goldbuying

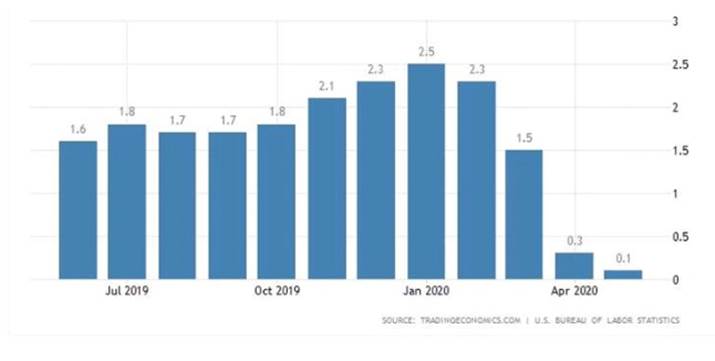

We have written previously about the effects ofdeflation and inflation on gold prices. We predicted that due to a significantfall in consumer spending, which makes up about two-thirds of the US economy,owing to covid-19 lockdowns, we would see a period of deflation ie., fallingprices, before witnessing inflation when the economy recovers and prices startrising again.

This is exactly what ishappening. US inflation is now the lowest since September 2015, falling from2.5% in January to 0.1% in May.

With global growthexpected to slip 8% this year, it is obviously too early to be worried aboutinflation. But it is interesting to see investors are already pouring moneyinto assets such as gold, property stocks and inflation-linked bonds, “on theview that the recent explosion of government spending and central bank stimulusmay finally rouse inflation from its decade-long slumber,” Reuters said on Sunday.

TreasuryInflation-Protected Securities, or TIPS, provide protection against inflation.Also known as linkers, the face value and interest payments on these securitiesrise with inflation, as measured by the Consumer Price Index.

Even though inflation maybe some years away, banks are advising clients to pick up cheap hedges, such asUS 10-year inflation-linked bonds, that show an inflation rate of just 1.2% ina decade.

“These hedges in manycases look extraordinarily cheap, so why not buy them now?” Reuters quotesColin Harte, multi-asset portfolio manager at BNP Paribas Asset Management. Henotes the S&P 10-year U.S. TIPS Index is already up 12% from Marchlevels.

Another fund manager,PineBridge Investments’ head of multi-asset Mike Kelly, has been buying gold onthe view that the covid situation will be different from what happened afterthe financial crisis, when prices failed to respond to all the money-printingduring rounds of quantitative easing:

“We will be pushing,pushing, pushing on the string and dropping our guard, then 3-5 years fromnow...that’s when the (inflation) dog will start barking,” he says. “Goldworries about such things long in advance. It has risen through thiscoronavirus with that down-the-road-risk top of mind.”

Private banks that caterto the world’s ultra-wealthy are also counseling clients toinvest more of their portfolios in gold, as bond yields plummetamid central bank stimulus programs.

“Our view is that theweight of monetary supply, expansion, is going to ultimately be debasing to thedollar, and the Fed commitments, which (are) anchoring real rates, make thecase for gold pretty sturdy,” said Lisa Shalett, Chief Investment Officer,Wealth Management at Morgan Stanley.

Dollar’s ‘exorbitant privilege’at risk

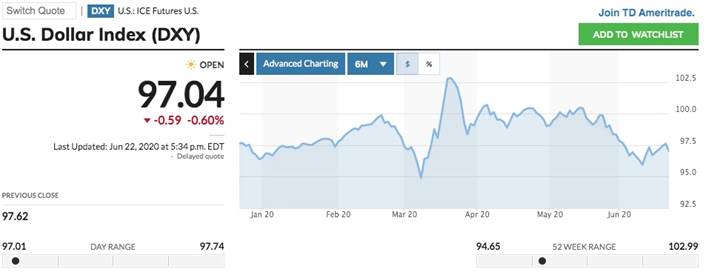

Speaking of the dollar,it has sunk steeply in recent weeks. In fact Donald Trump may finally get hiswish of a low dollar to support US exports - a rallying cry during the tradewar with China - except that the dollar is falling for reasons that areentirely the fault of the president.

Gold and the dollar movein opposite directions, so as the US convulses amid continued coronavirus chaos/economic fallout, White House divisions, and soaring racial tensions partlystoked by Trump (“when the looting starts the shooting starts”), gold hasbenefited.

In the 1960s Frenchpolitician Valéry d’Estaing complained that the United States and its exportersenjoyed an “exorbitant privilege” due to the dollar’sstatus as the world’s reserve currency. He had a point.

The dollar is still thereserve currency, but how important is it right now, with all that is going onin the world?

Renowned Yale economistStephen Roach believes that due to the decoupling of trade with its partners,and the rise of China, the dollar’s reign as the king of currencies looksshaky.

Appearing on CNBC’sTrading Nation a week ago, the university lecturer forecasts a 35% decline inthe US currency against its major rivals, due to the nation’s rising deficit(it recently tripled) and dwindling savings.

“The dollar is going tofall very, very sharply,” he told the business network.

In a Bloomberg op-ed, Roach said the US economyis already stressed by the recession caused by covid-19, and that the publichealth crisis will only amplify the dollar’s woes.

Goldman Sachs believes a weakerdollar will boost the purchasing power of major gold consumers inemerging-market (EM) economies like China and India. In its latest Commodities Researchnote, theinvestment bank upgraded the precious metal on “debasement fears”, noting thetwo main drivers sending gold prices higher will be lower real rates (interestrates minus inflation) and higher EM demand:

Our economistsexpect inflation over the next 5 years to average 1.73% vs current marketpricing of 1.02%. Therefore, real rates in the US are expected to continue tofall, increasing debasement concerns and putting upward pressure on gold (seeExhibit 9).

US burns, gold climbs

It does not require muchdigging to find reasons to question US leadership domestically andinternationally. Every day new headlines emerge indicating how unfit Trump isfor the highest office in the land, and how four years of his administrationhas culminated in deep divisions not only in the American economy but in theAmerican psyche.

Recent losses for Trumpinclude two Supreme Court decisionsthat went against him - one that blocked the termination of the Deferred Action forChildhood Arrivals (DACA) program, the other delivering a landmark opinion infavor of LGBTQ workers - along with withering criticism of both his handling ofthe George Floyd protests and the pandemic, and the release of John Bolton’sbook in which the former Trump national security advisor makes a number ofallegations including that Trump engaged in “obstruction of justice as a way oflife.”

The Atlantic notes Trump’s string ofSupreme Court defeats, including a challenge last year to his addition of acitizenship question to the census, all stem from an abuse of the executivebranch of government:

Much of hisadministration’s approach to governance rests on attempting executive actionsthat lack any meaningful justification rooted in expertise, or even rationalthought.

The Supreme Court asearly as this week could decide on whether Trump’s accountants must turn over hisfinancial records and tax returns to House Democrats and New York prosecutors,who are investigating “hush money” payments.

Only 42% of Americansapprove, and 55% disapprove, of the Trump presidency, according to the latestpolls.

The lies keep coming fromthe Tweeter-in Chief. Despite boasting of a million people seeking tickets forhis rally on Saturday in Tulsa, Oklahoma, only about 6,500 showed up - what canonly be described as a fizzle for Trump’s 2020campaign kick-off. TV coverage showed large sections of empty seats in the 19,000-seatBOK Center arena. An extra venue rented for over-flow crowds wentun-used.

His long-winded speechmade no attempt to unite a nation divided on race and economic prospects. Hedisparagingly, and wrongly (coronavirus is not influenza) referred to covid-19as “Kung Flu”, and said he told officials in his administration to slow downcoronavirus testing because of the rising number of cases. CNN reports,

“You know testingis a double-edged sword,” Trump said while complaining about press coverage ofhis handling of the virus. Claiming the US has now tested some 25 millionpeople, he added: "Here's the bad part ... when you do testing to thatextent, you're going to find more people; you're going to find more cases. So Isaid to my people, slow the testing down please."

Widespread testing andcontact tracing worked well to contain the virus in Singapore, and dramaticallylimited covid-19 deaths in South Korea. Testing is necessary to identify whohas the virus, so that the infected can be quarantined and their contacts canbe traced, something that has not been done effectively in the United Statesand other countries, including Canada.

The president keepsacting in ways that attempt to censor bad publicity or remove impediments tohis bid for re-election. First there was his administration’s attempt to block thepublication of John Bolton’s book, which contains a number of stingingallegations including that Trump once asked Chinese President Xi Jinping forhelp getting re-elected. Trump then fired Geoffrey Berman, the federalprosecutor whose office put his former personal lawyer in prison and isinvestigating his current one, heightening criticism that the president wascarrying out an extraordinary purge to rid his administration of officialswhose independence could be a threat to his re-election campaign, states the New YorkTimes.

Of course, Trump lastyear was impeached by the House of Representatives but acquitted by the Senateover allegations of obstruction of justice. The Times notes that Since the beginningof the year, the president has fired or forced out inspectors general withindependent oversight over executive branch agencies and other key figures fromthe trial.

Meanwhile a wave ofsocial unrest, which began with the death of George Floyd, who was black, whilein the custody of a white Minneapolis police officer, continues to wash overthe country.

Violence revisited theMidWest city early Sunday morning. A shooting in a popular nightlife andshopping district left one man dead and 11 people wounded.

Also on the weekend, inSeattle a 19-year-old man was killed and another person was in criticalcondition, following a 3 am shooting in the city’s police-free ‘autonomouszone’ set aside for protesters. When police officers responded to reports ofgunshots inside the protest zone, they “were met by a violent crowd thatprevented officers safe access to the victims,” according to a policedepartment press release.

Despite states being in variousstages of reopening their economies, the United States is nowhere nearrecovering from covid-19.

Last week 10 states saw arecord number of coronavirus cases, including Florida, which had the largestone-day count since the pandemic began.

White House officialsignored warnings from members of Trump’s coronavirus task force, about thehealth risks of holding large-scale indoor campaign rallies. The Tulsa rally tookplace despite six Trump campaign staffers testing positive for covid-19 and thevirus surging in Oklahoma.

And while the federalgovernment has attempted to cushion the economic blow for hard-hit Americans bydoling out $1,200 checks and bumping up unemployment insurance payments, manyare in financial trouble.

On June 1, a three-monthmoratorium on evictions expired, exposing millions of Americans to the threatof being tossed from their homes. While some of the 43 moratoriums, like in NewYork, have been extended, more than a third of those moratoriums have since been liftedand more are set to expire, leaving renters to come up with months of back payor face losing their homes, CNN Business said.

Homeowners aren’t anybetter off. Fully 30% of Americans didn’tmake their housing payments for June, with one-third of the 30% making a partialpayment and two-thirds unable to afford any payment at all.

This is what chaos lookslike in the land of the free and the home of the brave.

China rising

Gold is a store of valueand a hedge against inflation. It is also the logical response to fear.

Heightened globaltensions such as terrorist attacks, border skirmishes, coups, protests andpandemics, scare investors into shifting their funds to precious metals.

A flurry of safe-havendemand in recent weeks has pushed gold even further into the spotlight. We seea number of events happening that are both destabilizing, and move China andthe United States closer to blows.

On June 15, there was adisagreement over two Chinese tents and observation towers that Indianofficials said had been built on its side of a demarcation line in the disputedGalwan Valley.

The seemingly minorscuffle escalated into the first deadly border clash in nearly 40 years. Al Jazeera reports:

A large group ofChinese soldiers arrived and confronted the Indian troops. It was not clearwhat happened next, but the two sides soon clashed, the Chinese soldiersreportedly using iron rods and batons with spikes, killing 20 Indian soldiersand wounding dozens of others.

On Saturday the Times of India reported India has moved itsfighter jets to forward bases facing China, and warships were deployed tothe Bay of Bengal. China reportedly lined upmore jets and bombers to its air-based offensive platforms along the Line of Actual Controlin Ladakh.

Things are also heatingup regarding the constant friction between China and Taiwan, which Beijingconsiders a renegade province that must eventually unite with the Motherland.

As a seventh Chinesefighter in less than two weeks approached Taiwan’sairspace on Sunday, Harvard political science professor Graham Allison warned thatTaiwan's tireless pursuit of its independence may result in Beijing's militaryretaliation, Taiwan News reported:

Allison emphasizedthat Taiwan is in a dangerous position and that the only reason it has not beenattacked by Beijing is because of the CCP's uncertainty regarding the globalcommunity's response.

China has been planning,for the past 25 years, to defeat the US with an electromagnetic pulse (EMP)attack on US aircraft carrier fleets (currently 3) stationed in East Asia. As reported by The Hill,

A nuclear EMPattack against U.S. aircraft carriers is the key to victory in China’s militarydoctrine, as noted in a Feb. 12, 2000, article in the official newspaper of theShanghai Communist Party Central Committee:

“The weak points ofa modern aircraft carrier are: 1) As a big target, the fleet is easy for asatellite to reconnoiter and locate. … 2) A high degree of electronization islike an Achilles’ heel for an aircraft carrier fleet, which relies heavily onelectronic equipment as its central nervous system. These two characteristicsdetermine one tactic.” Therefore, military strategist Ye Jian said in thearticle in Jiefang Ribao: “The possession of electromagnetic pulse bombs(missiles) will provide the conditions to completely destroy an aircraftcarrier fleet, and the way to complete victory in dealing with aircraft carrierfleets.”

In March 2020, apanel of China’s military experts threatened to punish U.S. Navy ships forchallenging China’s illegal annexation of the South China Sea by making an EMPattack — one of the options they considered least provocative because the crewwould be unharmed, but most effective because the ship would be disabled. Nowthree U.S. aircraft carriers are in the Pacific to challenge China’s aggressionin the South China Sea.

Less threatening butgermane to our discussion on gold, Chinese companies have been particularlyactive in acquiring gold producers and gold juniors. In March Zijin Miningcompleted the takeover of Colombia-focused Continental Gold for CAD$1.3billion, and on May 8, another large Chinese gold miner, Shandong Gold Mining,agreed to acquire TMAC Resources for around CAD$230 million. Shandong alsosnapped up Australia’s Cardinal Resources, which operates in Ghana, for AUD$300million.

Conclusion

As smart resourceinvestors, we want to be investing in metals, and companies, that are at theleading edge of a trend.

Gold and silver offerstability during periods of extreme stock market volatility and low bondyields, and while they do not pay interest or dividends, they are not subjectto inflation like paper currencies.

Precious metals can beused as a “fail-safe” currency in the event of a total financial collapse.Until we can say, in a broad sense, that re-openings have succeeded and thecoronavirus is beaten, gold is going to continue to do well, and I wouldtherefore strongly suggest holding some physical bullion or investing in one ortwo quality gold juniors - which historically present the best leverage againsta rising gold price.

The way we see it, gold/silver have it made, whether economic growth picks up or it continues to muddlealong, still pinned down by the coronavirus. In the current deflationaryenvironment, gold is doing well because of all the other drivers that make itsuch an attractive investment - a high global debt to GDP ratio from thecombination of falling economic growth and rising national debts, owing tomassive virus-related stimulus; growth of the M2 money supply lighting a fireunder gold prices; continued low interest rates until at least 2022; a steadyflow of safe-haven demand, due to the numerous above-mentioned global hot spotsparticularly with regard to a more belligerent China; and social/ economicchaos gripping the United States as it enters a presidential election.

Gold is also poised togain in the likely event that all of this stimulus - at last count $18.4trillion!- leads to inflation.

If inflation goes, say,above 3%, yet interest rates remain near zero, that would create anotherbullish condition for gold - negative real rates (interest rates minusinflation). When US Treasury bond yields turn negative, investors typicallyrotate their funds out of bonds, into gold.

And we haven’t evenmentioned all the bullish supply drivers for the precious metal, outlined in a previousarticle, including peak gold, a lack of new discoveries due in part topared-down exploration budgets; the large gold-producing countries like Chinaand South Africa outputting less; coronavirus-related gold mine shutdowns;falling gold grades; and producers high-grading their deposits.

As for silver, we haverecently seen the gold-to-silver ratio decline, from over 100:1, to the current99:1, meaning it takes 99 ounces of silver to buy one ounce of gold.Historically, the ratio is closer to 60:1, so silver is really quiteundervalued compared to gold.

We have the same bullishindicators for silver as for gold, in terms of safe-haven demand incitinginvestors to park their money in silver bullion, silver ETFs or silver miningstocks, and the fact that silver is not subject to inflation like papercurrencies.

Now, supposing thecoronavirus retreats and economic growth begins to take off. As mentioned thiswould be inflationary, but silver wouldn’t react to inflation as much as gold,because it functions less as an investment metal than an industrialmetal.

Over 50% of silver demandcomes from industrial uses like solar panels, electronics, and the automotiveindustry. 5G is set to become another major new driver of silver demand.

In an earlier article we said what the globaleconomy really needs, in this low-growth, spending-stalled environment broughtabout by the pandemic, is a push - something big that will attract huge amountsof investment, and workers. As we have suggested, this could be a massiveinfrastructure spending program, on the scale of President Roosevelt’s “NewDeal”.

The Trump administrationis said to be preparing a nearly $1 trillioninfrastructure proposal – some of the dollars are geared toward 5G/ broadband - as away of spurring the world’s largest economy back to life.

According to the SilverInstitute, The electronic components that enable 5G technology will relystrongly on silver to make the global 5G platform perform seamlessly. In afuture 5G connected world, silver will be a necessary component in almost allaspects of this technology, resulting in yet another end-use for silver in analready vast and versatile demand portfolio.

The group expects silverdemanded by 5G to more than double, from its current ~7.5 million ounces, toaround 16Moz by 2025 and as much as 23Moz by 2030, which would represent a 206%increase from current levels.

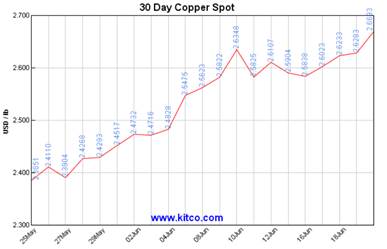

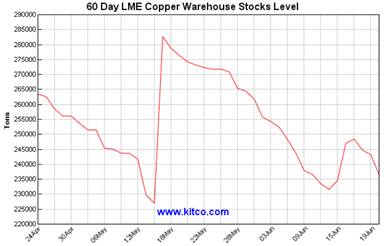

Copper’s widespread usein construction wiring & piping, and electrical transmission lines, make ita key metal for civil infrastructure renewal.

A report by Roskillforecasts total copper consumption will exceed 43 million tonnes by 2035, drivenby population and GDP growth, urbanization and electricity demand. Total worldmine production in 2019 was only 20Mt.

Many copper watchers wereexpecting the essential industrial metal to take a big hit from thecoronavirus, but if current market fundamentals continue, we might even seecopper posting a 2020 gain on economic recovery momentum.

The same goes for silver.Its hundreds of industrial applications make silver very responsive to thecondition of the global economy. Improved economic conditions resulting fromcountries successfully reopening from coronavirus lockdowns, would be great forcopper and silver explorers, and their investors, who know the best leverageagainst rising metals prices is to own an early-stage junior with a sizeable andscalable deposit in a mining-friendly jurisdiction.

As smart resourceinvestors, we want to be invested in metals, and companies, that are at theleading edge of a trend. At AOTH we see gold, silver and copper as THE bestmetals to own right now, offering investors both safety and opportunity forprice appreciation in a pandemic and post-pandemic world.

By Richard (Rick) Mills

If you're interested in learning more about the junior resource and bio-med sectors please come and visit us at www.aheadoftheherd.com Site membership is free. No credit card or personal information is asked for.

Richard is host of Aheadoftheherd.com and invests in the junior resource sector. His articles have been published on over 400 websites, including: Wall Street Journal, Market Oracle,USAToday, National Post, Stockhouse, Lewrockwell, Pinnacledigest, Uranium Miner, Beforeitsnews, SeekingAlpha, MontrealGazette, Casey Research, 24hgold, Vancouver Sun, CBSnews, SilverBearCafe, Infomine, Huffington Post, Mineweb, 321Gold, Kitco, Gold-Eagle, The Gold/Energy Reports, Calgary Herald, Resource Investor, Mining.com, Forbes, FNArena, Uraniumseek, Financial Sense, Goldseek, Dallasnews, Vantagewire, Resourceclips and the Association of Mining Analysts.

Copyright © 2020 Richard (Rick) Mills - All Rights Reserved

Legal Notice / Disclaimer: This document is not and should not be construed as an offer to sell or the solicitation of an offer to purchase or subscribe for any investment. Richard Mills has based this document on information obtained from sources he believes to be reliable but which has not been independently verified; Richard Mills makes no guarantee, representation or warranty and accepts no responsibility or liability as to its accuracy or completeness. Expressions of opinion are those of Richard Mills only and are subject to change without notice. Richard Mills assumes no warranty, liability or guarantee for the current relevance, correctness or completeness of any information provided within this Report and will not be held liable for the consequence of reliance upon any opinion or statement contained herein or any omission. Furthermore, I, Richard Mills, assume no liability for any direct or indirect loss or damage or, in particular, for lost profit, which you may incur as a result of the use and existence of the information provided within this Report.

© 2005-2019 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.