Gold Correlation To S&P 500 Makes This Asset Class A Necessity In Current Market Conditions

Gold as an asset class has a weak correlation to the stock market and is worth diversifying into.

Gold outperformed the S&P 500 index across the past 2 crisis in 2002 and 2009 and could be a good hedge in a frothy market.

Overall gold investments generated lower returns in the past 20 years but is important to include for portfolio risk management.

The market has been volatile with wild swings related to trade talk news, interest rate expectations, business or consumer data, global political uncertainties and lots more. Gold exposure has historically displayed weak correlation with movements in the stock market and hence this is an asset class that I am very interested to invest for diversification and risk management.

I watched a video on YouTube middle of this year, and made a note in my blog to remind myself to revisit gold at some point. This is the clip:

I made a screen of gold mining stocks and published the article Mining For Gold and shortlisted Newmont (NEM) and Newcrest (OTCPK:NCMGF) as potential investment targets with exposure to gold. I am grateful to readers who have suggested Alamos Gold Inc. (AGI) to research on and that is where I am spending my time, after covering Newcrest (OTCPK:NCMGF) in this article.

If there is a crucial element in my portfolio that is going to impact my investment returns and retirement goals, then I would have to do a deep dive and hope to understand this missing element as soon as possible.

Gold has a history of having a weak correlation to stock market movements.

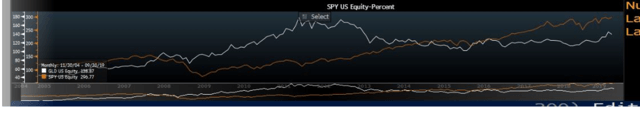

I have a screen capture of the Gold Shares ETF (GLD) and its relationship with the S&P 500 ETF (SPY) between 2013 and October 10, 2019. The resulting dot plot and red line drawn shows a weak linear correlation.

Source: Bloomberg

Specifically over the 2008 and 2009 financial crisis, the Gold ETF rose steadily while the S&P 500 suffered declines.

Source: Bloomberg

The picture above shows the period between January 1, 2008 and December 31, 2009. While the S&P 500 ETF (SPY) declined by 20%, the Gold Miners ETF (GDX) declined 6% while Gold Shares ETF (GLD) increased 27% in price, representing a 14% annual return.

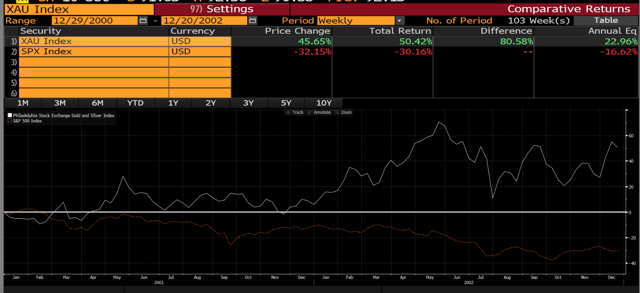

The benefit of investing in gold now is that if markets are turning volatile and uncertain, and interest rates are about to be lowered further, gold might be a flight to safety for investors. This was also the case between 2001 and 2002.

Source: Bloomberg

As a standalone asset class, I can understand why some investors would prefer just sticking to equities. I picked a near 20-year year comparison between a gold and silver index against the S&P 500 and the gold and silver index vastly underperformed.

Source: Bloomberg

However, I firmly believe that gold is an asset class for risk management especially if more political and economic uncertainty is ahead of us. In the weeks ahead, I will be researching more into gold and silver investments as well as precious metal mining stocks and ETFs. This is the most important investment theme I have at the moment and I am laser-focused on getting work done.

It helps to also take a look at what other contributors have written about gold as an asset class in October to find out what the view and rationale is from the bull and bear camp.

Adam Hamilton is in the bear camp citing recent gold investment demand to be fragile which reflects a short-term bearish outlook. The insight is that when gold investors sell the gold ETF (GLD) at a faster pace than the underlying gold price, the ETF fund manager steps in to buy in order to track the underlying gold price movement. The result is a decline in gold held by the ETF. Mr. Hamilton ends the article with a warning of a gold correction, which would represent a buying opportunity. The article can be found here.

Another bearish contributor Ploutos has a different rationale, comparing the long-term returns of gold performance as compared to stocks. The comparison was made since 1974 to the present day. The conclusion is that gold over the past 45 years underperformed stocks by 5% annually and is an expensive hedge although it had successfully outperformed stocks during risk-off conditions. The article can be found here.

Contributor SomaBull is in the bullish camp, and says gold is not even close to its top in his latest article. SomaBull contends that the S&P 500 trades at a 30% premium over the historical mean in terms of price-to-earnings. SomaBull demonstrated the correlation between M2 money supply with gold prices and targets gold to be at $2,000.

The above views will be taken into my short-term entry price level as I have decided to diversify rather than an all-or-nothing approach to investing in equities. At present, GLD has come off its 52-week high of $146 and is trading at $140. I would like to build up a position first in GLD gradually as the market swings on positive trade developments while I continue my research on the gold mining stocks.

Disclosure: I/we have no positions in any stocks mentioned, but may initiate a long position in GLD over the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Follow Big Alpha Research and get email alerts