Gold Developer Discovers High-Grade 9.47 g/t Breakthrough at Alaska's New Amalga

Grande Portage Resources Ltd. (GPG:TSX.V; GPTRF:OTCQB; GPB:FSE) gives an update on the transportation infrastructure for its New Amalga gold property in southeastern Alaska. Read why one expert thinks the project is one of the higher-grade development stories in North America.

Grande Portage Resources Ltd. (GPG:TSX.V; GPTRF:OTCQB; GPB:FSE) shared an update on the transportation infrastructure for its New Amalga gold property in southeastern Alaska in a release on December 15.

The current development plan envisions a compact underground mining operation with off-site processing by a third party, removing the need for an on-site mill or tailings storage facility.

Source: Grande Portage Resources Ltd.

Source: Grande Portage Resources Ltd.In August 2025, the company announced its application for a State of Alaska road easement, which would cover approximately the first third of the total road development needed to access the project site. The remaining two-thirds of the route are on federal land, requiring a separate regulatory process.

"The state easement application has now progressed to the adjudication stage at the Department of Natural Resources, a significant milestone that will, in due course, lead to a public notice period," Grande Portage said in the release. "The company has also signed a contract for an archeological and cultural resources survey to take place in early spring the primary baseline study which will be required before road construction can begin."

The easement for this initial road segment will allow the start of mine access road construction on state land while advancing the federal regulatory process for the portions of the project under federal land tenure, the company said. Importantly, it will also provide the near-term benefit of establishing a helicopter staging area much closer to the project site compared to the previous staging area at Juneau International Airport. This will significantly reduce the helicopter cycle distance for transporting drilling equipment and supplies, improving efficiency and reducing noise impacts to residential areas of Juneau.

The New Amalga gold project remains open to expansion in multiple directions and hosts an indicated resource of 1,438,500 ounces of gold at an average grade of 9.47 grams per tonne gold (g/t Au) from 4,726,000 tonnes and an inferred resource of 515,700 ounces of gold at an average grade of 8.85 g/t Au (1,813,000 tonnes), the company said.

The current development concept envisions a small-footprint underground mining operation that would transport material off-site for processing by a third party, eliminating the need for an on-site gold recovery plant or tailings storage facility.

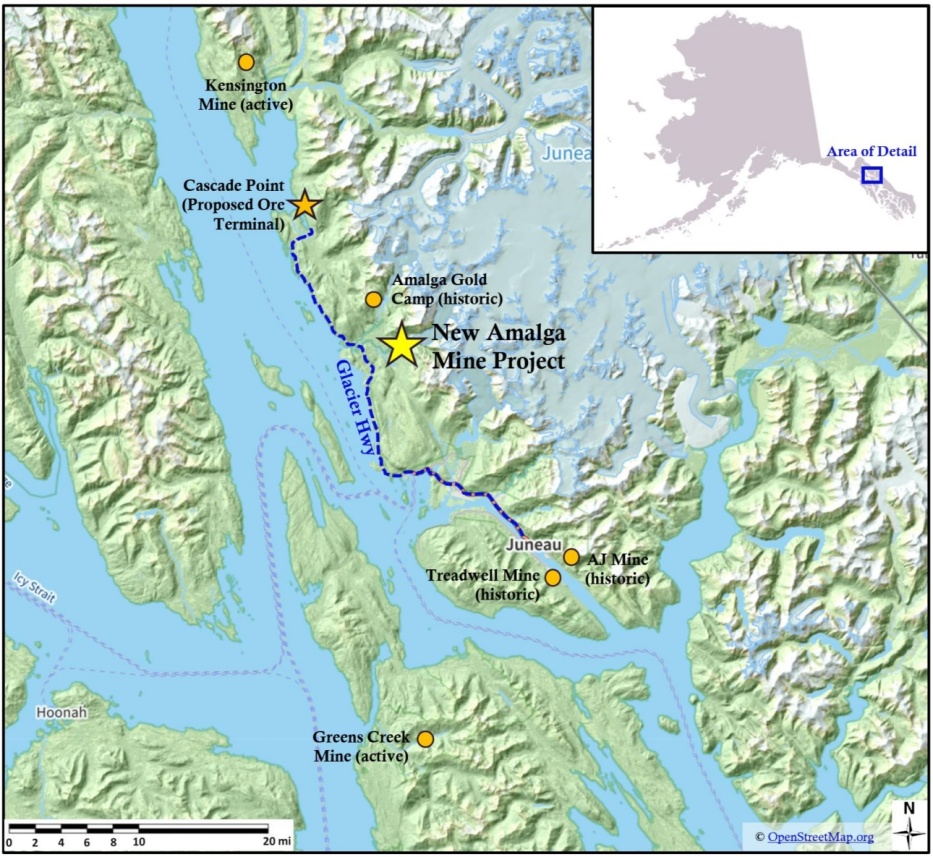

Update on Ore Barge Dock at Cascade Point

The company also gave an update on developments related to the proposed ore barge dock at Cascade Point, following the company's June 2024 announcement of a letter of intent (LOI) with Goldbelt Inc., Juneau's Alaska native corporation. Cascade Point is located approximately 24 kilometers from the New Amalga mine project and is accessible via Glacier Highway, an existing state-maintained roadway. The design for the ore dock will be integrated with Goldbelt's planning for a future Alaska Marine Highway System ferry terminal at the site, intended to improve marine access and transportation infrastructure in the Juneau area. The location can accommodate both functions in separate areas, with flexibility for the two projects to be built either concurrently or sequentially.

Since the execution of the LOI, significant progress has been made on the broader Cascade Point ferry terminal project, which is being advanced by the Alaska Department of Transportation & Public Facilities in coordination with Goldbelt, according to the release.

In July 2025, ADOT&PF awarded a US$28.5-million contract for phase 1 work at Cascade Point, covering uplands development, site preparation, and engineering and environmental studies. This work represents a key step toward preparing the site for the construction of marine infrastructure. Subsequently, in December 2025, the State of Alaska signed a US$1.3-million contract with Juneau Hydro to extend hydro power infrastructure to Cascade Point. The planned electrification will provide grid-based renewable power to the site, supporting lower operating costs and reduced emissions compared to diesel-based alternatives.

Grande Portage further reported that Goldbelt has provided the company with the next phase of engineering drawings for the proposed ore barge dock to be co-located at Cascade Point. The dock concept is intended to utilize available space at Cascade Point to operate alongside the passenger ferry terminal in a separate area of the site, subject to permitting, engineering refinement, and final agreements.

The dock is designed for barge loading of containerized ore using forklifts, rather than bulk (loose) ore by conveyor belt. This minimizes the construction of large infrastructure at the site while reducing any risk of spillage or dust generation, drawing on lessons learned from other regional ore terminals, including the requirements adopted by the City of Skagway, which requires that future ore shipments through the port of Skagway be containerized rather than handled in bulk.

"The advancement of the Cascade Point ferry terminal, combined with planned hydro power access and receipt of preliminary dock facility designs, represents significant progress since our initial announcement with Goldbelt," said Grande Portage President and Chief Executive Officer Ian Klassen. "These developments support our long-held objectives of establishing a practical, efficient, and environmentally responsible marine logistics solution for the New Amalga project."

'Grades Most Juniors Would Love to Have'

Grande Portage's flagship New Amalga project is distinguished as one of the higher-grade development stories in North America, according to Jeff Clark writing for TheGoldAdvisor.com on December 18.

"Located in southeast Alaska, the deposit is hosted in predictable, shallow, and continuous quartz veins and already supports an indicated resource of 1.44 million ounces (Moz) at 9.47 g/t gold, plus a further 516,000 ounces inferred at 8.85 g/t grades most juniors would love to have," he wrote.

Over the past month, Grande Portage has been accelerating activities at the project, Clark said. The company has applied for permits for a 4,300-meter drill program in 2026, completed a LiDAR survey to enhance geological understanding, and increased optionality through a new offtake study targeting a high-margin direct shipping ore strategy.

The market is beginning to take notice, Clark wrote. Shares have risen 70% since early November, reaching their highest level in three years. Major shareholder Eric Sprott recently doubled down with an additional CA$5 million investment.

"With a busy 2026 ahead and a long-awaited PEA due in Q1, I'm holding my overweight position," he wrote. "If the economics land well, the re-rate could continue, especially with gold prices providing a strong tailwind."

The Catalyst: Gold Continues Its Rise

Gold prices surged past US$4,400 on Monday, setting a new record high, as analysts highlighted escalating geopolitical tensions and more lenient monetary policies as key factors driving the increase, reported Mary Cunningham for CBS News MoneyWatch on December 23.

The price of the precious metal traded at US$4,475 per ounce at 4 pm EDT after hitting a high of US$4,477 per ounce earlier in the day, she reported. The asset has risen more than 70% since the start of this year. Gold is viewed as a safe-haven investment and typically acts as a hedge against inflation.

"The metals trade has been strong all year, and particularly for gold," Bret Kenwell, a U.S. investment and options analyst at eToro, told CBS News. "As its fundamentals remain intact, gold digested its recent rally to all-time highs quite well."

Review the annual outlooks from most major investment firms, and you'll find that experts are still bullish on gold, suggesting that buyers may not be too late to join the trend, according to a report by Chuck Jaffe for The Street on December 22.

In fact, the manager of a new gold and crypto fund believes that gold's rally is still in its early stages and will break all records over the next five years, Jaffe noted.

"After Covid is when we started seeing central banks really step up buying gold to an unprecedented level, and it hasn't really waned," said Ben McMillan of IDX Advisors, manager of the IDX Alternative Fiat ETF (GLDB), which launched in late October to provide investors exposure to gold, Bitcoin, silver, and Ethereum, according to the report. "That was kind of a structural shift, not a shift along the demand curve for gold; that's a regime change."

In a recent interview on "Money Life with Chuck Jaffe," McMillan noted that central banks' increased interest in purchasing gold, combined with the premium many investors are willing to pay for safe assets to mitigate geopolitical risk, along with stagnant gold mine outputs, has created "a massive sea change."

At the start of 2024, when the current rally was emerging, McMillan and IDX began forecasting that gold would reach US$5,000 an ounce within five years. Now, it seems gold will hit that target in just over half that time.

Streetwise Ownership Overview*

Streetwise Ownership Overview*

Grande Portage Resources Ltd. (GPG:TSX.V; GPTRF:OTCQB; GPB:FSE)

*Share Structureas of 12/23/2025"People thought we were insane," recalled McMillan, who also manages the IDX Dynamic Fixed Income ETF (DYFI) and other funds. "And we were saying, 'Listen, that doesn't mean you're going to all of a sudden slot in 40% of a 60-40 portfolio into gold, but it needs to be a non-zero in our mind. And since then, I think you've seen kind of more people appreciate that."

Ownership and Share Structure1

Holding companies own about 22% of the company, and insiders and management hold about 7%. The rest is in retail.

Top shareholders include 2176423 Ontario Ltd. with 22%, Alistair MacLennan with 3.94%, the President and CEO Ian Klassen with 1.89%, Michele Pillon with 0.86%, and Ronald Handford with 0.06%.

Its market cap is CA$65.62 million with 158.11 million shares outstanding. It trades in a 52-week range of CA$0.15 and CA$0.42.

| Want to be the first to know about interestingGold investment ideas?Sign up to receive the FREE Streetwise Reports' newsletter. | Subscribe |

Important Disclosures:

Steve Sobek wrote this article for Streetwise Reports LLC and provides services to Streetwise Reports as an employee.This article does not constitute investment advice and is not a solicitation for any investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Each reader is encouraged to consult with his or her personal financial adviser and perform their own comprehensive investment research. By opening this page, each reader accepts and agrees to Streetwise Reports' terms of use and full legal disclaimer. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company.For additional disclosures, please click here.

Ownership and Share Structure InformationThe information listed above was updated on the date this article was published and was compiled from information from the company and various other data providers.