Gold: Don't You Dare Sell

Gold dropped to $1,290 an ounce today.

We are approaching a ripe buying opportunity.

Ignore the bears.

Well the price of gold (GLD) collapsed today (05-15-2018) by well over $20 an ounce. The precious metal is now trading around the $1,291 mark. The GLD ETF finished up trading today at the $122,48 level, which means gold is now down well over 2% year to date. I wrote an article on the triple leveraged silver ETF (USLV) recently and stated that this vehicle (due to how oversold silver looks and how high the gold/silver ratio has climbed to) may be an attractive choice once precious metals bottom in earnest.

Timing this bottom depends on gold, as gold is essentially the leader of the precious metals sector. Where gold goes, silver and mining stocks usually follow. Yes, valuations of these segments can vary significantly at any given time but gold, gold and silver mining stocks and silver are highly correlated and invariably over time usually move in the same direction.

Therefore whether we use a vehicle like USLV, or the triple leveraged mining stock ETF (NUGT), once precious metals bottom, we use the gold chart for timing this bottom. The present downturn in gold looks like we are heading down into an intermediate decline. These declines are usually short but can be very aggressive. Let's discuss how to possibly pick a bottom.

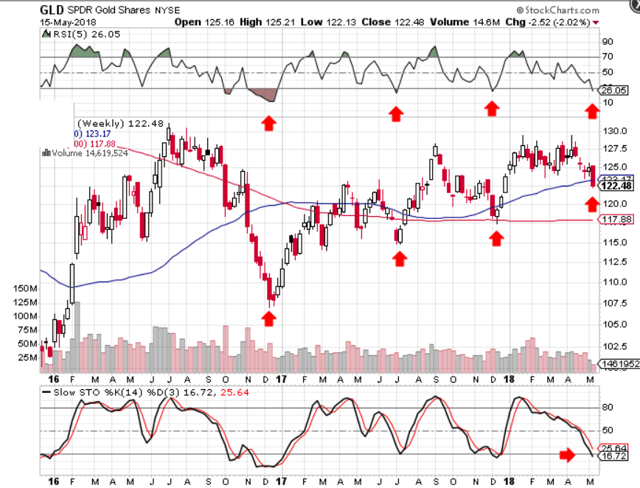

First of all, if we look at the weekly chart above, we can see that the stochastics and RSI numbers are pretty oversold and close to an intermediate bottom. These bottoms as the arrows illustrate occur every 6 months or so and take place like clockwork every cycle. When rapid selling takes place (like we had today), often the best thing to do is to wait for a swing low.

Why? Well there hasn't been a lot of breath to this present cycle so far (which bottomed in December of last year). In fact at $1,291 an ounce, gold isn't still that far from its highs in this intermediate cycle. Usually we get more breath than this (like we had in the July cycle). This prompts me to believing more downside may be ahead of us.

Now let's see how these intermediate bottoms usually behave. We can do this by going back to the last intermediate low (December 2017). Now as the chart illustrates below, after the sharp move down (which always has a big intra-day trading range), we had multiple trading days where the intra-day movement was much smaller.

These are the days where a possible swing low can take place, which is why caution is warranted at present. Buying at the close today is premature in the sense that a daily swing low has not taken place. If history is anything to go by, I expect a lower low over the next few days which will give us our opportunity to get in as near the final bottom as possible.

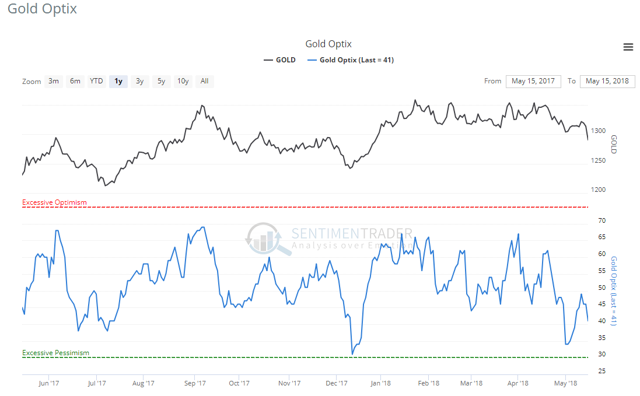

Long-term sentiment in gold is now getting to levels that we invariably see at intermediate lows. Price usually turns when the investing public get too pessimistic about the commodity at hand. Now silver investors would state that long-term sentiment in the white metal has been ultra pessimistic for multiple months now. This may very well be true but silver like the mining complex follows gold. However, due to the underperformance of the white metal of late, silver eventually has to outperform gold to bring the ratios back into sync. Maybe the next intermediate cycle may be the one of silver ? We shall see.

Charts Source : Sentimentrader.com

What is required now though is patience. The worst thing traders and investors alike can do now is to sell. Why? Just look at the first chart once more to see how oversold we are on the weekly chart. There is no reason to believe precious metals have begun a bear market. The commodity continues to make higher lows and higher highs. Until that trend changes, this pending bottom should be bought and not sold. Ignore the bearish commentary about gold dipping below its 200-day moving average. This always happens when it is dropping into an intermediate low. Patience is not simply the ability to wait - it's how we behave while we're waiting.

Disclosure: I/we have no positions in any stocks mentioned, but may initiate a long position in NUGT, USLV over the next 72 hours.

I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Follow Individual Trader and get email alerts