Gold - Early Stage Of A Secular Bear Market / Commodities / Gold and Silver 2018

Long Term Elliott WaveAnalysis

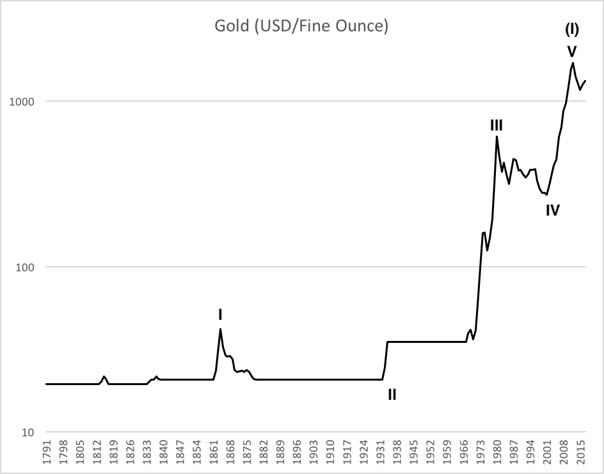

Gold probably shows a complete patternof supercycle degree into 2011. Its first spike appeared during the US civilwar. We interpret that as cycle wave I. The subsequent period shows acorrection that lasted for half of a century. It fits the character of acomplex sideways correction. It ended roughly at the same time as the USeconomy started growing from the Great Depression. The subsequent sharp risetook once again half of a century. This was the steepest portion of therecorded gold price progress. Therefore, we are dealing here probably with athird wave. The subsequent fourth wave correction took 20 years and shows azig-zag pattern with a B-wave triangle. This fits neatly into Elliott’salternation guidelines regarding a complex second wave. Gold prices took offaround the new millennium once again. They came to a stop in 2011. The fifthwave shows roughly equidistant progress to the first wave. We call itcomplete as long as we do not record a fading 3-wave drop from the top.

Fundamentals

There are little fundamental argumentson why gold should continue to rise. Industrial use is quite slim. Gold ismostly used for electrical connectors and this accounts for less than 10% ofnew gold production. The vast majority goes into consumption and investmentwith a share of more than 90%. The investment case is particularlyinteresting. There is a widespread belief that gold is a great protectionagainst inflation. Well, it isn’t!

Gold produced significant “reallosses”, which means inflation-adjusted losses on a very regular basis. Theperiods 1850-1870, 1890-1920, and 1935-1970 recorded heavy devaluation for goldin real terms. Each of this periods experienced a drop of more than 50% in thevalue of gold in real terms! That’s still nothing compared to the 1980-1999period. Gold devalued by roughly 80% in real terms during this period. Hence,gold is not a reliable protection against inflation at all.

Conclusion

There is a widespread misperception thatgold protects value during inflationary periods. An analysis of historic datareveals different facts. Moreover, the technical picture hints to a terminalpattern of a large scale. It is likely that we entered a secular bear marketfor gold in 2011. It will mark the biggest devaluation seen if our analysis provescorrect!

About The Author

Our background lies in economics andtrading. We have been trained at reputable universities and worked asproprietary traders as well as portfolio managers throughout the past couple ofdecades. We started exploring the field of behavioral economics due toself-interest in the late 90’s.

Our goal is to contribute outstandingtechnical analysis and forecasting. We focus on the most liquid assets that aresubject to worldwide public attention.

Please visit us for more information:

http://www.scienceinvesting.com/

© 2018Science Investing - All Rights Reserved

Disclaimer: The aboveis a matter of opinion provided for general information purposes only and isnot intended as investment advice. Information and analysis above are derivedfrom sources and utilising methods believed to be reliable, but we cannot acceptresponsibility for any losses you may incur as a result of this analysis.Individuals should consult with their personal financial advisors.

© 2005-2018 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.