Gold ETF Violates Pivotal Short-Term Low

Markets, including gold, react to latest Fed testimony.

Gold ETF (IAU) violates pivotal immediate-term support in the process.

My recommended stop-loss in IAU was consequently violated.

Gold suffered a setback on Tuesday after financial markets reacted negatively to the Congressional testimony of the new Federal Reserve chief. The gold price didn't violate its Feb. 7 pivotal low discussed in the previous report, but my favorite gold tracking ETF did. Here we'll discuss the implication of Tuesday's volatile trading session and how it might impact the immediate-term outlook for gold.

Gold prices were down over 1 percent on Tuesday after Fed Chairman Jerome Powell reaffirmed the central bank's commitment gradually raise interest rate rates. Spot gold shed 1.1 percent to close at $1,318 after hitting a two-week low earlier in the session. April gold futures also lost 1.1 percent to close at $1,318.

As reported by Briefing.com, Fed Chairman Powell's prepared remarks didn't contain any surprises as the incoming Fed chief largely maintained the policy of former Fed Chair Yellen. Powell indicated that he expects further gradual rate increases based on the economic outlook and that risks to the U.S. economy are "roughly balanced." Stocks and commodities dove into negative territory while the dollar rallied after Powell said his economic projections have increased since the December FOMC meeting, prompting investors to adjust their rate-hike expectations. According to the CME FedWatch Tool, the market is projecting three rate hikes this year with the likelihood of a fourth rate hike increasing to 33.1% from 24.4% on Monday.

The rally in the U.S. dollar index sealed gold's fate Tuesday with the PowerShares DB US Dollar Index Bullish Fund (UUP) closing 0.64% higher. The steady improvement in the dollar in just the last few days, as reflected in the UUP chart below, has created a strong headwind against the gold bulls' attempt at rallying the yellow metal out of its 5-week lateral trading range.

Source: www.BigCharts.com

While the dollar hasn't yet pushed decisively out of its 5-week basing formation visible in the UUP, its recent behavior has been lively enough to cause some concern for gold bulls. Specifically, the 15-day moving average which I use to delineate the immediate-term (1-4 week) trend for the dollar ETF has curled up and is now establishing a rising trend, as can be seen in the above graph. This suggests that the downside momentum which hindered the dollar index for the last few months is reversing, at least on a near-term basis which in turn will create increasing headwinds for the gold price.

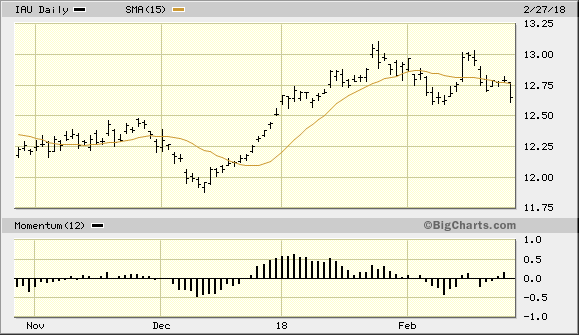

The next chart exhibit shows the daily progression of the iShares Gold Trust (IAU), my gold trading vehicle of choice. As can be seen here, IAU on Tuesday violated its nearest pivotal low of $12.62, which was established on Feb. 7. As I noted earlier this week, IAU was so close to its Feb. 7 pivotal low (which doubled as my recommended stop-loss on immediate-term trading positions) that it wouldn't take much for the bears to "run" this stop. That's exactly what happened on Tuesday as the $12.62 level was briefly violated on an intraday basis. Since the rules of my technical trading discipline are mechanical and not discretionary, this move stopped me out of my speculative trading position in IAU.

Source: www.BigCharts.com

It's always disconcerting to be stopped out of a trading position so soon after initiating it, but experience teaches that it's better to be safe than sorry in the event of any follow-through weakness in the gold price. At any rate a trading system is of no value if you don't follow its precepts religiously, even when it results in the occasional "whipsaw."

After Tuesday's downside day in the IAU, the gold ETF has its work cut out for it in terms of re-establishing support. IAU needs not only to recover decisively back above its 15-day moving average in order to reverse its latest setback, but it must also close above the nearest benchmark resistance level at $12.99 (the Feb. 15 high) fairly soon if the gold bulls want to have any chance of regaining control of gold's immediate-term trend, otherwise the risk increases that the inertia generated by the 5-week sideways trend will work against the gold price as its rate of change (momentum) declines.

In view of the above mentioned considerations, I recommend that conservative traders keep their powder dry and wait for the gold price to decisively strengthen before initiating any new trading positions. Longer-term investment positions in gold, however, can be maintained as the fundamentals underscoring gold's two-year recovery effort are still favorable.

Disclosure: I/we have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours.

I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.