Gold Fields Looks Interesting At Current Levels

Gold Fields' shares recovered from the South Deep-related sell-off in August 2018.

Now they look ready to continue the upside movement with several potential catalysts.

Right now, the market prioritizes cash flow over investment for gold miners, and Gold Fields is entering the right phase of the business cycle.

Shares of Gold Fields (GFI) have now completely recovered from the major sell-off in August 2018 which was caused by the announcement of South Deep restructuring. Currently, the company's stock resides at roughly the same levels as in July 2018, while the gold price is higher. Is the stock forming a base for more upside? Let's look at the key moving parts.

2019 guidance

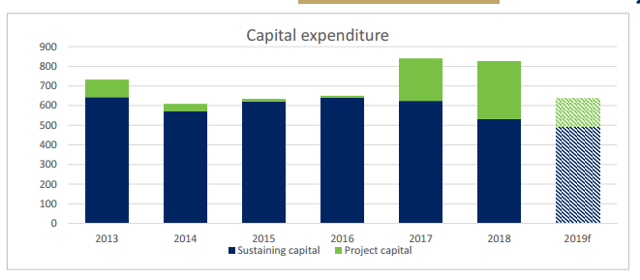

In 2018, Gold Fields produced 2.036 million ounces of gold at all-in sustaining (AISC) costs of $981 per ounce. For 2019, the company expects to produce 2.13 million-2.18 million ounces of gold at AISC of $980-995 per ounce. The first full year of contributions from Asanko (AKG) and the start-up of Gruyere will drive the production slightly up. More importantly, capital expenses are finally going down, which in combination with higher production levels should improve the company's cash flow performance:

Source: Gold Fields presentation

South Deep mine

The company has managed to go through a very challenging period of South Deep mine restructuring that was characterized by a violent strike and managed to say goodbye to as much as 1092 employees according to the annual report. This year, the company will be repositioning the mine for profitability - at least, that's the plan. However, the progress (if it happens) will not be fast: as per the annual report, the company expects that South Deep will produce 193,000 ounces of gold at AISC of $1394 per ounce. At this point, the mine's future is under a big question. It's logical that Gold Fields gives a potentially big operation a last chance, but only actual results will show whether it will work out for the company or not. The good news here is that the market's expectations are low, so South Deep currently serves as a "free option."

Asanko Joint Venture

As I have recently described in my article on Asanko, the market is putting the viability of the whole operation under question. However, Gold Fields has just recently acquired its stake in Asanko, and it will certainly engage in the development of the assets that it received. Asanko Gold Mine is de-facto a collection of pits, and current pits are underperforming. A big hope is put on the newest pit, Esaase - the updated information regarding this project is expected to be published in the second quarter of this year, and this release will likely be the biggest catalyst of this year for Asanko.

Gruyere

The project is expected to bring first gold in the second quarter of 2019 and reach a steady run-rate by the end of the year. As per the annual report, the most recent research anticipates that Gruyere will produce 300,000 ounces annually (Gold Fields has a 50% share in the project) at AISC of $738 per ounce over the life of mine. Gruyere's addition will pave the way for further production increase for the company.

Financials

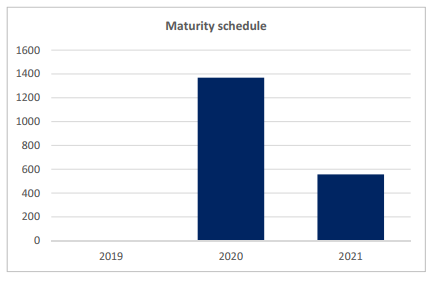

Gold Fields finished the year 2018 with $400 million of cash and $1.93 billion of long-term debt. The company will have to deal with major maturities soon:

Source: Gold Fields presentation

As per the presentation, the company is considering opportunities to access the US$ international bond markets to refinance debt. In my opinion, the company will not have problems with this refinancing - lower capital spending, higher production and reasonable gold price levels will attract potential creditors.

M&A

Big M&A in the industry that happened recently understandably led to various rumors. Gold Fields had its share in these rumors - it was said to explore the merger with AngloGold Ashanti (AU), a rumor that it immediately denied. I do not think that M&A considerations will play a material role for Gold Fields in 2019 - the company has enough developments going on, and there's hardly a need to complicate things further. Also, the diverse geography of the company's mines (Australia, West Africa, South America, South Africa) makes it harder to reach synergies that often drive the M&A process.

Technicals

Gold Fields' shares settled right on a material support level which can be used as a foothold for further upside. The company has enough potential catalysts due in 2019. Given the market's reaction to news of shelving various projects (Eldorado Gold (EGO), IAMGOLD (IAG)), currently gold investors prefer to see positive cash flow rather than material investments - and Gold Fields enters exactly this phase. As always, gold (GLD) prices are very important for a gold mining stock but assuming flat to higher gold prices, Gold Fields looks interesting both from a momentum and a more longer-term points of view.

If you like my work, don't forget to click on the big orange "Follow" button at the top of the screen and hit the "Like" button at the bottom of this article.

Disclosure: I/we have no positions in any stocks mentioned, but may initiate a long position in GFI over the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Additional disclosure: I may trade any of the above-mentioned stocks.

Follow Vladimir Zernov and get email alerts