Gold Finds Its Wings Again

British pound rally gives gold bulls the short-term advantage they need.

Geopolitical uncertainty, dollar weakness continue to support the metal.

Gold mining stocks are also teasing an intermediate-term breakout.

Just when it seemed as if gold's rally was running out of steam, the metal got a big lift on Friday from a convergence of bullish factors. Not the least of these factors was the sharp decline in the U.S. dollar index as the British pound strengthened on speculations over Britain's plan to exit the

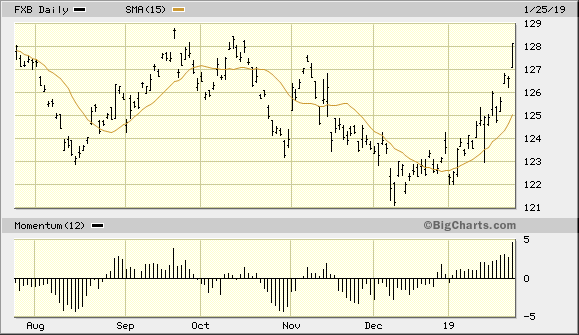

British Prime Minister Theresa May will lay out the next steps in the Brexit process on Jan. 29 as the parliament debates on various amendments to May's "Plan B" Brexit deal. Traders have speculated that a "no-deal" Brexit isn't likely to happen, which was reflected in an impressive rally in the British pound on Friday. The rally can be seen in the following chart which shows the Invesco CurrencyShares British Pound Sterling Trust (FXB). FXB rallied 1.2% on Friday to a 3-month high, reflecting the gains made in the pound.

Source: BigCharts

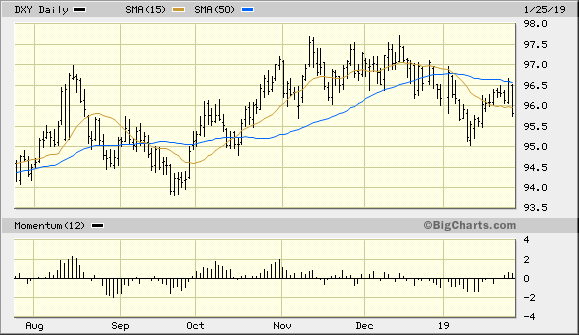

The strengthening pound put pressure on the U.S. dollar. The dollar's latest attempt at finishing the week above its widely watched, and psychologically significant, 50-day moving average was a failure thanks to the rally in Britain's currency. The U.S. dollar index (DXY) shown below reflects the downward pressure in the dollar late last week. After a failure to reach the 50-day MA (blue line) on Jan. 24, the dollar index remained well below this important trend line. This confirms that the dollar's intermediate-term (3-9 month) trend remains sideways-to-lower.

Source: BigCharts

More importantly for gold traders, the dollar's failure to rise above its 50-day moving average means that the metal's currency component remains strong. I've argued in recent reports that as long as the dollar index stays under the 50-day MA on a weekly closing basis, the gold bulls will continue to carry a decisive advantage going forward. Ever since the dollar fell below its 50-day MA, gold bulls have had little difficulty in pushing bullion prices higher thanks to the weakening currency in which gold is priced.

It should also be noted that DXY finished the latest week below its 15-day moving average. This is the trend line I use to validate the direction of the dominant immediate-term (1-4 week) trend. The sharp reversal under the 15-day MA in the dollar index means that the dollar is right back to square one as far as being in a position of technical weakness. This should further strengthen gold's immediate-term trend and give gold bulls another incentive to charge ahead in the coming week.

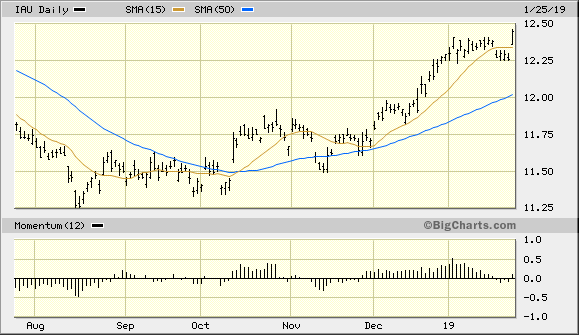

Turning our attention to the iShares Gold Trust (IAU), the ETF closed back above its 15-day moving average on Jan. 25. IAU's 1.55% rally in the latest session was encouraging and paves the way for a move higher in the coming days. I had previously mentioned that as long as the $12.25 level for IAU wasn't broken, the immediate-term uptrend for the gold ETF would likely remain intact. What's more, IAU should also continue to benefit in the weeks and months to come from the increasing demand for gold based on the anticipated oil price rebound discussed previously.

Source: BigCharts

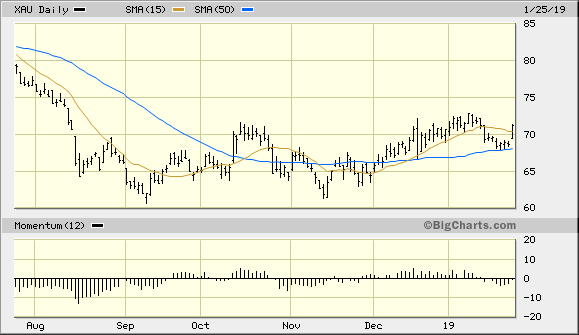

A word on the actively traded gold mining shares is in order here. Gold and silver stocks have remained under the radar in recent weeks, even as physical gold grabbed all the headline attention. The PHLX Gold/Silver Index (XAU) chart shown here reveals the lack of forward movement in the mining stocks by and large since October. The XAU even threatened a breakdown below is 50-day moving average last week.

Source: BigCharts

However, in the latest trading session the XAU made a remarkable comeback after bouncing off its 50-day MA and gaining almost 4% for the day. This was by far the XAU's best 1-day performance of the year to date, and the latest rally put the index back above its 15-day MA. If the XAU manages to close above the 78.78 level (the Jan. 9 closing level) in the coming week, it will confirm a new immediate-term buy signal per the rules of my trading discipline. The 78.78 level is the nearest high for the XAU and therefore of technical significance. A higher high above this level will also push the index out of its 5-month lateral trading range and establish a rising trend for the XAU.

In closing, things are looking good for gold again after a sluggish start to the New Year. The gold market appears to have found its wings again after the dollar's latest reversal. Geopolitical uncertainty, including the U.S.-China trade dispute and the upcoming Brexit debate, are also helping to support the metal by strengthening its fear component. Investors are justified in remaining bullish and assuming that gold's intermediate-term recovery will continue.

On a strategic note, we are still long the iShares Gold Trust after recently taking some profit. I also recently recommended raising the stop loss for the remainder of this trading position to slightly under the $12.25 level on an intraday basis. A violation of $12.25 in the IAU would signal a decisive shift in the gold ETF's immediate-term trend.

Disclosure: I am/we are long IAU. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Follow Clif Droke and get email alerts