Gold Fireworks Doubt the Official Inflation Story / Commodities / Gold and Silver 2021

The S&P 500 red candle and then some – erased in aday, that‘s what you get with the Fed always having your back. The staircaseclimb certainly looks like continuing without any real breather. Whatever steepascent you compare it to (Jun or early Sep 2020), this one is different in thatit doesn‘t offer but token corrections. Not that it would be reasonable toexpect a steep downswing given the tide of liquidity, but even sideways tradinghas become rarer than it used to be.

With the VIX still below 17 and the put/call ratio in themiddle of its slowly but surely less complacent range, the path of least resistance is higher –the signs are still aligned behind the upswing to go on:

(…) Don‘t pin your hopes too high for a (sharp)correction though. Yes, [on Wednesday] stocks listened to the weakeningcorporate credit markets, and the daily retreat in long-dated Treasuriesinspired some profit taking in tech. Quite some run there as yields stabilized,which has turned XLK from very stretched to the downside of its 50-day moving average,to the upside extreme. Tesla also followed suit but I doubt this is a truereversal of tech fortunes.

Just at yesterday‘s moves – technology surged higherwithout too much help from the behemoths, and value stocks surged. Evenfinancials ignored the sharp retreat in yields. Yes, that‘s the result ofretails sales outdoing expectations and unemployment claims dropping sharply –the economic recovery is doing fine, manufacturing expands, and inflationdoesn‘t yet bite. We‘re still in the reflationary stage where economic growthis higher than the rate of inflation or its expectations.

Gold loved the TLT upswing and Powell‘s assurances aboutnot selling bonds back into the market in rememberance of eating a humble pieafter the Dec 2018 hissy fit in the stock market (isn‘t this the third mandateactually, the cynics might ask). I called for the sharp gains across theprecious metals board sending my open position(s) even more into the black –both on Wednesday:

(…) CPI inflation is hitting in the moment, and itspressure would get worse in the coming readings. Yet the market isn‘t alarmednow as evidenced by the inflation expectations not running hot – the

Fed quite successfully sold the transitory story, itseems. Unless you look at lumber, steel or similar, of course. None of thecommodities have really corrected, and the copper performance bodes well forthe precious metals too.

and Thursday:

(…) Precious metals didn‘t swing higher immediately, butI expect them to take the commodities‘ cue next. When Powell says the Fed isn‘tthinking about selling bonds back into the market, and that he learned a lesson(hello, late 2018), real rates aren‘t probably rising much any time soon. Itappears to me a question of time before inflation expectations squeeze thenominal yields some more, which is what gold would love.

The stalwart performance in the miners goes on after adaily pause as gold gathers strength and silver outperformed yesterday. Silverminers and gold juniors are pulling ahead reliably as well, not just goldseniors.The run on $1,760 awaits.

This is just the beginning, and as I had been repeatedlystating on Twitter:

(…) The GDX closing convincingly above $35 would usher ingreat gold and silver moves.

Let‘s move right into the charts (all courtesy of www.stockcharts.com).

S&P 500 Outlook

New ATHs, again and this time on rising volume – themomentum still remains with the bulls even though the daily indicators arewaning in strength, and as said earlier, $NYFANG causes a few short-termwrinkles.

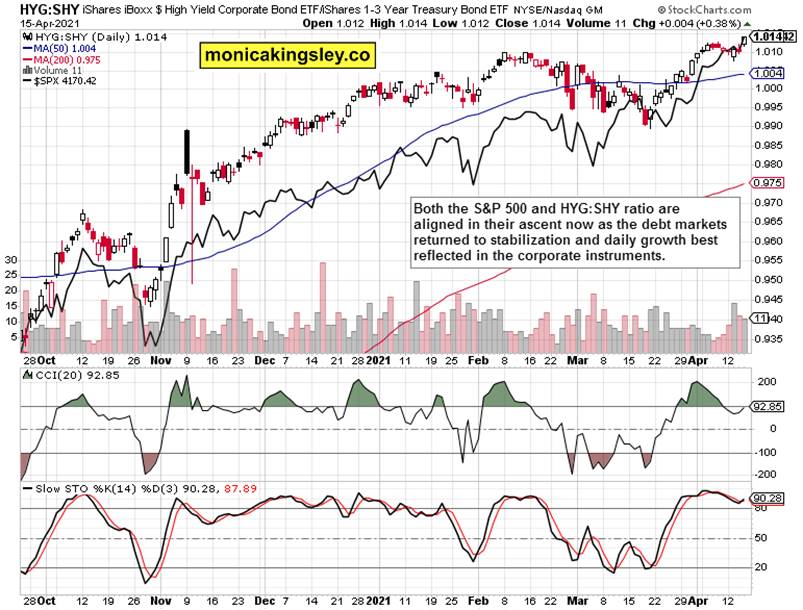

Credit Markets

The high yield corporate bonds to short-dated Treasuries(HYG:SHY) ratio performance got better aligned with the S&P 500 one, nowthat nominal yields have retreated.

Smallcaps and Emerging Markets

Reflecting the turn in the Treasury markets, both theRussell 2000 (IWM ETF) and emerging markets (EEM ETF) clearly turned higher,confirming the direction the S&P 500 has been on practically non-stop sincelate Mar.

Inflation Expectations

Inflation expectations are going down, that‘s theconventional wisdom – and nominal yields duly follow. But the RINF ETF isn‘tbuying the TIPS message all that much, proving my yesterday‘s point:

(...) Have the rising inflation expectations beenbanished? I‘m not convinced even though they aren‘t running hotter in the wakeof PPI and CPI figures, which are bound to get worse next – if copper and oilare to be trusted (they are). Remember that this is the Fed‘s stated missionfor now – to let inflation run to make up for prior periods of its lesserprominence.

Gold in the Limelight

Gold is surging higher ahead of the nominal yieldsretreat, as the bond vigilantes failed yetagain to show up. In the meantime, the inflationary pressures keep buildingup...

Gold, Silver and Miners

As stated the day before, seniors (GDX ETF) would leadgold by breaking above their recent highs convincingly (solidly above $35 onrising volume and bullish candle shape), as the tide in the metals has turned.The unavoidable inflation data bringing down real rates would do the trick,which is exactly what happened. Silver scored strong gains as well, yet didn‘tvisibly outperform the rest of the crowd. I look for the much awaited preciousmetals upleg to go on, and considerably increase open profits.

Summary

The daily S&P 500downswing is history, and the relentless push higher (best to be compared witha rising tide), goes on.

Gold and miners took a cue from the surging commodities,and nominal yields retreat. Patience has been rewarded, and a close above$1,775, is what I am looking for next as the gold bottom is in.

Thank you for having read today‘s free analysis, which isavailable in full at my homesite. There, you can subscribe to the free Monica‘s Insider Club, whichfeatures real-time trade calls and intraday updates for both Stock TradingSignals and Gold Trading Signals.

Thank you,

MonicaKingsley

Stock Trading Signals

Gold Trading Signals

www.monicakingsley.co

mk@monicakingsley.co

* * * * *

All essays, research andinformation represent analyses and opinions of Monica Kingsley that are basedon available and latest data. Despite careful research and best efforts, it mayprove wrong and be subject to change with or without notice. Monica Kingsleydoes not guarantee the accuracy or thoroughness of the data or informationreported. Her content serves educational purposes and should not be relied uponas advice or construed as providing recommendations of any kind. Futures,stocks and options are financial instruments not suitable for every investor.Please be advised that you invest at your own risk. Monica Kingsley is not aRegistered Securities Advisor. By reading her writings, you agree that she willnot be held responsible or liable for any decisions you make. Investing,trading and speculating in financial markets may involve high risk of loss.Monica Kingsley may have a short or long position in any securities, includingthose mentioned in her writings, and may make additional purchases and/or salesof those securities without notice.

© 2005-2019 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.