Gold firms gear up for growth as cost of mining the metal falls

The cost of mining gold for the world's top producers dropped more than 7% in the first three months of the year as most companies ignored the metal price's spike and continued efforts to straighten out their books, a new report shows.

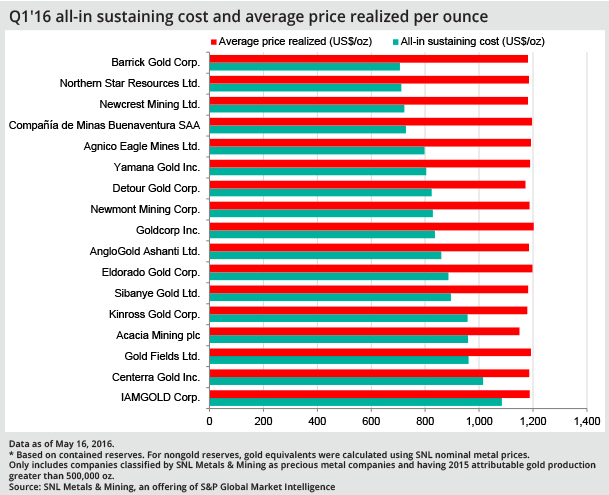

According to data compiled by SNL Metals & Mining, the top 17 publicly listed gold companies that reported all-in sustaining costs (AISC) produced the metal at a weighted-average cost of $833 per ounce in the first quarter of 2016. This compares to the $900 an ounce price calculated by Gold Fields Mineral Services (GFMS) for the same period last year.

The strengthening of the US dollar against local currencies and lower global fuel prices also fuelled the cost reductions, the report shows.

Courtesy of SNL Metals & Mining.

Canada's Barrick Gold (TSX, NYSE: ABX), the world's top bullion producer by output, had the quarter's lowest AISC at $706 per ounce or $130 less than the group median of $836 per ounce. The Toronto-based miner benefited mainly from operating and capital-cost control initiatives, as well as lower fuel prices and foreign exchange gains.

Early signs of activity include Kinross's March decision to expand its Mauritanian gold mine and Goldcorp acquisition of junior Kaminak in May.Australia's Northern Star Resources (ASX:NST) was next lowest with all-in sustaining costs of $711 per ounce, a 5% decline from the previous quarter and a 30% drop from Q1 2015, primarily due to lower contracting, labour and supply rates that became effective Jan. 1, 2016.

The third place was taken by another Aussie miner, Newcrest Mining (ASX:NCM) with an AISC of $723 per ounce for the period, thanks to high production at its Cadia Hill operation and significant cost cuts at the Hidden Valley mine.

IAMGOLD Corp. (TSX:IMG), Centerra (TSX:CG) and Gold Fields (NYSE, JSE:GFI) were on the other end of the spectrum, SNL Metals & Mining data shows:

Canada-based IAMGOLD Corp. reported the highest AISC compared with its peers, at $1,084 per ounce of gold sold. Although the company's March quarter AISC was 3% lower than the year-ago quarter, it was high compared with its peers due to an increase in sustaining capital and lower sales.Other companies with high AISC were Centerra Gold Inc. and Gold Fields Ltd., with AISC of $1,015 per ounce and $961 per ounce respectively.

Comparing gold producers based on first-quarter profit margin, Barrick Gold again led the pack with a margin of 40.2%, well above the group's weighted average of 29.8%. Northern Star Resources and Compa??ia de Minas Buenaventura also stood out with a margin of 39.9% and 39.1% respectively.

Courtesy of SNL Metals & Mining.

Gold prices began dropping in late 2012 as worries about global inflation faded, reducing bullion's value as a hedge against rising prices.

So far this year, the precious metal has gained 18%, the best start to a year in a decade, pushing gold miners shares up in the process. According to Reuters, the Philadelphia Gold and Silver Index is up 98% versus a paltry 3.5% increase in the Standard & Poor's 500 Index.

The price recovery is making some bullion producers consider abandoning austerity measures of the last five years to resume expansions. Early signs of activity include Kinross Gold's (TSX:K) (NYSE:KGC) March decision to expand its Tasiast mine in Mauritania and Goldcorp's (TSX:G, NYSE: GG) acquisition of junior Kaminak for $520 million in May.