Gold: From Ancient Treasures to Tomorrow's Wealth Standard

Brian Hicks of Wealth Daily shares his thoughts on gold's importance and how he believes NatGold Digital Ltd. represents a great opportunity to capitalize on gold.

Throughout human history, great societies have constructed their wealth upon golden foundations from Roman vaults and imperial Chinese treasuries to Spanish vessels during the golden age of exploration.

In our modern era, gold transcends mere ornaments or ingots; it represents global power dynamics, international reserve banking, and a stabilizing force against currency uncertainty. Within this unfolding narrative, my bold projection $16,402 per ounce reflects both historical patterns and calculated foresight.

Let me explain why precious metal markets are poised for an unprecedented upward trajectory, examining the evidence. . .

Financial Titan's Resource Stockpiling

Investment legend Ray Dalio, who established Bridgewater Associates, consistently advocates for gold as protection against monetary devaluation and institutional vulnerabilities. His Bridgewater funds recently expanded physical gold holdings substantially, directing $319 million during the year's first quarter alone.

His reasoning stems from historical understanding: tracking gold's evolution. Dalio's perspective aligns perfectly with our analysis: Gold's thousand-year journey now intersects with dollar weakness, mounting international liabilities, and transforming global hierarchies. His guiding principle resonates: Gold exists "independent of any one nation's economy."

Wealthy Investors Securing Mining Interests

This precious metal pursuit extends beyond major investment firms. Ultra-wealthy individuals are claiming their stakes.

John Paulson renowned from the 2008 financial meltdown anticipates $5,000 gold within three years. He's invested $1 billion into Alaska's Donlin Gold venture, targeting one of Earth's richest undeveloped reserves. His analysis suggests that central banking institutions pivoting from traditional currencies drives this movement.Thomas Kaplan mining entrepreneur and Donlin participant through NovaGold Resources Inc. (NG:TSX; NG:NYSE.MKT) supports this optimistic outlook. His Kaplan Doctrine advises investing in premium, expandable deposits within secure jurisdictions. This pattern reveals a broader shift: Financial elites transitioning from passive bullion ownership to enhanced exposure via mining operations.I'm thoroughly convinced my $16,402 price target isn't mere speculation it's a calculated strategy.

Reserve Banks: Contemporary Gold Guardians

National reserve institutions propel gold's market ascension. A January 2025 HSBC survey spanning 72 central banks discovered over one-third planned to boost gold reserves with none indicating reductions.

Bloomberg confirms: "Central banks will keep buying gold in a push to diversify away from paper currencies amid political and economic upheaval."

BRICS nations (Brazil, Russia, India, China, South Africa) spearhead this accumulation. Russia has amassed reserves since its 2022 asset confiscation a cautionary lesson about traditional currency risks. China and India, culturally connected to gold, have expanded both national reserves and domestic bullion demand. As one market observer noted, gold increasingly serves as the "de-dollarization tool" against Western financial influence.

BRICS Alliance and Gold-Centered Economic Systems

The BRICS coalition represents more than trade partnerships and political alignment it signals monetary strategy evolution. India, China, Russia, and additional members explore de-dollarized trade settlements, potentially incorporating gold-backed frameworks. While a formal "gold-based currency" partnership remains aspirational, the momentum grows undeniably.

BRICS participants actively expand gold reserves for financial security. A popular phrase circulates among their strategists: "When U.S. paper whispers, BRICS gold roars." As international power structures evolve, gold assumes a transformative role in global finance.

The Weakening Foundation: Diminishing American Currency

The inverse relationship between gold and dollar values follows predictable patterns yet accelerates now. The dollar confronts:

Exploding federal obligations (approaching 140% of GDP)Persistent government shortfallsFederal Reserve independence challenges, heightening inflation worriesRecurring international commerce disputes, undermining dollar confidenceThese circumstances create ideal conditions for gold's ascendancy. Our $16,402 forecast depends on continued dollar deterioration a narrative seemingly shared by Dalio, Paulson, and monetary authorities worldwide.

Eastern Hemisphere's Consumer Gold Enthusiasm

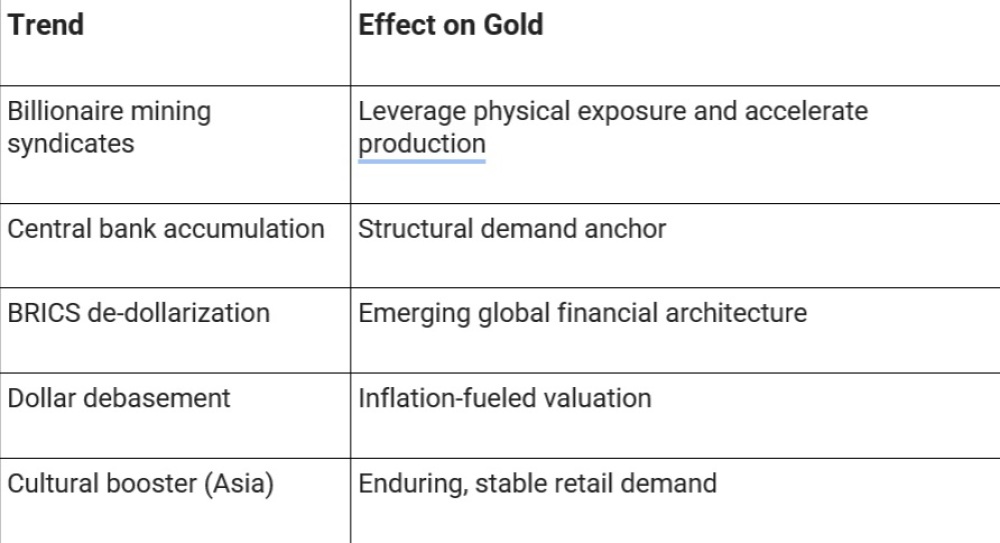

Asia the global gold epicenter maintains impressive momentum. Singapore Bullion Market Association reporting emphasizes regional consumer appetite. Yet our pathway toward $16,402 isn't fantasy it's a narrative where:

Our $16,402 projection captures gold's multifaceted convergence, representing more than mere valuation but fundamental significance. Amid currency vulnerability and global transformation, gold transcends simple hedging it embodies historical continuity.

Now, considering gold's trajectory toward $16,402 per ounce (many analysts project even higher valuations), NatGold Digital Ltd. represents exceptional opportunity.

Consider this crucial point: As gold appreciates, its fundamental worth increases. However, extraction expenses remain relatively stable, meaning NatGold token values will skyrocket dramatically . . . alongside your investment returns.

Let me elaborate...

How NatGold Tokens Enable Ownership Before Wall Street's Discovery

Imagine obtaining shares in America's subterranean gold wealth before extraction begins. Imagine preceding Wall Street, exchange listings, and media coverage. And imagine this investment representing not just precious metal . . . but American prosperity itself.

This embodies NatGold Tokens pioneering blockchain-secured gold certificates directly linked to verified, untouched, domestic gold deposits within American borders. This isn't conventional stock ownership, exchange-traded funds, or another digital currency. It represents digital gold's evolutionary leap and following recent American economic policy shifts, could soon become central to national financial strategy.

Presidential Initiative: Establishing $12 Trillion National Investment Fund

Earlier this year, Executive Order 14241 received presidential authorization, enabling development across 640 million federal acres containing approximately $100 trillion in untapped mineral resources.

This encompasses substantial copper, uranium, rare earth elements, and crucially: gold reserves.

The presidential vision?

Creating an American Sovereign Wealth Fund utilizing tokenized natural assets finally monetizing underground national treasures without decades-long permitting delays.

Simply stated, America is beginning to digitize its inherent wealth, with NatGold pioneering this transformation.

Digitizing Inaccessible Resources: Major Deposits Nationwide

For generations, America has possessed some earth's most valuable yet unavailable gold deposits.

Northern Dynasty Minerals Ltd.'s (NDM:TSX; NAK:NYSE.MKT) Pebble Creek (Alaska) Among the world's largest undeveloped gold-copper resources, delayed through environmental regulatory challenges.Nova Gold Resources Inc.'s (NG:NYSE) Donlin Gold (Alaska) Contains over 39 million gold ounces, with regulatory hurdles preventing development across decades.Ruth, Nevada Premium gold concentration zone with billions in buried assets, largely abandoned through outdated extraction regulations.These represent merely several "stranded resources" NatGold aims to unlock, not through physical extraction but digital tokenization. Each NatGold Token is supported by an authentic geological assessment verified through NI 43-101 protocols, providing token holders with a legal interest in these assets. This represents gold ownership without equipment, permits, or litigation, and zero environmental impact.

Gold: Returning as American Monetary Foundation

Since 1971, American currency has operated independently, without gold backing. Yet historical patterns often circle back. With global debt expansion, persistent inflation, and competing economies like BRICS planning gold-backed currencies, America quietly reintroduces gold into economic discussions.

Presidential conversations have included potential new gold standards utilizing blockchain technology. Consequently, gold ownership becomes not merely prudent, but potentially fundamental to the American fiscal framework. Through NatGold Tokens, everyday investors participate before institutional recognition.

| Want to be the first to know about interestingSpecial Situations andGold investment ideas?Sign up to receive the FREE Streetwise Reports' newsletter. | Subscribe |

Important Disclosures:

As of the date of this article, officers and/or employees of Streetwise Reports LLC (including members of their household) own securities of NatGold Digital Ltd.Brian Hicks: I, or members of my immediate household or family, own securities of: NatGold Digital Ltd. My company has a financial relationship with: None. My company has purchased stocks mentioned in this article for my management clients: None. I determined which companies would be included in this article based on my research and understanding of the sector.Statements and opinions expressed are the opinions of the author and not of Streetwise Reports, Street Smart, or their officers. The author is wholly responsible for the accuracy of the statements. Streetwise Reports was not paid by the author to publish or syndicate this article. Streetwise Reports requires contributing authors to disclose any shareholdings in, or economic relationships with, companies that they write about. Any disclosures from the author can be found below. Streetwise Reports relies upon the authors to accurately provide this information and Streetwise Reports has no means of verifying its accuracy. This article does not constitute investment advice and is not a solicitation for any investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Each reader is encouraged to consult with his or her personal financial adviser and perform their own comprehensive investment research. By opening this page, each reader accepts and agrees to Streetwise Reports' terms of use and full legal disclaimer. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company.For additional disclosures, please click here.