Gold: Fundamentally Overvalued

Contrary to traditional opinion, there is no stable, long-term correlation between gold and the VIX index or the S&P 500 index.

Gold is in a strong, long-term relationship with the value of the dollar and the level of the U.S. real interest rate.

Neither the dollar nor the real interest rate has dropped so much that this could explain the current price of gold.

Investment Thesis

The analysis of the gold market prospects amid the actual driver indicates the risk of a correction in gold prices and, consequently, the SPDR Gold Trust ETF (GLD), which is tied to gold.

I will begin my analysis with reviewing the degree of activity of the key gold market drivers.

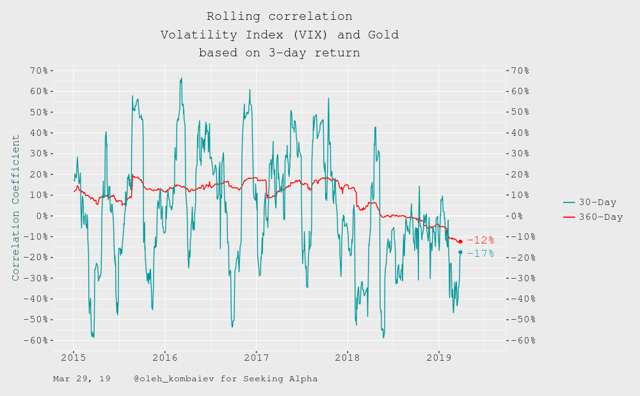

Firstly, contrary to traditional opinion, there is no stable, long-term correlation between gold and the volatility index (VIX):

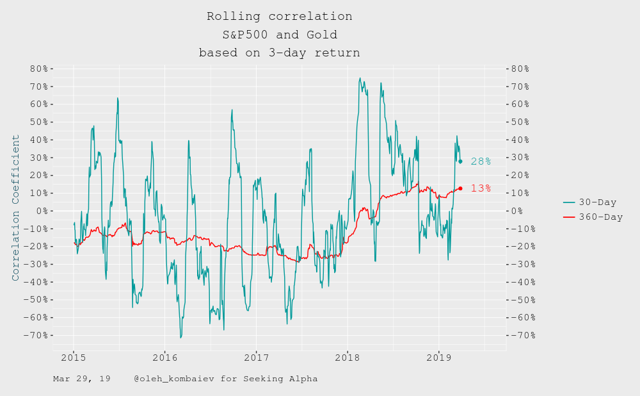

The same way, there is no stable correlation between gold and the S&P 500:

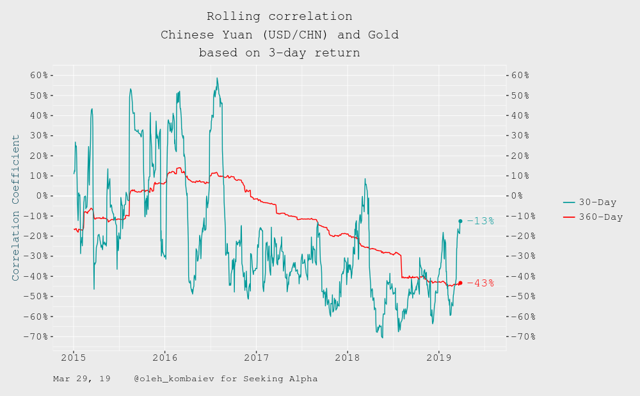

There is a more or less significant long-term correlation between gold and yuan's value denominated in dollars. But it is not strong enough to build a model.

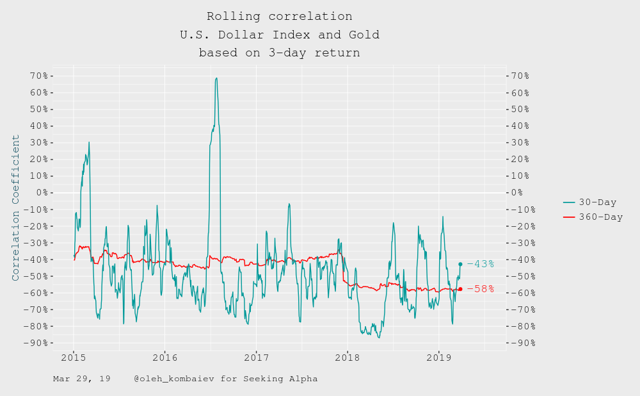

Finally, a sufficiently significant correlation is becoming apparent between gold and the dollar. This fact indicates that the dollar invariably plays the most direct role in the fate of gold.

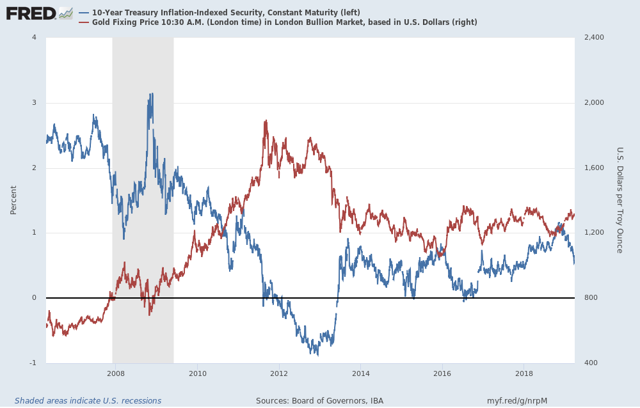

There is another driver that traditionally has a strong impact on gold - this is the U.S. real interest rate. I want to note that this indicator incorporates two indicators: the 10-year Treasury yield and the rate of inflation in the United States. In view of the limitations in calculating the correlation, I cannot provide an appropriate graph, but even a visual assessment proves that the level of the real interest rate has a considerable impact on gold:

So, gold is in a long-term relationship with the value of the dollar and the level of the U.S. real interest rate. And now we'll do the following:

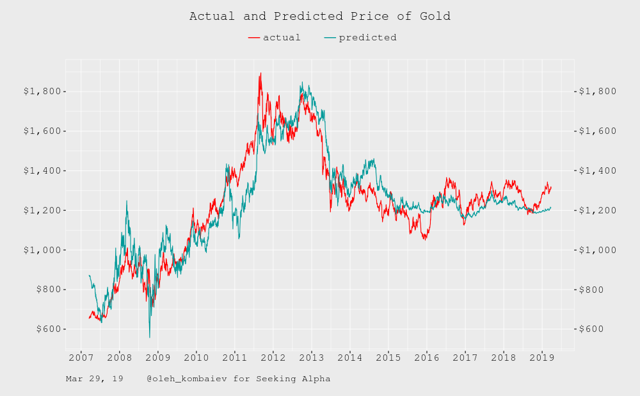

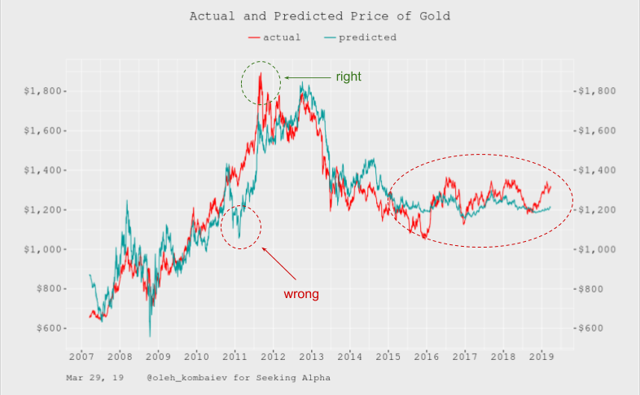

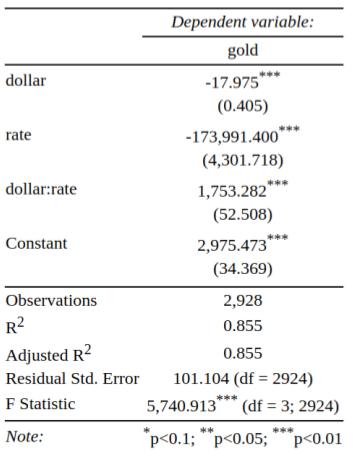

Based on the history of the last 12 years, we will build a statistical model that will predict the price of gold based on (1) the value of the dollar, (2) the level of the real interest rate, and (3) the combined effect of these two parameters.

I will not describe the process of building a model in detail due to its tediousness and will only give its final parameters:

I want to note that all key model quality assessments are high: R2=0.86 and p-value<0.01. It is also important that there is no strong internal relationship between the dollar and the real interest rate, and the nature of the distribution of deviations between the predicted and the actual price of gold is close to normal. However, I do not ask to overestimate the significance of such a model. Treat it as a kind of smart average.

By the way, here the model itself:

It is worth noting that in the historical context, the model has had its successes and failures. For example, the model was wrong predicting a drop in the price of gold in early 2011, but it rightly determined that in August 2011 gold was overbought. But the most interesting is that since 2015, the model has been predicting well the balanced price of gold around which its actual price fluctuates. And the current price of gold is rated as overvalued.

Final Thoughts

I think that for the last six months, the gold market has been growing in advance. That is neither the dollar nor the real interest rate has dropped so much that this could explain the current price of the gold. Probably the market believes that the situation will change in the future and the dollar will become cheaper, and the real interest rate will decrease. By the way, I also think so. But for the time being, it seems that the gold market is in suspense and the probability of correction to the level of $1,200 is very high.

Applying the foregoing to the ETF GLD (a fund that tracks the price of gold), I believe that the price of the fund is prone to a short-term correction at the level of $118.

Disclosure: I/we have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Follow Oleh Kombaiev and get email alerts