Gold Gains a Powerful Friend / Commodities / Gold and Silver 2018

Yesterday, gold won an influential supporter in theWhite House. Who is he?

Yesterday, gold won an influential supporter in theWhite House. Who is he?

The Enemy of Gold’s Enemy Is Gold’sFriend

As the ancient proverb goes, my enemy’s enemy is myfriend. Although it is usually employed in foreign policy, this concept alsoapplies to finance. Given the negative correlation between the greenback and gold, theenemies of the U.S. dollar are generally gold’s friends.

U.S. Treasury Secretary Steven Mnuchin has recentlyjoined this elite club. On Wednesday, he welcomed the weakness in the Americancurrency. According to Bloomberg, Mnuchin told reporters at the annual Davossummit of business and political leaders that a weaker dollar is not bad forthe U.S., at least in the short term: “Obviously a weaker dollar is good for usas it relates to trade and opportunities”. He also added that the currency’sshort-term value is “not a concern of ours at all.”

Is Mnuchin aGold Bulls’ Secret Agent?

Surely, it’s not the case that Mnuchin wants thecollapse in the U.S. dollar. He is the Treasury Secretary, after all. Indeed,he also winked yesterday at the dollar’s fans:

Longer term,the strength of the dollar is a reflection of the strength of the U.S. economyand the fact that it is and will continue to be the primary currency in termsof the reserve currency.

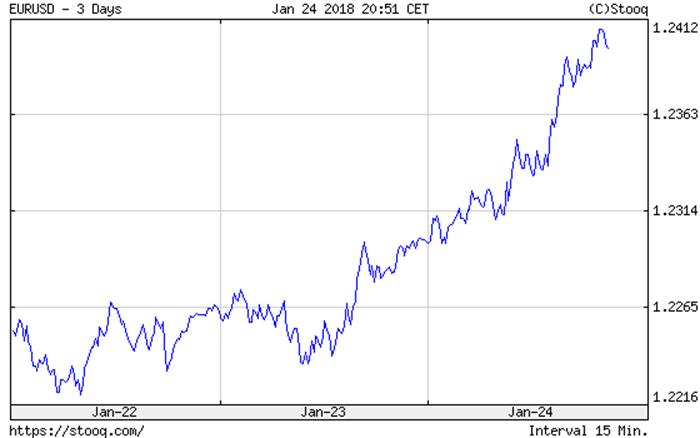

Everyone was pleased. Almost. As the chart belowshows, the U.S. dollar has plunged against the euro. Actually, the greenbacksank to the level not seen since late 2014.

Chart 1: EUR/USD exchange rate over the last threedays.

The reason behind the decline was the fact thatMnuchin’s remarks were unexpected. His comments departed from the strongrhetoric on the U.S. dollar of Treasury Secretaries before him, but wereactually perfectly in line with Trump’s views that a weak greenback is positivefor American exporters. As a reminder, the President said last year that thedollar was “too strong”, sending it south. So Mnuchin’s comments shouldn’t besurprising. But they were to many analysts.

Luckily not to us and our readers. We warned them inthe January edition of the Market Overview that “the U.S. dollar could continue a downwardtrend in 2018” due to the weak U.S. economic policy. We wrote:

the decline in the U.S. dollar indexmight reflect weak U.S. economic policy. As a reminder, in January 2017,President Trump started to express his desire for a weaker greenback. In otherwords, the protectionist measures and attempts to stimulate the economy in theshort-term (through fiscalstimulus) replaced policies aimed atimproving productivity. The combinationof protectionist schemes and deficitspending weakenedthe U.S. position in the global economy, so the greenback fell against theeuro.

Indeed, Mnuchin’s words rekindled fears ofprotectionism, pushing the greenback down. The recent introduction of steepglobal tariffs on imported washing machines and solar panels by Donald Trumpand Commerce Secretary Wilbur Ross’s comments on NAFTA and the possible actionover China’s infringements of intellectual property also added some fuel to thefire.

Conclusions

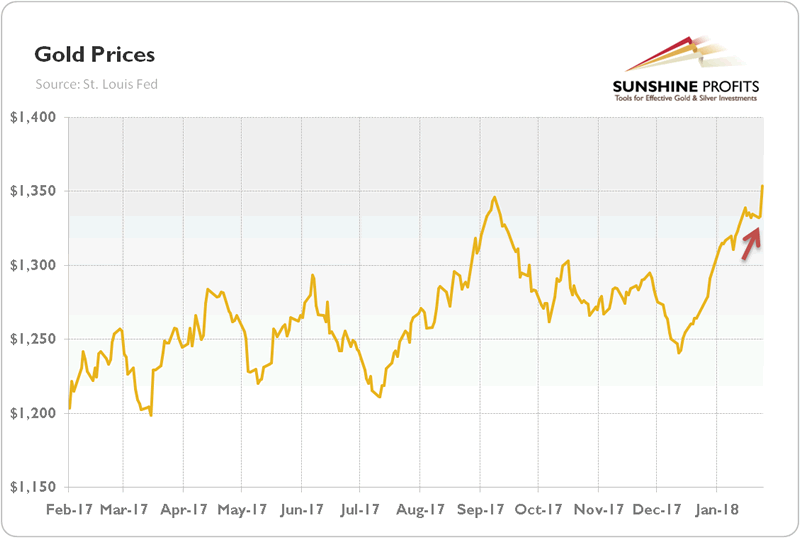

Gold definitely liked Mnuchin’s comments. Let’s seethe chart below, which paints the price of the yellow metal over the lasttwelve months.

Chart 2: Gold prices over the last twelve months.

As you can see, gold has jumped above $1,350 thanks toMnuchin’s remarks. It may be a beautiful beginning of a new friendship. Tradersused to repeat “don’t fight the Fed”. But perhaps investors should replace thismantra with a new one: “don’t fight the White House which wants the weakerdollar”. So far Trump has got what he wanted. And it may be not the end, giventhe worries about the U.S. economic policy and the revival of the Eurozone. Wewill elaborate on this in the February edition of the Market Overview. Staytuned!

Thank you.

If you enjoyed the above analysis and would you like to knowmore about the gold ETFs and their impact on gold price, we invite you to readthe April MarketOverview report. If you're interested in the detailed price analysis andprice projections with targets, we invite you to sign up for our Gold & SilverTrading Alerts . If you're not ready to subscribe at this time, we inviteyou to sign up for our goldnewsletter and stay up-to-date with our latest free articles. It's freeand you can unsubscribe anytime.

Arkadiusz Sieron

Sunshine Profits‘ MarketOverview Editor

Disclaimer

All essays, research and information found aboverepresent analyses and opinions of Przemyslaw Radomski, CFA and SunshineProfits' associates only. As such, it may prove wrong and be a subject tochange without notice. Opinions and analyses were based on data available toauthors of respective essays at the time of writing. Although the informationprovided above is based on careful research and sources that are believed to beaccurate, Przemyslaw Radomski, CFA and his associates do not guarantee theaccuracy or thoroughness of the data or information reported. The opinionspublished above are neither an offer nor a recommendation to purchase or sell anysecurities. Mr. Radomski is not a Registered Securities Advisor. By readingPrzemyslaw Radomski's, CFA reports you fully agree that he will not be heldresponsible or liable for any decisions you make regarding any informationprovided in these reports. Investing, trading and speculation in any financialmarkets may involve high risk of loss. Przemyslaw Radomski, CFA, SunshineProfits' employees and affiliates as well as members of their families may havea short or long position in any securities, including those mentioned in any ofthe reports or essays, and may make additional purchases and/or sales of thosesecurities without notice.

Arkadiusz Sieron Archive |

© 2005-2018 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.