GOLD GDX, HUI Stocks - Will Paradise Turn into a Dystopia? / Commodities / Gold and Silver Stocks 2021

The GDX and HUI Index are enjoying ablissful moment. With HUI behaving civilly, will the GDX cling to theunrealistic and try to leap to cloud “ten”?

With the GDX ETF punching a hole throughits glass ceiling, the seniorminers are now witnessing an environment that’s beyond their wildestdreams: sunshine, clear skies and a utopia that’s eluded them since thebeginning of the New Year. However, while leaving paradise is often moredifficult than arriving, the GDX ETF’s recent vacation is likely coming to anend. And with the senior miners about to resume the daily grind of real life,their optimism will likely fade with the tropical sun.

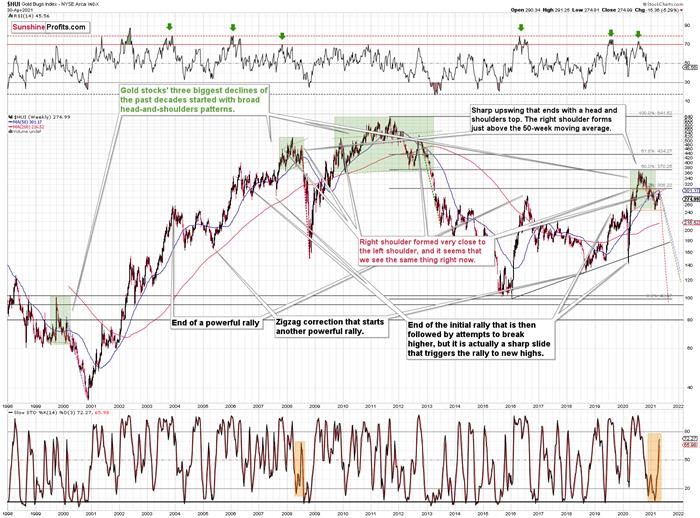

To explain, while the GDX ETF remains oncloud nine, the HUIIndex (a proxyfor gold mining stocks ) has already left the resort. With the latter’slong-term outlook still intact and its broad head & shoulders patternremaining on schedule, I wrote previously that the right shoulder would likelyform after the HUI Index reaches 300. And after closing at 301.72 on May 7, theBUGS (after all, HUI is called the GoldBugs Index) are currently living up to expectations.

Please see below:

Moreover, while corrective short-termupswings within a medium-term downtrend can feel discouraging, it’s importantto remember that similar instances occurred in 2008 and 2012. Remember: TomPetty & The Heartbreakers warned us that the waiting is the hardest part.However, in the end, the wait should be more than worth it.

To explain, note that the 2007 – 2008 andthe 2009 – 2012 head and shoulders patterns didn’t have the right shoulders allthe way up to the line that was parallel to the line connecting the bottoms. Imarked those lines with green in the above-mentioned formations. In the currentcase, I marked those lines with orange. Now, in both cases, the final top – the right shoulder – formedclose to the price where the left shoulder topped. And in early 2020, the leftshoulder topped at 303.02.

That’s why Ipreviously wrote that “it wouldn’t be surprising to see a move to about 300in the HUI Index”. And that’s exactly what we saw. To clarify, onehead-and-shoulders pattern – with a rising neckline – was already completed,and one head-and-shoulders pattern – with a horizontal neckline – is beingcompleted, but we’ll have the confirmation once miners break to new yearlylows.

For more context, I wrote previously:

Therecent rally is not a game-changer, but rather a part of a long-term pattern that’s notvisible when one focuses on the short-term only.

Thething is that the vast majority of individual investors and – sadly – quitemany analysts focus on the trees while forgetting about the forest. During thewalk, this might result in getting lost, and the implications are no differentin the investment landscape.

Fromthe day-to-day perspective, a weekly – let alone monthly – rally seems like ahuge deal. However, once one zooms out and looks at the situation from a broadperspective, it’s clear that:

“Whathas been will be again, what has been done will be done again; there is nothingnew under the sun.” (-Ecclesiastes 1:9)

Therally is very likely the right shoulder of a broad head and shouldersformation. “Very likely” and not “certainly”, because the HUI Index needs to break to new yearly lows in order to complete the pattern – for now, it’s just potential. However,given the situation in the USD Index (i.a. the positions of futures traders asseen in the CoT report , and the technical situation in it), it seems very likely that thisformation will indeed be completed. Especially when (not if) the general stockmarket tumbles.

In addition, three of the biggestdeclines in the mining stocks (I’m using the HUI Index as a proxy here), allstarted with broad, multi-month head-and-shoulders patterns. And in all threecases, the size of the decline exceeded the size of the head of the pattern.

Can we see gold stocks as low as we sawthem last year? Yes.

Can we see gold stocks even lower than attheir 2020 lows? Again, yes.

Of course, it’s far from being a surebet, but the above chart shows that it’s not irrational to expect these kind ofprice levels before the final bottom is reached. This means that a $24 targeton the GDX ETF is likely conservative.

In addition, mining stocks are currentlyflirting with two bearish scenarios:If things develop as they didin 2000 and 2012-2013, gold stocks are likely to bottom close to their early2020 high.If things develop like in 2008(which might be the case, given the extremely high participation of theinvestment public in the stock market and other markets), gold stocks couldre-test (or break slightly below) their 2016 low.

I know, I know, this seems too unrealto be true… But wasn’t the same said about silver moving below its 2015 bottomin 2020? And yet, it happened.

Keep in mind though: scenario #2 mostlikely requires equities to participate. In 2008 and 2020, the sharp drawdowns in the HUI Index coincidedwith significant drawdowns of the S&P500 . However, with the words ‘all-time high’ becoming commonplace acrossU.S. equities, the likelihood of a three-peat remains relatively high.

Circling back to the GDX ETF, on May 7,the senior miners inched closer to their May 2020 high. And while thedevelopment may seem bullish on the surface, the price action actually createssymmetry between the GDX ETF’s left and right shoulders. With May 2020’s peakoccurring at nearly the same level, a move lower from here would only enhancethe validity of the GDX ETFs H&S pattern.

On top of that, this is the third timethat the GDX ETF has poked its head above the upper trendline of its roughlyone-and-a-half-month channel. An ominous sign, the GDX ETF’s swoon in late2020/early 2021, occurred precisely after the senior miners delivered theirthird act. Furthermore, a small breakout without confirmation is akin to apromise from a friend that can’t keep his word. Thus, with the GDX ETF stillunderperforming gold on a relative basis, it’s important to analyze the recentprice action within its proper context.

Please see below:

For more context, I wrote on May 5:

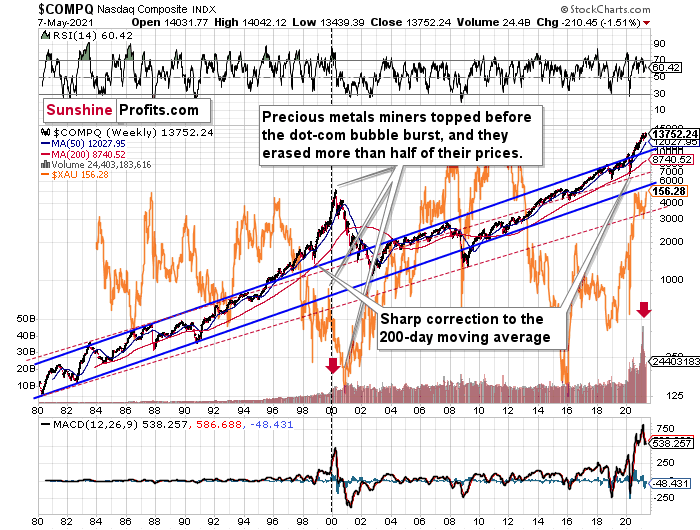

Thehistory might not repeat itself, but it does rhyme, and those who insist onignoring it are doomed to repeat it. And there’s practically only one situationfrom more than the past four decades that is similar to what we see right now.

It’sthe early 2000s when the tech stock bubble burst. It’s practically the only time whenthe tech stocks were after a similarly huge rally. It’s also the only time whenthe weekly MACD soared to so high levels (we already saw the critical sell signal fromit). It’s also the only comparable case with regard to the breakout above therising blue trend channel. The previous move above it was immediately followedby a pullback to the 200-week moving average, and then the final – most volatile– part of the rally started. It ended on significant volume when the MACDflashed the sell signal. Again, we’re already after this point.

Therecent attempt to break to new highs that failed seems to have been the finalcherry on the bearish cake.

Whyshould I – the precious metals investor care?

Becauseof what happened in the XAU Index (a proxy for gold stocks and silver stocks ) shortly after the tech stock bubble burst last time.

Whathappened was that the mining stocks declined for about three months after theNASDAQ topped, and then they formed their final bottom that started the trulyepic rally. And just like it was the case over 20 years ago, mining stockstopped several months before the tech stocks.

Mistakingthe current situation for the true bottom is something that is likely to make ahuge difference in one’s bottom line. After all, the ability to buy somethingabout twice as cheap is practically equal to selling the same thing at twicethe price. Or it’s like making money on the same epic upswing twice instead of“just” once.

Andwhy am I writing about “half” and “twice”? Because… I’m being slightlyconservative, and I assume that the history is about to rhyme once again as itvery often does (despite seemingly different circumstances in the world). TheXAU Index declined from its 1999 high of 92.72 to 41.61 – it erased 55.12% ofits price.

Themost recent medium-term high in the GDX ETF (another proxy for mining stocks)was at about $45. Half of that is $22.5, so a move to this level would be quitein tune with what we saw recently.

Andthe thing is that based on this week’s slide in the NASDAQ that followed theweekly reversal and the invalidation, it seems that this slide lower hasalready begun.

“Wait,you said something about three months?”

Yes,that’s approximately how long we had to wait for the final buying opportunityin the mining stocks to present itself based on the stock market top.

Thereason is that after the 1929 top, gold miners declined for about three monthsafter the general stock market started to slide. We also saw some confirmationsof this theory based on the analogy to 2008. Consequently, we might see the next major bottom – and the epic buyingopportunity in the mining stocks – about three months after the general stockmarket tops. The NASDAQ might have already topped, so we’re waiting for theS&P 500 to confirm the change in the trend.

The bottom line?

New lows are likely to complete the GDXETF’s bearish H&S pattern and set the stage for an even larger medium-termdecline. And if the projection proves prescient, medium-term support (orperhaps even the long-term one) will likely emerge at roughly $21.

But why ~$21?

Likewise, when analyzing the situationthrough the lens of the GDXJ ETF, the juniorminers are eliciting the same bearish signals. If you analyze the chartbelow, you can see that despite the recent strength, the GDXJ ETF is stilltrading below its medium-term rising support line (the thick black line below).More importantly, though, with the junior miners failing to reclaim this keylevel, their bearish H&S pattern remains intact.

Even more ominous, the GDXJ ETF remains asignificant underperformer of the GDX ETF. Despite sanguine sentiment and astrong stock market creating the perfect backdrop for the junior miners, theGDXJ ETF has failed to live up to the hype.

To explain, I wrote previously:

GDXJis underperforming GDX just as I’ve been expecting it to. Once one realizesthat GDXJ is more correlated with the general stock market than GDX is, GDXJ should be showing strength here, and it isn’t. Ifstocks don’t decline, GDXJ is likely to underperform by just a bit, but when(not if) stocks slide, GDXJ is likely to plunge visibly more than GDX.

Expanding on that point, the GDXJ/GDXratio has been declining since the beginning of the year, which is remarkablebecause the general stock market hasn’t plunged yet. However, once the generalstock market suffers a material decline, the GDXJ ETF’s underperformance willlikely be heard loud and clear.

Please see below:

So, how low could the GDXJ ETF go?

Well, absent an equity rout, the juniorscould form an interim bottom in the $34 to $36 range. Conversely, if stocksshow strength, juniors could form the interim bottom higher, close to the $42.5 level. For context, the above-mentionedranges coincide with the 50% and 61.8% Fibonacci retracement levels and theGDXJ ETF’s previous highs (including the late-March/early-April high in case ofthe lower target area). Thus, the S&P 500 will likely need to roll over forthe weakness to persist beyond these levels.

Moreover, the HUI Index/S&P 500 ratiohas recorded a major, confirmed breakdown. And with the ratio nowhere nearrecapturing its former glory, it’s another sign that a storm is brewing.Moreover, after moving back and forth for the last few months, not only has theHUI Index/S&P 500 ratio broken below its rising support line (the upwardsloping black line below), but the ratio has also broken below the neckline ofits roughly 12-month H&S pattern (the dotted red line below). As a result,given the distance from the head to the neckline, the HUI Index/S&P 500ratio is on a collision course back to (at least) 0.050.

Please see below:

When the ratio presented on the abovechart above is rising, it means that the HUIIndex is outperforming the S&P 500. When the line above is falling, itmeans that the S&P 500 is outperforming the HUI Index. If you analyze theright side of the chart, you can see that theratio has broken below its rising support line. For context, the last timea breakdown of this magnitude occurred, the ratio plunged from late-2017 tolate-2018. Thus, the development is profoundly bearish.

Playing out as I expected, a sharp movelower was followed by a corrective upswing back to the now confirmed breakdown level (which is now resistance). Mirroringthe behavior that we witnessed in early 2018, after breaking below its risingsupport line, the HUI Index/S&P 500 ratio rallied back to the initialbreakdown level (which then became resistance) before suffering a sharpdecline. And with two-thirds of the analogue already complete, the current movelower still has plenty of room to run. Likewise, the early-2018 top in the HUI Index/S&P 500 ratio is precisely whenthe USD Index began its massive upswing. Thus, with history likely to rhyme,the greenback could spoil the miners’ party once again.

In addition, the HUI to S&P 500 ratiobroke below the neck level (red, dashed line) of a broad head-and-shoulderspattern, and it verified this breakdown by moving temporarily back to it. Thetarget for the ratio based on this formation is at about 0.05 (slightly aboveit). Consequently, if the S&P 500 doesn’t decline, the ratio at 0.05 wouldimply the HUI Index at about 196. However, if the S&P 500 declined to about3,200 or so (its late-2020 lows) and the ratio moved to about 0.05, it wouldimply the HUI Index at about 160 – very close to its 2020 lows.

All in all, the implications of miningstocks’ relative performance to gold and the general stock market are currentlybearish.

But if we’re headed for a GDX ETF cliff,how far could we fall?

Well, there are three reasons why the GDXETF might form an interim bottom at roughly ~$27.50 (assuming no big decline inthe general stockmarket ):

Keep in mind though: if the stock market plunges, all bets areoff. Why so? Well, because when the S&P 500 plunged in March 2020, theGDX ETF moved from $29.67 to below $17 in less than two weeks. As a result,U.S. equities have the potential to make the miners’ forthcoming swoon all themore painful.

In conclusion, with gold, silver andmining stocks staying at the same springtime resort, their departure fromreality implies plenty of jet lag at the end of their trip. And with the clockticking, passengers boarding and their flight nearing takeoff, a return to reallife is just around the corner. Moreover, with the USD Index long overdue forsome R & R, a reversal of fortunes could leave the precious metalssuffering severe envy. Thus, while gold, silver and mining stocks have enjoyednothing but sun, sand and surf over the last few weeks, the pile of work thatawaits them will likely keep them swamped over the medium term.

Thank you for reading our free analysistoday. Please note that the above is just a small fraction of today’sall-encompassing Gold & Silver Trading Alert. The latter includes multiplepremium details such as the target for gold that could be reached in the nextfew weeks. If you’d like to read those premium details, we have good news foryou. As soon as you sign up for our free gold newsletter, you’ll get a free7-day no-obligation trial access to our premium Gold & Silver TradingAlerts. It’s really free – sign up today.

Przemyslaw Radomski, CFA

Founder, Editor-in-chief

Toolsfor Effective Gold & Silver Investments - SunshineProfits.com

Tools für EffektivesGold- und Silber-Investment - SunshineProfits.DE

* * * * *

About Sunshine Profits

SunshineProfits enables anyone to forecast market changes with a level of accuracy thatwas once only available to closed-door institutions. It provides free trialaccess to its best investment tools (including lists of best gold stocks and best silver stocks),proprietary gold & silver indicators, buy & sell signals, weekly newsletter, and more. Seeing is believing.

Disclaimer

All essays, research and information found aboverepresent analyses and opinions of Przemyslaw Radomski, CFA and SunshineProfits' associates only. As such, it may prove wrong and be a subject tochange without notice. Opinions and analyses were based on data available toauthors of respective essays at the time of writing. Although the informationprovided above is based on careful research and sources that are believed to beaccurate, Przemyslaw Radomski, CFA and his associates do not guarantee theaccuracy or thoroughness of the data or information reported. The opinionspublished above are neither an offer nor a recommendation to purchase or sell anysecurities. Mr. Radomski is not a Registered Securities Advisor. By readingPrzemyslaw Radomski's, CFA reports you fully agree that he will not be heldresponsible or liable for any decisions you make regarding any informationprovided in these reports. Investing, trading and speculation in any financialmarkets may involve high risk of loss. Przemyslaw Radomski, CFA, SunshineProfits' employees and affiliates as well as members of their families may havea short or long position in any securities, including those mentioned in any ofthe reports or essays, and may make additional purchases and/or sales of thosesecurities without notice.

Przemyslaw Radomski Archive |

© 2005-2019 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.