Gold Gets The Green Light From The Fed

The Fed's recent flip on monetary policy is inadvertently creating an ideal environment for gold to thrive in.

Its dovish path should further suppress the dollar, lower interest rates, and eventually create excess inflation.

These are extremely positive developments for gold.

These factors also coincide with increased interest amongst speculators, and a very constructive technical image that suggests gold prices are on the verge of a major breakout.

Ultimately, gold should have a very productive 2019, and is likely to break out to new multi-year highs by the end of this year.

Source: Imgflip.com

Gold Gets Green Light From The Fed

Gold/SPDR Gold Trust ETF (GLD) is up by roughly 11% since hitting a bottom last August. Incidentally, the bottom in gold came around the same time the Fed was at its most hawkish and markets firmly believed there would be 3 or 4 rate hikes this year.

Gold 1-Year

Source: StockCharts.com

GLD 1-Year

Considering the Fed's flip on monetary policy, expectations are much different now. Due to the Fed's significantly more dovish outlook, the dollar is likely to continue to give up ground, bond rates could trend lower, and inflation will likely rise over time. This phenomenon essentially gives gold the green light to go substantially higher from here.

In addition, speculators are showing signs of renewed interest, the technical image looks extremely constructive, and gold appears to be on the verge of a major breakout. Ultimately, the Fed is inadvertently creating an ideal environment for gold, and the yellow metal could break out to new multi-year highs by the end of this year.

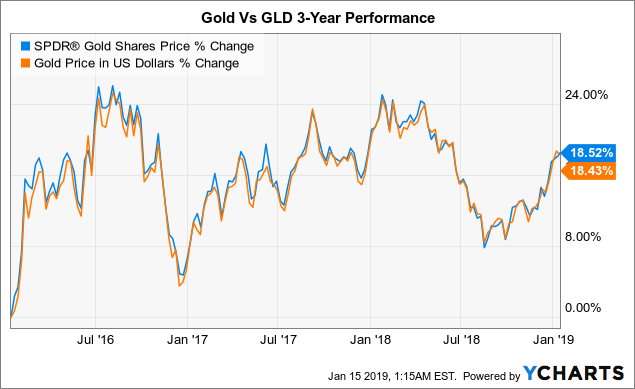

About GLD

GLD is the largest physically backed gold exchange-traded fund in the world, with roughly $30 billion worth of net assets. It offers market participants an efficient way to access the gold market, as it mimics the price of gold almost identically.

GLD data by YCharts

GLD data by YCharts

In addition, the ETF is an attractive alternative to trading gold futures, as it can be traded much like a stock on the NYSE Arca exchange, instead of dealing with alternative exchanges and trading requirements pertaining to futures contracts.

Furthermore, it is an appealing alternative to trading physical gold, as investors get exposure to the same price action as the metal, but can buy and sell gold with great fluidity of an ETF using GLD.

Since the ETF mimics the price of gold almost identically, I will refer to GLD and gold interchangeably throughout this article.

Fed's Dovish Stance - Goldilocks Environment for Gold

Perhaps nothing impacts gold prices in the short and intermediate term quite like Fed policy. Due to the Fed's easing or tightening, the dollar fluctuates, bond rates move, and inflation can increase or decrease. Naturally, gold benefits from a weaker dollar, as gold is denominated in dollars, and a weaker greenback makes gold cheaper in competing currencies.

Probably the most prominent reason why gold had a difficult year in 2018 (finishing essentially flat after a rollercoaster ride) was because the Fed hiked rates four times. The dollar had a super strong run last year, appreciating by more than 10% (from peak to trough) at one point.

Bonds had a very strong run-up last year as well. For instance, the 10-year treasury went from below 2.4% all the way up to 3.25% last year. Bonds represent a competing asset class to gold. Thus, the higher the popular bond rates yield, the more attractive they become in comparison to owning gold. This is true if the inflation adjusted rate of return is higher than the rate of inflation.

Furthermore, inflation got suppressed temporarily towards the end of the year due to a combination of Fed tightening, a strong dollar, cascading oil prices, and the perceived slowdown in the economy.

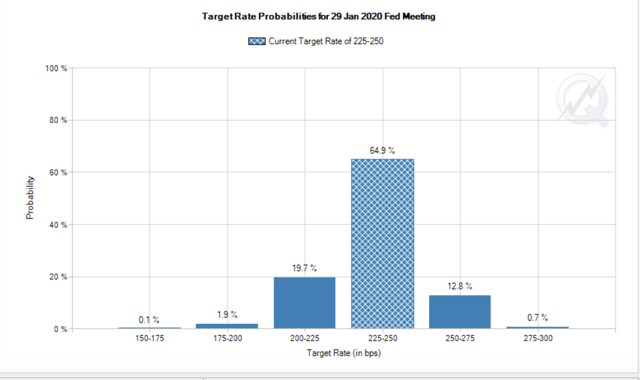

However, now that essentially all the potential rate hikes for 2019 have been priced out of the equation, gold is likely to go a lot higher. Following chair Powell's uber-dovish conference about a week ago, the chances of future rate hikes diminished considerably. In fact, the market now gives 86.5% probability to rates being the same or lower in early January 2020.

Source: CMEGroup.com

Moreover, there is now a 21.7% chance that rates will be lower, versus only a 13.5% chance rates will be higher in early 2020. The Fed is in the process of setting up an environment in which the dollar is destined to go lower, bond yields could also decrease, or even turn negative at some point, and inflation should go higher. This phenomenon will likely lead to a Goldilocks environment for gold prices.

The Dollar - Likely Headed Lower

We can see that the dollar had a very nice bounce off the lows, producing a substantial rally that lasted more than 8 months last year, and delivering more than 10% in upside. However, further gains are unlikely, and I would be very surprised to see the dollar index hit 100, never mind prior highs or any new highs.

USD 5-Year

The dollar has at least three major headwinds now. First is the Fed, which is in the process of halting its tightening path. Second is the overall slowdown in the U.S. economy, and the third is the onset of inflation that is likely to spill over into the real economy.

Therefore, the dollar is likely going lower, and possibly much lower over the next several years. In fact, the dollar index may be putting in a top right now. The next attempt higher may fail and build a second shoulder in the chart pattern, and then, once the neckline breaks, the dollar could slide and gold could break out substantially higher.

Bond Rates - Also Could be Headed Lower

Bond rates are important because they represent a competing "safe haven" asset class to gold. The problem with U.S. bonds is that they are priced in dollars, and the longer-dated the maturity rate, the longer someone must hold that bond. This creates a higher probability that the principal invested may lose value due to inflation.

For instance, if you invest $10,000 in a 10-year treasury, and that treasury payed you 2.7% annually for the next ten years, you would have a total of about $13,052 at the date of maturity. However, if inflation was at 3%, or anything higher than 2.7%, your real rate of return would have been negative, as the money you had invested would have lost more purchasing power than the accumulated interest combined with the principal.

In this case, it would not make much sense to own bonds, because you are essentially receiving less in purchasing power than you lent out in the first place. This is a horrible investment, and gold would be a much better play in this case.

With the Fed likely to lower rates or possibly take them negative when the next downturn arrives, the real return on bonds will almost inevitably be negative. On the other hand, inflation is likely to rise due to probable future rounds of monetary easing, increasing of the money supply, and the overall debasement of the dollar. Therefore, the disconnect between bond yields and the rate of inflation could widen substantially.

This kind of market dynamic will make gold extremely attractive, and investors could rush in for several reasons, including a hedge against inflation and as an alternative investment to bonds. We've already seen bond rates drop notably since the recent highs in October and November, and this trend may continue as the Fed continues with its much more dovish outlook on policy.

Inflation - Likely to Regain Momentum

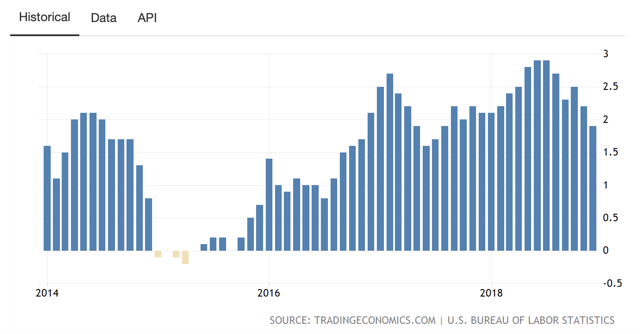

We see that inflation dipped lower in the second part of 2018. However, this was very likely due to several transitory factors, like the expectation of higher rates, a strong dollar, crashing oil prices, and other temporary factors.

CPI Inflation Rate 5 Years

Source: TradingEconomics.com

In fact, now that the Fed has signaled a possible end to its tightening trajectory, oil has recovered, and the dollar may have peaked, inflation is very likely to return to its 2.5% and higher range. Wage growth, a forward-looking indicator on inflation, jumped by 3.2% YoY and by 0.4% MoM in the latest report.

Furthermore, despite the CPI's recent dip, the longer-term trajectory is still clearly higher. As inflation increases, so should the price of gold, as gold is the ultimate hedge against inflation and a debasing fiat currency.

COT Report - Speculator Interest Starting to Strengthen

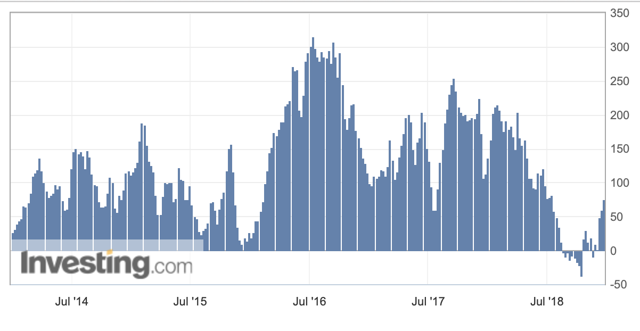

Traders and speculators are just beginning to wake up to gold's enormous future prospects. After one of the most bearish periods in its history (during which net speculative positions went negative for 10 weeks straight), speculators are just starting to come back to the gold market.

Gold Futures Positions 5-Year

Source: Investing.com

However, as the thesis for much higher gold prices gradually strengthens, investors are likely to rush into gold more and more over the next several years. This next wave of potential retail and institutional investor interest has the potential to take gold much higher, possibly even above its all-time highs reached in 2011.

Nothing Fuels Gold Prices Like QE

One of the reasons I am confident gold will go substantially higher is because the Fed has suggested it will likely come back to its QE policy once the economy is in a recession and stocks are under pressure again.

There is no escaping a recessionary period, and one of the only tools the Fed has at its disposal is QE. This is essentially the policy of significantly expanding the money supply, or in other words, printing money and debasing the currency. Also, the Fed may institute negative rates in the next crisis - something Japan and the ECB have done in the past. This would also be extremely beneficial to gold prices.

Essentially, anything the Fed does to shore up the economy prior to, during, and after the next economic downturn will be extremely bullish for gold. Therefore, by default, it is only a matter of time until gold goes much higher.

Technical Perspective - Very Constructive

We see that gold is in a constructive uptrend that started at the late 2015 $1,045 gold bottom. We see a series of higher lows and improving overall technical momentum. Moreover, gold's 50-day moving average is on the verge of crossing the 200-day, which will be a very favorable technical signal when it occurs.

Gold 38 Months

GLD 38 Months

Perhaps most importantly, we have a very constructive cup and handle pattern developing, with the entire cup pattern mostly completed. This implies that gold sold off, consolidated, and is now recovering. And now that gold is at the crucial $1,300, it will likely build out the handle part of the pattern and then proceed to move higher above the $1,300 level.

The Bottom Line - Gold Likely Going Much Higher

Gold prices have been somewhat subdued in recent years despite hitting a significant bottom in late 2015. The lackluster performance has a lot to do with the Fed's tightening policy of the past few years. As the Fed has been normalizing rates and implementing QT, bond rates have risen, the dollar has strengthened, and inflation has been kept in check.

Despite being in a negative Fed-induced environment, gold is currently about 24% higher than its late 2015 bottom. This is because we are very likely in the early stages of a significant gold bull market. So, how high do you think it will go when the Fed inadvertently creates an extremely positive environment for gold?

With the Fed towards the end of its tightening cycle, and a likely economic slowdown on the horizon, the Fed will need to eventually halt QT, lower rates, possibly take rates back down to zero or invert them, and implement new rounds of QE. These are the primary tools the Fed has at its disposal to battle a recession and a bear market in stocks.

These Fed actions will cause the dollar to weaken substantially, cause bond rates to head lower, and could spark a substantial wave of inflation. Such factors are extremely bullish for gold, and mainstream investors appear to be waking up to the likelihood of such a scenario unfolding. That is why we are seeing increased interest from speculators, and the technical image appears extremely constructive now.

Gold may be on the verge of a major breakout. 2019 should be a great year to get into gold, and ultimately, prices are likely to go substantially higher over the next several years, possibly surpassing the prior highs achieved at the height of the 2011 bull market.

Disclaimer: This article expresses solely my opinions, is produced for informational purposes only, and is not a recommendation to buy or sell any securities. Investing comes with substantial risk to loss of principal. Please conduct your own research, consult a professional, and consider your investment decisions very carefully before putting any capital at risk.

Want more? Want full articles that include technical analyses, trade triggers, trading strategies, portfolio insight, option ideas, price targets, and much more? To learn how to best position yourself for a rally in gold please consider joining Albright Investment Group.

Subscribe now and receive the best of both worlds, deep value insight coupled with top-performing growth strategies.Enjoy access to AIG's top-performing portfolio that outperformed the S&P 500 by over 19% in 2018.Take Advantage of the limited time 2-week free trial offer now and receive 20% off your introductory subscription pricing. Click here to learn more.Disclosure: I am/we are long GOLD, SILVER, AND GOLD MINING STOCKS. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Follow Victor Dergunov and get email alerts