Gold GLD Fund: Divergence Signals Shortage / Commodities / Gold & Silver 2019

A Perfect Storm ishitting the Gold market, with an internal factor (QE), an external factor (SGE),and a systemic factor (Basel). All three forces are positive in releasing Gold from the corruptclutches of the Anglo-American banker organization. The East has an all-out blitz to ditch the USDollar and to adopt the Gold Standard in its early form, namely trade payment.In the last ten years since the Lehman Brothers failure,all systems have undergone the same reckless treatment that the mortgage bondsendured. Slowly the realization is coming to the fore, stated by a few astuteanalysts. In the last decade, the US-UK bankstershave created the USTreasury bond as the global subprime bond. This is theresult of astounding persistent magnificent QE abuse, debt explosion, andhidden corruption. The so-called financial stimulus is actually hypermonetary inflation, which has destroyed the bond market. There are nolegitimate USTreasury buyers outside the US foreign vassal states.

A Perfect Storm ishitting the Gold market, with an internal factor (QE), an external factor (SGE),and a systemic factor (Basel). All three forces are positive in releasing Gold from the corruptclutches of the Anglo-American banker organization. The East has an all-out blitz to ditch the USDollar and to adopt the Gold Standard in its early form, namely trade payment.In the last ten years since the Lehman Brothers failure,all systems have undergone the same reckless treatment that the mortgage bondsendured. Slowly the realization is coming to the fore, stated by a few astuteanalysts. In the last decade, the US-UK bankstershave created the USTreasury bond as the global subprime bond. This is theresult of astounding persistent magnificent QE abuse, debt explosion, andhidden corruption. The so-called financial stimulus is actually hypermonetary inflation, which has destroyed the bond market. There are nolegitimate USTreasury buyers outside the US foreign vassal states.

PERFECT FINANCIAL STORM

The perfect financial storm will be three tofive times worse than the 2008 financial crisis that engulfed the subprime bondmarket. The corporate bond market isturning gradually into a $trillion BBB junk bond field and broken bone yard,after years of abused bond issuance devoted to share buybacks and executiveoptions. It can be stated with accuracy that the entire global bond market issubprime, led by the USTBonds. In the last ten years, absolutely nothing has been fixed, no remedyeven attempted, while all the errors, crimes, and reckless monetary policy thatcreated the Lehman fiasco with the Global Financial Crisis, have been repeatedon a global scale. Debt has exploded globally, andespecially in the USGovt finances. The great unfolding crisis will engulfsovereign bonds, national banking systems, and major corporations. For the lastten years, the USD-based money supply has almost tripled. The process created acoiled spring. The Gold price is due to triple in compensation. Much lost timewill be made up for. It just needs some internal, external, and systemic pushes.The Gold market will never let a crisis go to waste; it will respond.

The unfolding globalcrisis will expose the USTreasury Bond as toxic, the new subprime bond. It willstruggle to maintain the safe haven status, but lose the battle. Gold willassume the safe haven status, along with other undetermined hard assets. Attempts by the Basel bunch ofuber-bankers, who have no official authority over the Western central banks,will change the course of banking history. That Gold is made a risk-free Tier-1asset will put forth a direct challenge to the USTBond in banking reserves. All systems will change.

GLD FUND FLASHING SIGNAL OF SHORTAGE

The GLD Exchange Traded Fundcan serve as a very reliable early warning signal for a very tight gold supply,and corresponding Gold price upward moves. It signals shortage and tight supplynow, with a divergence between London Gold price versus GLD Fund inventory intonnage.

Consider a lesson on the GLDExchange Traded Fund. Some preliminary remarks are necessary. It is a fund todeceive the public, whose prospectus is routinely violated by the Londonbanksters. The GLD Fund is used as a magnet for naive ignorant lazyinvestors, lured to think they own gold. While they might enjoy the upside potentialin the Gold price, their investment is a major vehicle used to keep the pricedown. Its inventory is raided by the US-UK banks, and sold into the marketin regular frequent events. The big investors are often denied access to physicalgold delivery, since not club members at the big banks, a violation. Nobodyenforces the rule. The inventory contains real gold metal, but it is a massivevat for discharge into the market in pure price suppression by the criminalbanker set. They manage the fund like a criminal slush fund. With each raidon the GLD vault, the LBMA official Gold price comes down. Notice the tightcorrelation in the graph below, except in recent months.

Evidence is clear. Adivergence can now be seen, from the clear signal between the LBMA Gold priceand the critically low GLD vault inventory. The Gold price is going up,while the GLD inventory is going down. Since three months ago, the divergencehas begun to show itself. The chart shows data through February of this year.

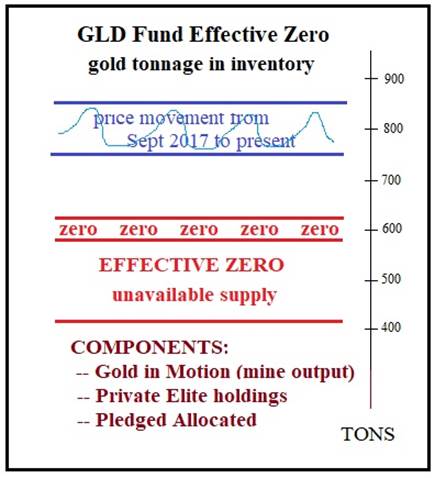

Another key but subtle pointof interest. The official inventory level of the GLD Fund includes gold inmotion, a term to describe delivery from mining firms that is in transit. Itis never truly in the vaults, since when a delivery is made, another deliveryis in motion under new contract stipulation. By that is meant not just trucksloaded with bars, but trucks loaded with concentrated ore heading to refineries,plus bars under contract delivery within the quarter (three months).Furthermore, other gold shows up in the GLD inventory, but it is not available,such as private elite accounts, even pledged allocated gold.

Therefore the effective zero level is far above the postedzero level, which is often estimated by the expert analysts (like EuroRaj) tobe around 400 to 600 tonnes gold, very much unknown. This is animportant point, since the official GLD inventory is just above 750 tonnescurrently. It has varied from 750 tonnes to 850 tonnes in the last 18 months,now near the effective zero mark. As the GLD vaults reach effective zero, theBoyz on Wall Street and London Centre lose the ability to reach into the vaultsovernight in dumping exercises intended to pull the Gold price down. They essentiallyhave a tool taken away.

Consider sage words from aJackass colleague. The purpose of GLD is a private warehouse run by the Bank ofEngland. When the public demand or central bank demand has to be met, theyraid the inventory by redeeming share baskets and remove physical barsovernight. The redemption of shares is an act of selling of the paper thatdrives prices lower, when more exactly the process is actually driven bydrainage of physical at this banker slush fund. There is physical gold butit belongs primarily to BOE and certain billionaires. The sheeple cannot get accessto it unless they pony up enough cash for 10,000 ounces, and even then, theyare often denied the metal. Since the USFed went dovish in December in areversal of language away from further tightening, and toward more easing, theGold price has been going up while the GLD Fund tonnage has been going down.The Big Boyz know the RESET is here. Refer to the divergence in progress forthe last three months.

The clear signs of physical golddrainage lead to growing distrust in the entire USDollar & USTreasuryframework like a creeping slow motion cancer. Gold drainage affects thedelicate Supply & Demand equilibrium. The result is an assured imminent situationthat reeks of financial instability. The true refuge will be Gold held inpersonal possession or with trusted access by agents. The irony could be thatbroken trust of the GLD Fund and broken trust of the LBMA/COMEX, complete withlawsuits, could bring down the paper game and lead the masses into true physicalGold holdings. For more background and other discussion, see Sprott Money (HERE)with a Craig Hemke interview.

DUAL UNIVERSE

The next stage for global finance will incorporateregional structures and platforms. The entire community of nations is makingmajor adjustments as preliminary preparation to the Global RESET, in order tominimize the shock, disruption, and potential chaos. Expect regional themes to dominate, as the Dual Universe comes intoform. The East will prefer to trade in Chinese RMB terms, and often in Euroterms. The West will prefer to conduct trade in USD terms, but also BritishPounds in trace amounts within the old colonies. A dichotomy has formedwith great geopolitical division amidst hostility and trade friction. Theentire USFed QE initiative, coupled with unbridled $trillion USGovt debts, hasfostered a rebellion amidst visible bond fraud. The rest of the globe is in activerevolt, whose movement gains momentum each month. The transition period will involve the two dominant currencies at work:the USD and RMB. The USDollar will not go away quickly or easily. It iswell rooted in trade payments systems, in credit systems, in banking systems,and more. The entire Langley seven silos of corrupt illegal enterprises (narcotics,weapons, human trafficking, human organs) are based in the USDollar, with gargantuansavings accounts and business investments. They will not go away anytime soon, whichdictates an interim period. The Dual Universe has been born, without much fanfare.The Chinese RMB is to be the designated caretaker, used for ushering in theGold Standard.

In the meantime, the United States will facean acute risk for the transition. It must assure import supply. The USTreasury Billwill no longer be trusted, or even accepted, following the RESET. Entirely newtrade payments systems are coming, and the US will lose its privilege of payingfor hard goods with phony money and IOU coupons. The USTBill has a fraudulentbacking, an unlimited supply, fraudulent masters, and is coupled with massivedebt which is widely seen as unpayable. TheUS must adapt to the Gold Trade Note in usage. It must contend with shortagesand rising prices, following import supply interruptions. It must shareglobal power, while losing the exceptional status. It must ward off isolation. Itmust reindustrialize. It must pay down the $22 trillion debt. It must sourcegold for the new currency. It must face the risk of a starkreality in the New Scheiss Dollar, a Third World conception, provided theUSGovt resorts to its usual fraudulent finances.

HAT TRICKLETTER PROFITS IN THE CURRENT CRISIS.

“Jim Willie’s proprietary contacts in highly strategicpositions around the world help him better predict the future with anaccurately as high as 90%. That is astounding! The Hat Trick Letter is mysecret sauce to better understand what is really happening, so I can makebetter financial decisions during this tumultuous period.”

(PaulK in Kentucky)

"I have continued my loyal patronage of yourexcellent commentaries not so much because of my total agreement with yourviewpoints, but because you have proven yourself to be correct so often overthe years. When you are wrong, you have publicly admitted it. You are, Isuppose by nature, an outspoken and irreverent spokesman for TRUTH againstpower, which differentiates you from almost all other pundits on worldaffairs."

(PaulR in Hawaii)

"For over five years I have been eagerlyassimilating any and all free information (articles, interviews, etc) that JimWillie puts out there. Just recently I finally took the plunge and became apaid subscriber. I regret not doing this much sooner, as my expectations wereblown away with the vast amount of sourced information, analysis tied together,and logical forecasts contained in each report."

(JosephM in South Carolina)

"Jim Willie is a gift to our age who is the onlyclear voice sounding the alarm of the extreme financial crisis facing theWestern nations. He has unique skills of unbiased analysis with synthesis ofinformation from his valuable sources. Since 2007, he has made over 17 correctforecast calls, each at least a year ahead of time. If you read his work orlisten to his interviews, you will see what has been happening, know what toexpect, and know what to do."

(Charles in New Mexico)

"A Paradigm change is occurring for sure. Yourreports and analysis are historic documents, allowing future generations tohave an accurate account of what and why things went wrong so badly. There isno other written account that strings things along on the timeline, as yourwritings do. I share them with a handful of incredibly influential people whosedecisions are greatly impacted by having the information in the Jackass format.The system is coming apart on such a mega scale that it is difficult to wrapone's head around where all this will end. But then, the universe strives forequilibrium and all will eventually balance out."

(The Voice, a European gold trader source)

Jim Willie CBis a statistical analyst in marketing research and retail forecasting. He holdsa PhD in Statistics. His career has stretched over 25 years. He aspires tothrive in the financial editor world, unencumbered by the limitations ofeconomic credentials. Visit his free website to find articles from topflightauthors at www.GoldenJackass.com.For personal questions about subscriptions, contact him at JimWillieCB@aol.com

Use the above link to subscribe to the paid research reports, which include coverage of several smallcap companies positioned to rise during the ongoing panicky attempt to sustain an unsustainable system burdened by numerous imbalances aggravated by global village forces. An historically unprecedented mess has been created by compromised central bankers and inept economic advisors, whose interference has irreversibly altered and damaged the world financial system, urgently pushed after the removed anchor of money to gold. Analysis features Gold, Crude Oil, USDollar, Treasury bonds, and inter-market dynamics with the US Economy and US Federal Reserve monetary policy.

Jim Willie CBis a statistical analyst in marketing research and retail forecasting. He holdsa PhD in Statistics. His career has stretched over 25 years. He aspires tothrive in the financial editor world, unencumbered by the limitations ofeconomic credentials. Visit his free website to find articles from topflightauthors at www.GoldenJackass.com,which includes a Squirrel Mail public email facility.

Jim Willie CB Archive |

© 2005-2019 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.