Gold & Gold Stocks Approaching Resistance / Commodities / Gold and Silver Stocks 2018

Gold and gold stocks have enjoyed an excellentrebound since their December lows. Over the past six weeks Gold rebounded froma low of $1238 all the way to $1365 in recent days. The miners meanwhilerebounded nearly 18% (GDX) and 21% (GDXJ). However, these markets areapproaching important resistance levels and at a time when sentiment isbecoming stretched and the US Dollar has become very oversold.

Gold and gold stocks have enjoyed an excellentrebound since their December lows. Over the past six weeks Gold rebounded froma low of $1238 all the way to $1365 in recent days. The miners meanwhilerebounded nearly 18% (GDX) and 21% (GDXJ). However, these markets areapproaching important resistance levels and at a time when sentiment isbecoming stretched and the US Dollar has become very oversold.

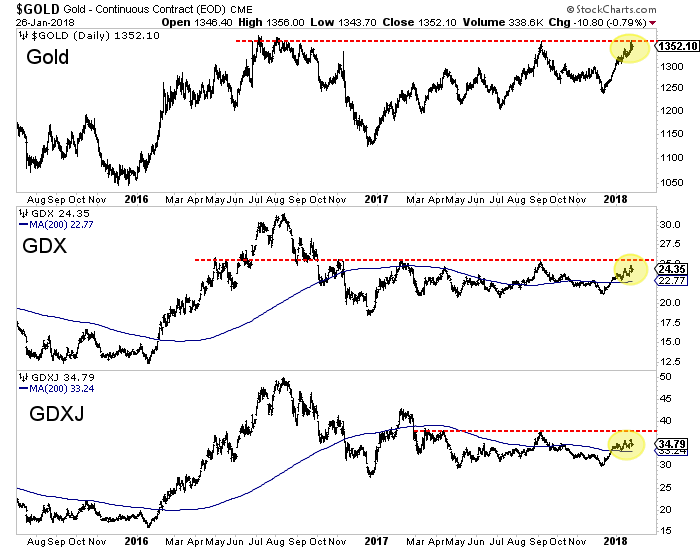

Take a look at the charts of Gold, GDX andGDXJ. Gold has reached the September 2017 highs while GDX came within 2%-3%.GDXJ is lagging but came within less than 5%. Another round of buying over afew days should be enough to push the miners to resistance.

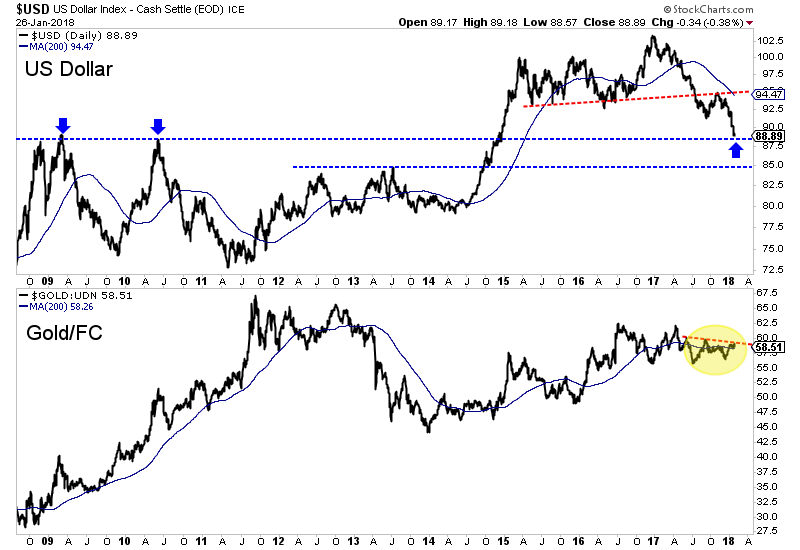

Recent strength in Gold and gold stocks ismostly due to weakness in the US Dollar which is very oversold and approachingimportant support. On Friday, the US Dollar Index touched 88, which marks the2009 and 2010 peaks and is the only real support between the low 80s and thelow 90s. We also plot Gold against foreign currencies (Gold/FC) which tells if Goldis rising in real terms or if its rising due to the US Dollar weakness. Gold/FCfailed to break above key resistance. That signals that over the short-term,Gold would be vulnerable to a bounce in the US Dollar.

Some sentiment indicators suggest the reboundin precious metals could be in its later innings. Thursday the daily sentimentindex for Gold hit 91% bulls. Friday, the daily sentiment index for thegreenback hit 10% bulls. The CoT’s are not as extreme. Gold’s net speculativeposition (relative to open interest) is 40% bulls. The 2011, 2012 and 2016peaks were around 55% bulls. Meanwhile, Silver’s net speculative position is at26% bulls.

Gold and gold stocks have enjoyed a great reboundsince the Fed rate hike but technicals and sentiment suggest they are due for apause or correction. The miners and Gold are very close to the resistance levels we noted in a recent editorial.Recent strength has been driven mostly by weakness in the US Dollar which isvery oversold and testing support. Meanwhile, the daily sentiment index hasreached short-term extremes for Gold and the greenback. The odds appear tofavor a pause in this rebound or a short-term correction. That is great newsfor anyone who missed the rally as it would setup a decent buying opportunitybefore a major breakout. We continue to seek the juniors that are trading atreasonable values but have fundamental and technical catalysts that will driveincreased buying.

Good Luck!

Bio: Jordan Roy-Byrne, CMT is a Chartered Market Technician, a member of the Market Technicians Association and from 2010-2014 an official contributor to the CME Group, the largest futures exchange in the world. He is the publisher and editor of TheDailyGold Premium, a publication which emphaszies market timing and stock selection for the sophisticated investor. Jordan's work has been featured in CNBC, Barrons, Financial Times Alphaville, and his editorials are regularly published in 321gold, Gold-Eagle, FinancialSense, GoldSeek, Kitco and Yahoo Finance. He is quoted regularly in Barrons. Jordan was a speaker at PDAC 2012, the largest mining conference in the world.

Jordan Roy-Byrne Archive |

© 2005-2018 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.