Gold In Pre-Recession World / Commodities / Gold & Silver 2019

The yieldcurve has inverted.It suggests that we are about one year before the recession. How should theyellow metal behave in such a period? We invite you to read our today’s articleand find out how gold is likely to behave in the pre-recession world.

The yieldcurve has inverted.It suggests that we are about one year before the recession. How should theyellow metal behave in such a period? We invite you to read our today’s articleand find out how gold is likely to behave in the pre-recession world.

The yield curve has inverted. If its strong predictive power of the recession remains intact –in the previous part of this report, we presented strong arguments that this isreally the case (or, that there are no strong evidence for a weakenedpredictive power) – it means that we should expect an economic slump around May2020.

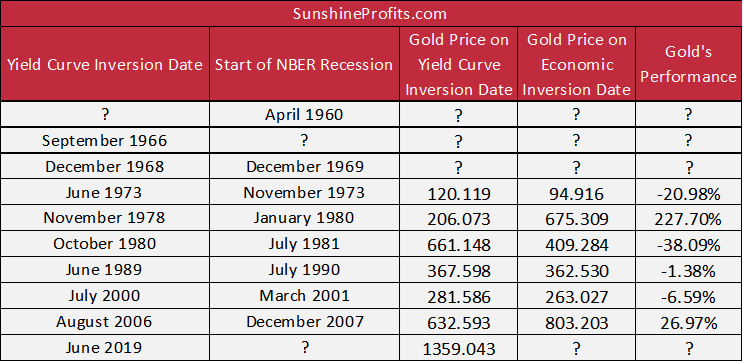

But what about gold? How should the yellow metal behave in apre-recession world? To answer this trillion question, we analyzed thehistorical yield curve inversions and examined their impact on gold prices. Weput the results in the table below.

Table 1: Gold prices between the yield curve inversionand the following economic recessions.

Our research sample is terribly small, as Treasuryspread series goes back just to 1959, while the gold prices were not freeduntil the gold standard was dismantled in early 1970s. So we couldinvestigate the impact of only six yield curve inversions on the price of theyellow metal. Nevertheless, the resultsare interesting, if not surprising, at least for some investors. Goldgained only in two in two cases: after the yield curve inversion in November1978 and in August 2006. Surely, the geometric average is positive – 11 percentup – but this is because of the astronomical surge of 228 percent in the late1970s.

What does it imply for theprecious metals investors? First, the yield curve inversion has not been necessarily bullish for the gold prices. They responded positively in the medium term only in onethird of cases. Second, gold is not the best recessionary indicator. More oftenthan not its price declines between the yield curve inversion and the followingrecession. Third, it seems that thesecular trends were much more important for the gold’s behavior. The priceswent up in the aftermath of the yield curve inversion only in the late 1970sand mid-2000, when the yellow metal enjoyed its great bull markets.

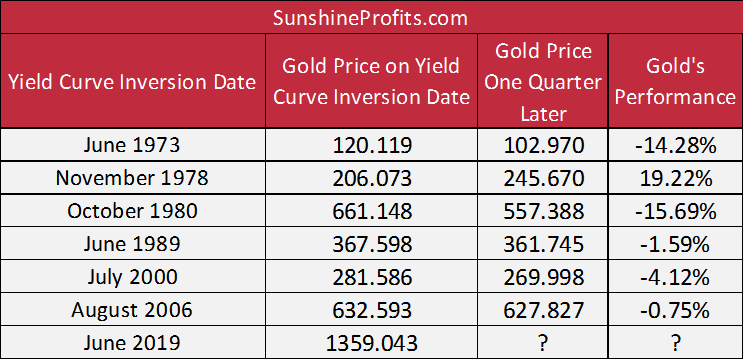

But what about the shortrun? Maybe the goldprices reacted positively to the yield curve inversion, but the effect was seenonly in the short term? Well, the table below shows the gold’s performancewithin one quarter after the yield curve inversion.

Table 2: Gold prices on the yield curve inversiondate and one quarter later.

As one can see, the results are even worse. Gold reacted positively only once, inthe late 1970s, but the gain shrunk to 19 percent. Consequently, the geometricaverage plunged to negative 3.5 percent.

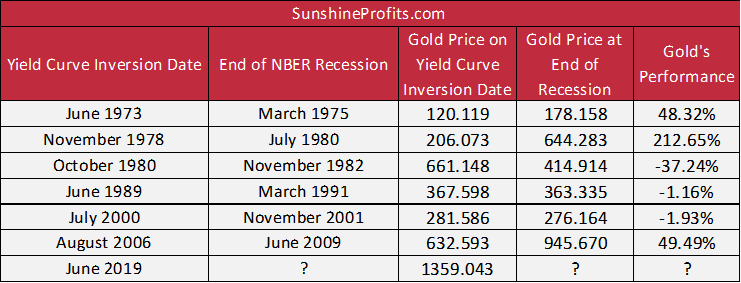

But maybe gold shined inthe long-run? Let’sinvestigate this possibility as well. This time, we lengthened the period up tothe end of the recession following the yield curve inversion. The table belowprovides the results.

Table 3: Gold prices between the yield curveinversion and the end of the following economic recessions.

As one can see, the results are better than in both previous views. Gold gained inthree cases now, and the geometric average jumped to 27 percent. Although theyellow metal did not shine in each case, the better results over the longerhorizons, which included recessions, confirm to some extent the notion that gold may serve as asafe-haven asset.

What are the implications of our analysis for goldin the context of the recent yield curve inversion? Contrary to popularopinion, neither the inversion nor eventhe following recession have to be necessarily bullish for the gold prices.This is at least what history teaches us: there were both cases when the priceof the yellow metal reacted positively but there were also instances of bearish response.

Who wins this time: the bears or the bulls? We believe that the latter will bevictorious in the end, while gold might suffer in the short run. Why?Fundamental axiom about gold is that ittends to perform relatively well during periods when confidence in thefinancial system is declining. The key is that the yield curve inversionwill add to recessionary fears. Actually, this is what the inversion means –that investors expect risks to increase substantially very soon. And they mightbe right. After all, the Fed’s ‘insurance’ cut is a clear signal that the U.S.central bank panics in a desperate effort to steepen the yield curve. But thismay be not enough to avert the recession – and investors know it. They will beafraid that – with the current level of the federal funds rate – the Fed will lack of ammunition when therecession hits. They will fear the negative interest rate policy and other unconventional monetary policy, lookingfor a shelter in gold. Unless policymakers propose some reasonable escapingthe debt trap – hint: lower interest rates and more debt are not the real solution – the confidence in the financial system willremain low, supporting the gold prices.

If you enjoyed the above analysis, we invite you tocheck out our other services. We provide detailed fundamental analyses of thegold market in our monthly Gold Market Overview reports andwe provide daily Gold & Silver Trading Alerts with clearbuy and sell signals. If you’re not ready to subscribe yet and are not on ourgold mailing list yet, we urge you to sign up. It’s free and if you don’t likeit, you can easily unsubscribe. Sign uptoday!

Arkadiusz Sieron

Sunshine Profits‘ MarketOverview Editor

Disclaimer

All essays, research and information found aboverepresent analyses and opinions of Przemyslaw Radomski, CFA and SunshineProfits' associates only. As such, it may prove wrong and be a subject tochange without notice. Opinions and analyses were based on data available toauthors of respective essays at the time of writing. Although the informationprovided above is based on careful research and sources that are believed to beaccurate, Przemyslaw Radomski, CFA and his associates do not guarantee theaccuracy or thoroughness of the data or information reported. The opinionspublished above are neither an offer nor a recommendation to purchase or sell anysecurities. Mr. Radomski is not a Registered Securities Advisor. By readingPrzemyslaw Radomski's, CFA reports you fully agree that he will not be heldresponsible or liable for any decisions you make regarding any informationprovided in these reports. Investing, trading and speculation in any financialmarkets may involve high risk of loss. Przemyslaw Radomski, CFA, SunshineProfits' employees and affiliates as well as members of their families may havea short or long position in any securities, including those mentioned in any ofthe reports or essays, and may make additional purchases and/or sales of thosesecurities without notice.

Arkadiusz Sieron Archive |

© 2005-2019 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.