Gold in the Negative Real Interest Rates Environment / Commodities / Gold & Silver 2019

Many believe that negative interest rates willnever arrive to the United States. This can’t possibly happen here. Thediscussions of their theoretical benefits almost remind you of thenot-in-my-backyard mentality. But this is not true – they are already presentin America. Hard to believe it? Hiding in plain sight, let’s take it a stepfurther and look at gold in the negative real interest rates environment.

Many believe that negative interest rates willnever arrive to the United States. This can’t possibly happen here. Thediscussions of their theoretical benefits almost remind you of thenot-in-my-backyard mentality. But this is not true – they are already presentin America. Hard to believe it? Hiding in plain sight, let’s take it a stepfurther and look at gold in the negative real interest rates environment.

Many people believe that negative interest ratesare the ailment of Europe and Japan, and that they will never materialize inthe United States. But this is not true. They are already present in America. Can’t believe it? Please take a look atthe chart below.

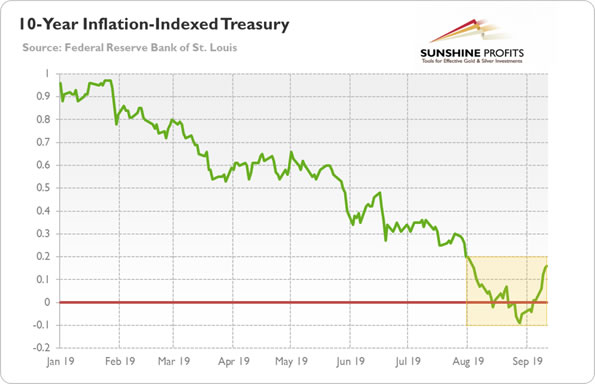

Chart 1: Yields on the US 10-Year Inflation-IndexedTreasury in 2019

Asone can see, the yield on the U.S. 10-year inflation-indexed Treasury has divedbelow zero at the turn of August and September. Hence, although nominal interest rates are still positive in America, the real interest rates have turned negative for a while recently. By the way, the chart also shows that the real bond yields have been gradually declining in 2019 untilSeptember, which boosted the gold prices.

Butwhy is the fall of real interest rates into negative territory so important?Well, more generally, everything thatrelates to the real interest rates should be of great interest to preciousmetals investors. This is because of the very strong negative correlation between the real interest rates and gold. It meansthat the gold prices tend to move in the opposite direction to real interestrates, as it is illustrated by the chart below.

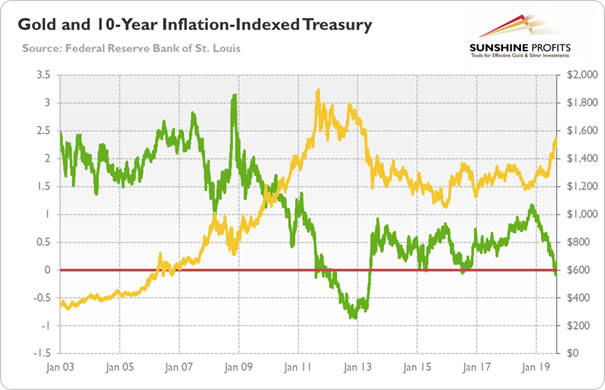

Chart 2: Gold prices (yellow line, right axis,London P.M. Fix, in $) and yields on the US 10-Year Inflation-Indexed Treasury(green line, left axis, in %) from January 2003 to September 2019

Morespecifically, the previous two timeswhen the 10-year TIPS yield went negative, the price of the yellow metal peaked.Just take one more look at the chart above. Last time when the real interestrates proxy went negative was in July 2016, which coincided with a medium-termpeak in the gold prices. This is because the TIPS bottomed and reversed theirtrend soon after they dipped into negative territory. As real interest ratesrallied, the yellow metal struggled.

Thesecond case of the TIPS going negative occurred in August 2011, which coincided with a historical peak ingold prices. Interestingly, the real interest rate continued to trenddownward for several months after the gold price peaked. It indicates thateither other (perhaps technical) factors prevented the yellow metal from rallyingfurther or that the following slide in the real interest rates was alreadyfactored into the gold prices.

TIPS are a great proxy for real interest rates.However, the data series dates back onlyto 2003. This is why we constructed another proxy, simply by subtractingthe annual percentage change in the CPI from the 10-year Treasury yields. We display it, together with the gold prices,on the chart below.

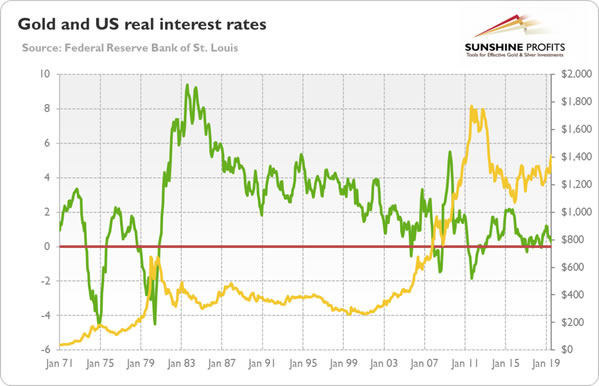

Chart 3: Gold prices (yellow line, right axis,London P.M. Fix, in $) and the difference between the US 10-Year Treasuryyields and CPI annual percentage change (green line, left axis, in %) fromJanuary 1971 to July 2019

Asone can see, there were two additional periods of negative real long-terminterest rates: in 1973-1975 and in 1978-1980. In both cases, the bottoms inreal interest rates were caused by high inflation and coincidedwith peaks in gold prices.

Whatdoes it all mean for the future real interest rates path and the gold market?Well, either the real interest rates will rebound, forcing correction in thegold market, or they will continue its downward trend for a while. Given therecent cuts in the federal funds rate and the expected further cuts – perhaps until the yield curve reinverts itself – the latter scenario seems to bemore probable.

However, the more dovish central banks and the lower real interest rates could already be priced in thegold market. As it happenedin 2011, this is the risk we see currently. Indeed, the sentiment towards goldis very positive right now, as the total speculative net-long position in Comex is very high, which strengthens the view thatwe could see a correction.

We think that 2019 would be more positive for the yellow metal than 2018.However, that does not rule out ashort-term or medium-term correction.What is important is that the correction should not take years. In recessionary2008, the real interest rates increased due to the jump in the risk-premium,but from the end of 2008 to the end of 2012, the TIPS remained in the downwardtrend. Similarly, given that recession is expected to arrive probably nextyear, the real interest rates may find themselves in the downward trendagain. To the benefit of gold.

If you enjoyed the above analysis and would you like to knowmore about the gold ETFs and their impact on gold price, we invite you to readthe April MarketOverview report. If you're interested in the detailed price analysis andprice projections with targets, we invite you to sign up for our Gold & SilverTrading Alerts . If you're not ready to subscribe at this time, we inviteyou to sign up for our goldnewsletter and stay up-to-date with our latest free articles. It's freeand you can unsubscribe anytime.

Arkadiusz Sieron

Sunshine Profits‘ MarketOverview Editor

Disclaimer

All essays, research and information found aboverepresent analyses and opinions of Przemyslaw Radomski, CFA and SunshineProfits' associates only. As such, it may prove wrong and be a subject tochange without notice. Opinions and analyses were based on data available toauthors of respective essays at the time of writing. Although the informationprovided above is based on careful research and sources that are believed to beaccurate, Przemyslaw Radomski, CFA and his associates do not guarantee theaccuracy or thoroughness of the data or information reported. The opinionspublished above are neither an offer nor a recommendation to purchase or sell anysecurities. Mr. Radomski is not a Registered Securities Advisor. By readingPrzemyslaw Radomski's, CFA reports you fully agree that he will not be heldresponsible or liable for any decisions you make regarding any informationprovided in these reports. Investing, trading and speculation in any financialmarkets may involve high risk of loss. Przemyslaw Radomski, CFA, SunshineProfits' employees and affiliates as well as members of their families may havea short or long position in any securities, including those mentioned in any ofthe reports or essays, and may make additional purchases and/or sales of thosesecurities without notice.

Arkadiusz Sieron Archive |

© 2005-2019 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.