Gold: Intermediate Decline Looks To Be Underway

We have a clear weekly swing high.

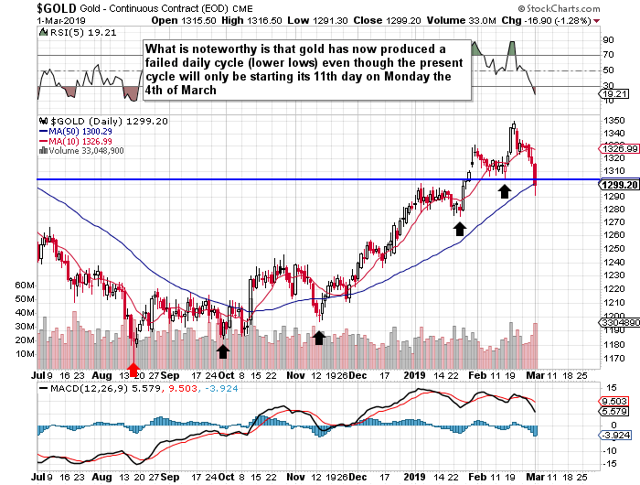

We also have a failed daily cycle.

We are heading into week 29 this week in gold's intermediate cycle.

Considering the length of the cycle (and the length of the previous one), the odds are high that an intermediate decline has begun.

In the precious metal sector, we remain long the SPDR Gold Trust ETF (GLD) and hope to add to our metals exposure at the next intermediate cycle low. We discussed in a recent article why our exposure in equities vastly outweighs the small exposure we have in precious metals. With respect to the metals, we adopt more of a swing trade strategy where we get ultra-aggressive at bottoms and slowly unwind positions as price approach tops.

In saying this, we fully intend to keep some type of long unleveraged deltas in the metals portfolio for the duration of this bull market. Gold for example looks pretty cheap from a long-term standpoint when adjusted for inflation. Yes, holding physical or investing in an ETF which tracks the spot price may not distribute any type of regular cash flow, but we still want some diversification in this area.

Gold at present is trading at $1,292 an ounce. The yellow metal topped out at over $1,350 last month, so price has dropped around $60 an ounce already. Let's have a look at the charts to see where our next buying opportunity will unfold.

As we can see from the chart above, what is noteworthy is that gold has now produced a failed daily cycle (lower lows) even though the present cycle will only be starting its 11th day on Monday the 4th of March. The red arrow above shows the last intermediate low in gold, whereas the black arrows are the daily cycle lows. The short duration of the present cycle demonstrates to me that we could be another month at least here from a firm intermediate low. Maybe price chops around for a bit or we go substantially lower. However, due to how short the current daily cycle is, we are not in the timing band for an intermediate low here just yet, so patience is required.

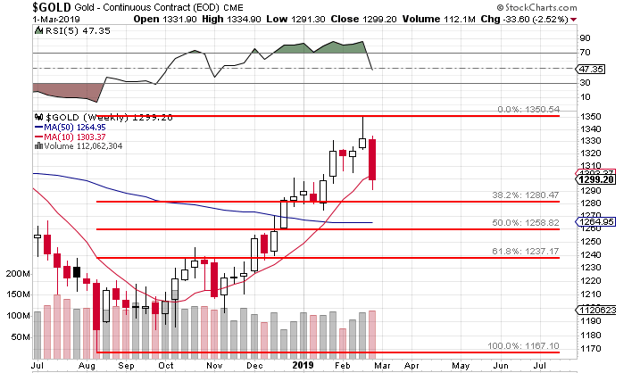

My thesis is supported on the weekly chart. Although, we are now about to start week 29 in this intermediate cycle in gold (with the cycle having topped in week 27), the slow stochastics are still way overbought for an intermediate cycle low to take place here. In fact, as we can see from the chart, we would expect the intermediate trend-line to be breached before printing the next intermediate cycle low. This means price at a minimum would have to dip below $1,250 before completing its intermediate cycle low.

This is why traders need to be prepared for at least a 61% retracement from the February top in this intermediate cycle. Considering the shallowness of that intermediate trend-line, the 62% level seems to be the most probable area for an intermediate low at this stage.

If the 62% retracement of around $1,237 was going to be the approximate level for gold's next ICL, that would be a $113 an ounce drop from the February high. Remember, ETFs such as GLD, SLV or GDX do not pay a dividend, which means one cannot average down into the funds when price is plummeting. This is the advantage of dividend growth investing in stocks. One has the opportunity to reinvest those increasing dividends which over time reduces the initial cost basis of the shares. ETFs in the precious metals space do not offer us that luxury. This is why we prefer to swing trade in this asset class and not hold indefinitely through intermediate or yearly declines for that matter.

As mentioned in previous commentary, we intend to aggressively go long either silver (due to how high the gold/silver ratio is at present) or GDX (due to how undervalued the mining complex remains from a historical standpoint) at the next intermediate cycle low. Again it will be a swing trade which we will look to take the majority of it off at the next intermediate top. Patience though is required at present until we let this decline play itself out.

-----------------------------------

Get access to our portfolio here

-----------------------------------

Disclosure: I am/we are long GLD. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Follow Individual Trader and get email alerts