Gold Is Below $1,700 Again. Will It Repeat Its Fall to $1400? / Commodities / Gold and Silver 2022

The current situation of gold and itsbehavior in 2013 share many bearish analogies. Is the yellow metal only halfwaythrough its massive collapse?

ADecade Ago

After we posted last week’s goldprice forecast, gold, silver, and mining stocks declined in tunewith the analysis. Is the rally over?

Let’s start by taking a closer look atgold.

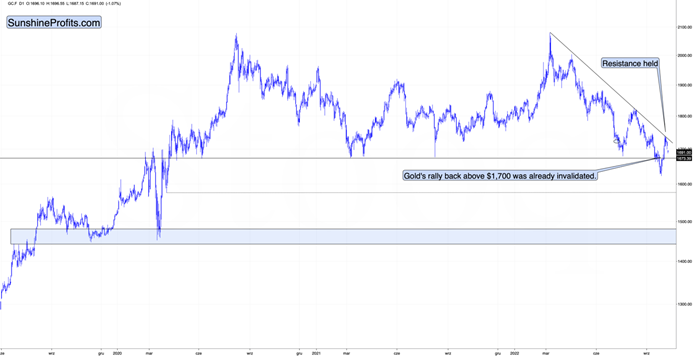

Gold declined after touching itsdeclining, medium-term resistance line, and at the moment of writing thesewords it’s trading at about $1,690 – visibly below the important $1,700 level.

This means that the attempt to breakabove this level failed.

It’sbearish on its own, but it’s much more so when you compare the currentsituation to what happened in April 2013 at the analogous moment.

I’ve been writing about this importantanalogy for months,but if you haven’t read my previous analyses, please focus on the orangerectangles on the above chart – how the price behaved and what happened in theRSI and MACD indicators. The situations are near-perfectly aligned.

If you were monitoring the gold marketback in April 2013, you might remember the overall feeling among gold investorsand traders when gold rallied from the 2012 lows. Practically everyone andtheir brother were convinced that the bottom in gold is really in, and that itwas about to soar to new highs.

Sort of like what we experiencedrecently.

Whereis the Line?

However, it wasn’t the bottom. It wasn’t even the mid-point of the entiremedium-term decline.

Sure, history doesn’t have to repeatitself to the letter, and the geopolitical and monetary situation now isdifferent than it was back in 2013, but… Fear and greed work in the same way,and when people try toforecast the future by looking at previous price patterns (very fewpeople look at the big picture; most just focus on the last year or so), theyultimately follow a similar emotional process. This leads them to repeat theirpast behaviors and, as a result, the price patterns continue to be similar.

Actually, the situation regardingmonetary policy now supports even a more profound slide than it did back in2013. Still, due to geopolitics,the decline could be “only” similar to what we saw back then.

There’s very strong support just a bitbelow $1,400, and the decline to this level (approximately) would be in tunewith the size of the 2011-2013 decline.

Cangold really slide that low? Absolutely.

Will it slide there immediately? There’sa good chance we’ll have some sort of correction in the meantime, and one ofthem might be tradable. The rebound from the 2020 lows seems quite likely atthe moment, but I’ll keep monitoring the situation and report to my subscribersaccordingly. I’ll also describe which part of the precious metals sector islikely to benefit the most from this decline. At this time, it seems thatjunior mining stocks are likely to decline the most (as they have so far thisyear), but this might change as prices move lower.

Either way, the short- and medium-termoutlooks for gold are bearish.

Thank you for reading our free analysistoday. Please note that the above is just a small fraction of today’sall-encompassing Gold & Silver Trading Alert. The latter includes multiplepremium details such as the target for gold that could be reached in the nextfew weeks. If you’d like to read those premium details, we have good news foryou. As soon as you sign up for our free gold newsletter, you’ll get a free7-day no-obligation trial access to our premium Gold & Silver TradingAlerts. It’s really free – sign up today.

Przemyslaw Radomski, CFA

Founder, Editor-in-chief

Toolsfor Effective Gold & Silver Investments - SunshineProfits.com

Tools für EffektivesGold- und Silber-Investment - SunshineProfits.DE

* * * * *

About Sunshine Profits

SunshineProfits enables anyone to forecast market changes with a level of accuracy thatwas once only available to closed-door institutions. It provides free trialaccess to its best investment tools (including lists of best gold stocks and best silver stocks),proprietary gold & silver indicators, buy & sell signals, weekly newsletter, and more. Seeing is believing.

Disclaimer

All essays, research and information found aboverepresent analyses and opinions of Przemyslaw Radomski, CFA and SunshineProfits' associates only. As such, it may prove wrong and be a subject tochange without notice. Opinions and analyses were based on data available toauthors of respective essays at the time of writing. Although the informationprovided above is based on careful research and sources that are believed to beaccurate, Przemyslaw Radomski, CFA and his associates do not guarantee theaccuracy or thoroughness of the data or information reported. The opinionspublished above are neither an offer nor a recommendation to purchase or sell anysecurities. Mr. Radomski is not a Registered Securities Advisor. By readingPrzemyslaw Radomski's, CFA reports you fully agree that he will not be heldresponsible or liable for any decisions you make regarding any informationprovided in these reports. Investing, trading and speculation in any financialmarkets may involve high risk of loss. Przemyslaw Radomski, CFA, SunshineProfits' employees and affiliates as well as members of their families may havea short or long position in any securities, including those mentioned in any ofthe reports or essays, and may make additional purchases and/or sales of thosesecurities without notice.

Przemyslaw Radomski Archive |

© 2005-2019 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.