Gold is on the Verge of a Bull-run and Here's Why / Commodities / Gold & Silver 2019

The majority of gold traders are very bearishon the gold market currently. The sentiment could signal a start of a possiblejump in price for the precious metal.

The majority of gold traders are very bearishon the gold market currently. The sentiment could signal a start of a possiblejump in price for the precious metal.

If you are also expecting such a price shift,you might want to consider buying the SPDR Gold Shares ( a fund holding bullionbars).

This year, the price of gold dropped due tothe rising dollar. The evaluation of the yellow metal tends to act inverselywith the dollar value. You can check today's live gold rateson business24-7.ae

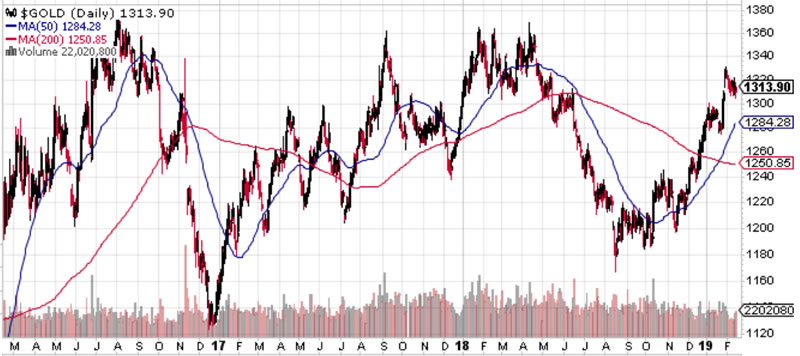

One troy ounce of gold bullion currently costs$1,197 which is 13% less than it was at the start of the year, according toBloomberg data.

The majority of futures market traders arecounting on a decrease in the gold price.

The amount of such speculations is quiteextreme. There are many speculators who believe that the price will decrease.The amount of bets on a decrease now stands at more than two standarddeviations from the average. The data comes from the Macro Risk Advisorscompany, which is based in New York. Such amount of bets is therefore ratherunusual.

It makes sense that traders behave this way,as betting on a decrease turned out to be profitable since January this year.If you follow the basic science of investing, you will do what is profitableuntil it is not anymore.

Another thing we are aware of, is that whentraders become very bullish or bearish, the price will most likely move intothe opposite direction. To say it differently, the future market speculation atthe extreme is often considered to be a contrary indicator of the pricemovement.

By this logic, the historically high number ofshort positions indicates that the gold price is going to increase, moving intothe opposite direction of the future market predictions.

We can't say for sure when it will happen andfor how much the price will increase. What we do know, is that the evaluationof the U.S. dollar plays a significant role to what happens on the gold market.

If the dollar value drops, we expect to see ajump in gold prices. Even a small move could trigger the domino effect as traders,who are counting on a continued drop of gold prices react and reverse theirpositions. That means they would buy back the future contracts they soldbeforehand. That would mean a quick and sharp upswing on the markets. This isknown as a shot-covering rally.

The possibility of such rally is here, howevernothing is completely certain, especially on the speculation markets. We alsocan't predict if such a move would be a short term swing or a long lastingchange on the markets.

What you should look for right now is the nextmovement of the U.S dollar value. If it drops, the gold markets will mostlikely rally. If it moves the opposite direction, we could see another drop ingold prices.

By Umer Mahmood

© 2019 Copyright Umer Mahmood - All Rights Reserved Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

© 2005-2019 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.