Gold Is Still A Bargain

Despite the recent rally, gold still offers value to investors.

Gold is undervalued compared to stocks and U.S. government bonds.

Mining stock demand is also still strong, which bodes well for the metal.

After the 10% gold price increase last month, some would-be buyers have concluded that gold has reached its upside potential and is due for a major pullback. Under normal circumstances, this would be a reasonable assumption. But as the events of recent weeks have shown, these aren't normal times. In today's report, we'll look at ways in which gold can still be considered a bargain even at current elevated prices. We'll also examine the condition of the actively traded gold mining shares as I make the case that mining stock strength is also supportive of buoyant gold prices.

After hitting an intraday peak at around the $1,440 level in late June, gold has spent the last two weeks in consolidation, as per my expectation. Since late June, I've made the case that it would likely spend a few weeks in a lateral or sideways consolidation range, before eventually resuming its upward trend later this summer. The reasoning behind this assumption is that the gold price simply rose too far, too fast for the May-June rally to be sustainable into July. But while the gold market may still be regarded as somewhat "overheated" on a short-term basis, the yellow metal is by no means overvalued. By some measures, gold can actually be regarded as offering value despite current market prices.

In order to determine whether or not gold offers value, we must compare its price with that of other popular financial assets. When we do this, we find that one significant way in which gold still offers value is in its relationship versus equities. Shown here is a ratio comparison of the gold price with the benchmark S&P 500 Index (SPX). This chart shows that while the gold price is currently near a 2-year high, the gold:SPX ratio is still considerably below its nearest major peak from two years ago. This tells us that gold is still relatively undervalued compared with large-cap stocks.

(Source: StockCharts)

Another way in which gold can be regarded as undervalued is in comparison with U.S. Treasury bonds. Below is a ratio comparison of the gold price with the iShares 10-20 Year Treasury Bond ETF (TLH), which can be used as a proxy for the 10-year Treasury bond price trend. Right now, the bond market is red-hot as investors around the globe are pouring money into Treasuries in search of safety. The safe haven value of U.S. sovereign debt is unquestionable in times of geopolitical turmoil, so from that perspective it's not unusual that T-bonds are outperforming gold. However, the following relative strength chart shows that gold still has plenty of room to rise before it becomes richly valued compared with its nearest safe haven competitor.

(Source: StockCharts)

About the only way gold could be considered overvalued is by comparing its current price with that of silver. Indeed, a relative strength comparison between the two metals shows silver to be vastly undervalued vis-? -vis gold. This will bode well for the white metal once gold's latest consolidation phase has ended and its march toward an all-time intraday high price of $1,923 has resumed.

(Source: StockCharts)

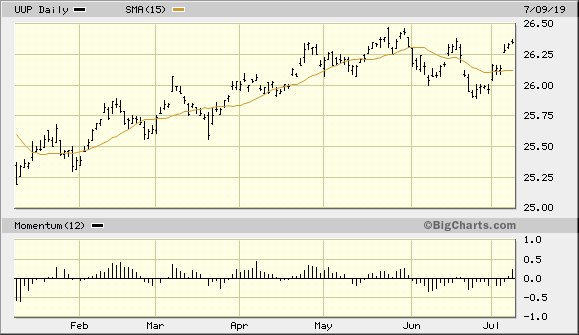

One of the biggest factors holding gold back from continuing its recovery now is the recent strength in the U.S. dollar index. The dollar index rally which began in late June is the primary reason for gold being stuck in a lateral trading range right now. Shown below is the Invesco DB USD Bullish ETF (UUP), which closely tracks the dollar's progress. As you can see here, the fund is near its high for the year.

(Source: BigCharts)

Yet, the dollar's latest rise isn't backed by forward momentum or even by relentless demand among foreign investors who are liquidating financial assets and exchanging them for dollars. The global stock market in May was what gave the dollar most of its upward impetus, but the dollar's latest rally is arguably due to investors' expectations of a Federal Reserve interest rate cut later this month. Lower rates tend to be beneficial for non-yielding gold, which partly explains why gold is able to remain buoyant despite the strengthening dollar.

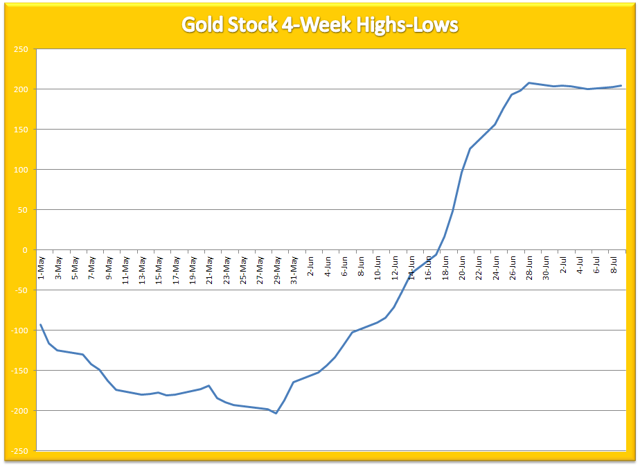

Turning our attention to the gold mining stocks, the demand for mining shares remains high despite the "pause that refreshes" in the gold price. My favorite measure of gold stock demand is the new highs and lows for the 50 most actively traded gold producers. Shown below is the 4-week rate of change (momentum) indicator for the gold stock's new highs and lows. As long as this indicator is in a rising trend, investors are justified in holding onto their gold stocks. I wouldn't be a buyer at these levels, but neither does the market's internal profile justify selling. A "Hold" posture is still warranted for the gold stock bulls, however.

(Source: NYSE)

The residual strength which this indicator reflects for the gold mining shares is also another reason why gold should remain buoyant this month. Although there could be a further dip in gold prices before the lower end of its lateral range is established, the ongoing demand for the companies which produce gold is a harbinger of strength for the physical metal. Historically, gold stock prices tend to lead bullion prices at critical junctures, and if investors foresee difficulties ahead for gold, they'll usually respond by dumping gold stocks first.

In conclusion, the gold market is recovering from its overheated technical condition in June and will likely continue consolidating its recent gains in a lateral range in the coming days, while remaining above its 50-day moving average. Silver, which is undervalued versus gold, should also benefit from the temporary pause in the trend. What's more, gold stock internal momentum remains bullish, and this also bodes well for the gold outlook. Investors are, therefore, justified in maintaining a bullish intermediate-term (3-6 month) bias toward gold mining shares, as well as toward physical gold and silver.

On a strategic note, I'm currently long gold via the VanEck Vectors Gold Miners ETF (GDX). For this ETF, I'm using the $24.00 level as a stop-loss on an intraday basis. Participants should also book some profit in GDX after its impressive run in the last few weeks. Investors can also maintain longer-term investment positions in gold and gold ETFs, as mentioned in previous commentaries.

Disclosure: I am/we are long GDX. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Follow Clif Droke and get email alerts