Gold Is the Belle of the Ball. Will Its Dance Turn Bearish? / Commodities / Gold and Silver 2022

The precious metals still dopirouettes on the trading floor, but they can stumble in their choreography.The bears are just waiting for it.

With the GDX ETF soaring on significantvolume on Jan. 19, the senior miners had a renewed pep in their step. Withgold, silver, and mining stocks all dancing to the same beat, the preciousmetals garnered all of the bullish attention. However, with the trio known tocut their performances short as soon as investors arrive, will the mood musicremain so sanguine?

Well, for one, the GDX ETF has a historyof peaking when the crowd enters the party. For example, I marked with the bluevertical dashed lines and blue arrows below how large daily spikes in volumeoften coincide with short-term peaks. Moreover, with another ominous eventunfolding on Jan. 19, historical data implies that we’re much closer to the topthan the bottom.

To explain, I wrote on Jan. 20:

Fromthe technical point of view, we just saw another daysimilar to the other days that I marked with vertical dashed lines and blackarrows. Those days were either right at the tops or not far from them. As muchas yesterday’s (7%!) rally looks bullish, taking a look at the situation from abroad perspective provides us with the opposite – bearish – implications.

Thezig-zag scenario is being realized as well. The GDX ETF moved to the upperborder of the rising trend channel. Also, doesn’t it remind you of something?Hint: it happened at a similar time of the year.

Yes,the current price/volume action is similar to what we saw in early 2021. TheRSI was above 60, a short-term rally that was preceded by a bigger decline, anda strong daily rally on huge volume at the end of the correctiverally. We’ve seen it allnow, and we saw it in early 2021.

Please see below:

What’s more, the senior miners’ fatigueis already present. For example, the GDX ETF declined by 1.40% on Jan. 20, andthe index ended the session only $0.30 above its 2021 close. Likewise, thesenior miners failed to rally above the upper trendline of their ascendingchannel (drawn with the blue lines above). As a result, the price actionresembles an ABC zigzag pattern, and while the short-term outlook is lesscertain, the medium-term outlook is profoundly bearish.

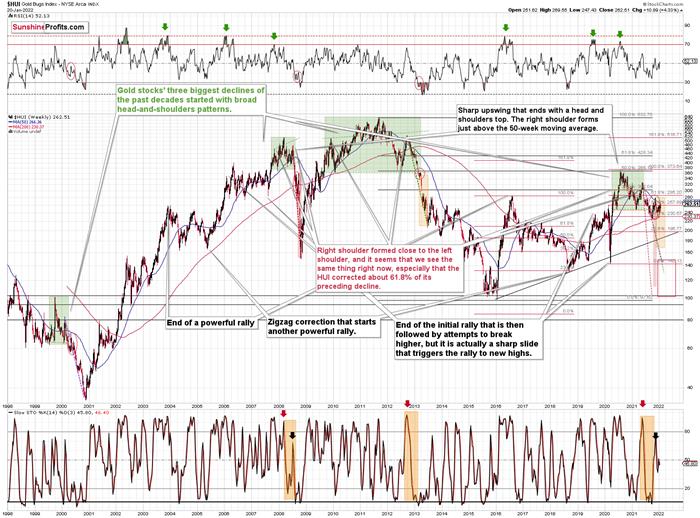

As further evidence, the HUIIndex’s weekly chart provides some important clues. For example,despite the profound rally on Jan. 19, the index’s stochastic indicator stillhasn’t recorded a buy signal. Moreover, the HUI Index dropped after reachingits 50-week moving average, and the ominous rejection mirrors 2013. Back then,the index approached its 50-week moving average, then suffered a pullback, andthen suffered a monumental decline. As a result, is this time really different?Remember – history tends to rhyme, and this time the analogies from the past favora bearish forecastfor gold stocks.

Turning to the GDXJ ETF, the juniorminers were off to the races on Jan. 19. However, the size of therally is actually smaller than what we witnessed in early 2021. Moreover, whenthe short-term sugar high ended back then, optimism turned to pessimism and theGDXJ ETF sank to new lows. Thus, with the junior miners’ 2021 story one oflower highs and lower lows, 2022 will likely result in more of the same.

Please see below:

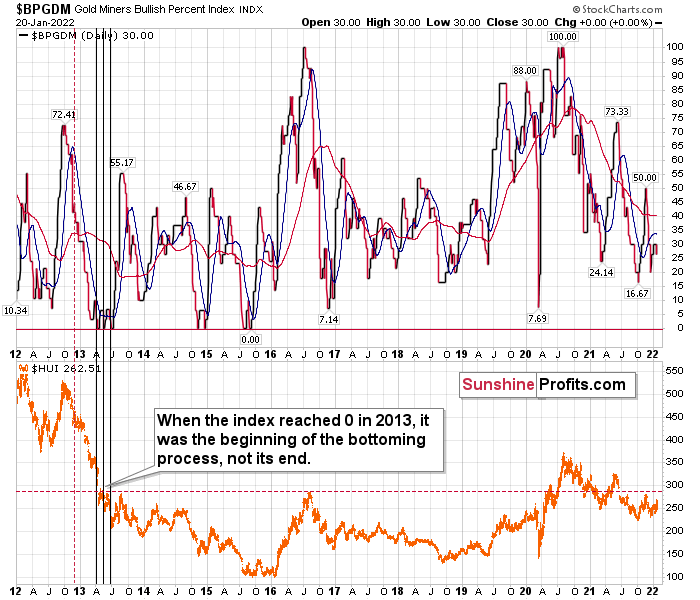

Finally, the GoldMiners Bullish Percent Index ($BPGDM) isn’t at levels that trigger a major reversal. The Index is now at30. However, far from a medium-term bottom, the latest reading is still morethan 20 points above the 2016 and 2020 lows.

Likewise, when the BPGDM hit 30 in 2013, the HUI Index was already in the midstof its medium-term downtrend (similar to what we witnessed in 2021). However,the milestone was far from the final low. With material weakness persistingand a lasting bottom not forming until the end of 2015/early 2016, furtherdownside for gold (and silver)likely lies ahead.

For context, it’s my belief that theprecious metals will bottom when the BPGDM hits zero – and perhaps when itremains there for some time.

In conclusion, gold, silver, and miningstocks put on quite a show on Jan. 19. However, with their bullish rhythm knownto turn bearish in an instant, investors should proceed with caution. Moreover,the data shows that when investors rush to buy the precious metals, theirover-enthusiasm results in medium-term weakness, not strength. As a result, thetrio’s declines likely have more room to run before long-term buyingopportunities emerge later in 2022.

Thank you for reading our free analysistoday. Please note that the above is just a small fraction of today’sall-encompassing Gold & Silver Trading Alert. The latter includes multiplepremium details such as the targets for gold and mining stocks that could be reached in the next few weeks. If you’dlike to read those premium details, we have good news for you. As soon as yousign up for our free gold newsletter, you’ll get a free 7-day no-obligationtrial access to our premium Gold & Silver Trading Alerts. It’s really free– sign up today.

Thank you.

Przemyslaw Radomski, CFA

Founder, Editor-in-chief

Toolsfor Effective Gold & Silver Investments - SunshineProfits.com

Tools für EffektivesGold- und Silber-Investment - SunshineProfits.DE

* * * * *

About Sunshine Profits

SunshineProfits enables anyone to forecast market changes with a level of accuracy thatwas once only available to closed-door institutions. It provides free trialaccess to its best investment tools (including lists of best gold stocks and best silver stocks),proprietary gold & silver indicators, buy & sell signals, weekly newsletter, and more. Seeing is believing.

Disclaimer

All essays, research and information found aboverepresent analyses and opinions of Przemyslaw Radomski, CFA and SunshineProfits' associates only. As such, it may prove wrong and be a subject tochange without notice. Opinions and analyses were based on data available toauthors of respective essays at the time of writing. Although the informationprovided above is based on careful research and sources that are believed to beaccurate, Przemyslaw Radomski, CFA and his associates do not guarantee theaccuracy or thoroughness of the data or information reported. The opinionspublished above are neither an offer nor a recommendation to purchase or sell anysecurities. Mr. Radomski is not a Registered Securities Advisor. By readingPrzemyslaw Radomski's, CFA reports you fully agree that he will not be heldresponsible or liable for any decisions you make regarding any informationprovided in these reports. Investing, trading and speculation in any financialmarkets may involve high risk of loss. Przemyslaw Radomski, CFA, SunshineProfits' employees and affiliates as well as members of their families may havea short or long position in any securities, including those mentioned in any ofthe reports or essays, and may make additional purchases and/or sales of thosesecurities without notice.

Przemyslaw Radomski Archive |

© 2005-2019 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.