Gold Isn't Sweating The Interest Rate Outlook

Gold no longer fears competition from higher interest rates.

Central banks are putting rate hikes on hold, which benefits gold.

Gold's all-important currency component is still beneficial for the bulls.

As Wall Street anxiously awaits the Federal Reserve's interest rate policy decision on Wednesday, the gold market remains unconcerned. Instead, it's confirming that the intermediate-term outlook for the yellow metal remains strong. As we'll review in today's report, the gold price is being supported by continued fears of a global slowdown as well as weakness in the U.S. dollar. We'll also look at how the interest rate outlook is no longer a major threat to gold's ongoing recovery.

With the U.S. federal government shutdown now over, traders returned to the markets on Monday with one less uncertainty standing in the way. While this can be construed as a positive for the broad stock market, some investors might regard the government's re-opening as being bearish for the gold outlook. Specifically, the end of the shutdown is being viewed by some participants as an erosion of gold's "fear factor." Along with the decline in equity market volatility, they view this as one less psychological support for gold's 5-month recovery.

The fading of investors' fears over the stock market and U.S. political outlooks aren't necessarily bearish for gold. As I've argued in recent reports, gold's currency component is a far more important factor for the integrity of its upward trend than the presence of fear. With that in mind, let's take a look at the dollar in which gold is priced to see if gold's currency component is still strong.

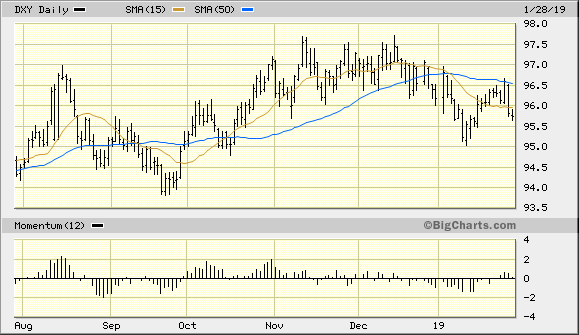

Source: BigCharts

Show above is the U.S. dollar index (DXY) relative to its 15-day and 50-day moving averages. As you can see here, DXY failed in its most recent attempt at overcoming its widely watched, psychologically significant 50-day moving average (blue line). This confirmed from a technical standpoint that the dollar's interim trend is still weak. Historically, whenever the dollar index has trended above its 50-day MA there have been significant currency-related headwinds for the gold price. When the dollar is below this trend line, however, is when gold has typically made its most impressive strides.

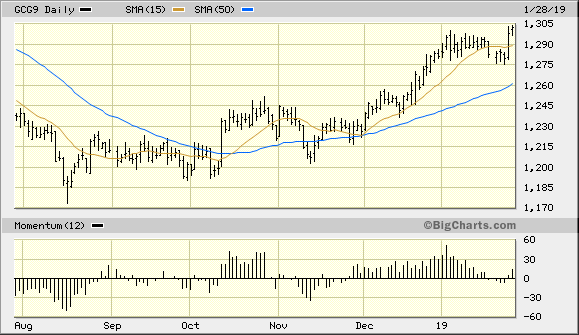

The fact that the dollar index is below both its 15-day moving average and 50-day MAs is telling me that the immediate-term (1-4 week) and intermediate-term (3-9 month) trends are still in gold's favor. This is confirmed by the recent breakout to new multi-month highs in the February gold futures price show below. With the gold price continuing to make higher highs and lows, the intermediate-term trend is still clearly in favor of the bulls.

Source: BigCharts

Another sign that gold remains unconcerned by the seeming loss of the fear factor is the likelihood that it won't have to compete with higher interest rates for investors' attention anytime soon. Not only is the Federal Reserve expected to leave its benchmark interest rate unchanged at its Jan. 29-30 policy meeting, but so too is ECB President Mario Draghi. Last week, Draghi recently warned that a drop in the euro zone's economy could be worse than expected and would warrant holding off on raising interest rates. Even China's central bank is keeping its interest rates on hold in an effort to stimulate its economy. This amounts to a coordinated global interest rate policy and is favorable for the gold price outlook since the metal doesn't like rising rates.

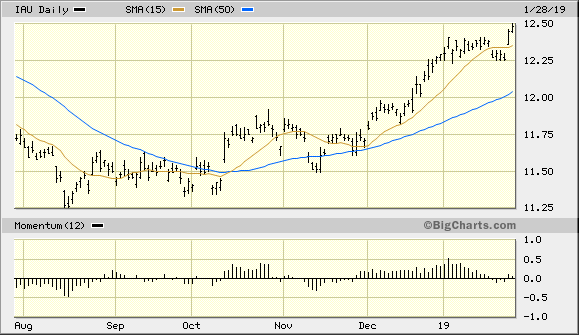

Turning our attention to the iShares Gold Trust (IAU), the ETF is benefitting from the recent weakness in the dollar, along with the anticipated hold on interest rate hikes mentioned above. IAU remains above its rising 15-day moving average, which technically confirms that its immediate-term trend is still up. Last week I emphasized that as long as the $12.25 level for IAU remains unbroken, the immediate trend for the gold ETF will likely remain intact. IAU should also benefit in the weeks and months to come from the increasing demand for gold-backed funds as discussed in recent reports.

Source: BigCharts

In the final analysis, gold still has plenty of support even as fears fade about the likelihood of increased global financial market volatility. Moreover, the gold price is showing renewed strength in the wake of the dollar's latest decline. investors are justified in remaining bullish and assuming that gold's intermediate-term recovery will continue.

On a strategic note, we are still long the iShares Gold Trust after recently taking some profit. I also recently recommended raising the stop loss for the remainder of this trading position to slightly under the $12.25 level on an intraday basis. A violation of $12.25 in the IAU would signal a decisive shift in the gold ETF's immediate-term trend.

Disclosure: I am/we are long IAU. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Follow Clif Droke and get email alerts