Gold Joins the Decline - the Earth is Shaking / Commodities / Gold and Silver 2018

Gold, silver and miningstocks declined in a quite visible way yesterday, which is in tune with ourprevious expectations. In the previous days it was only silver and miners thatdeclined in a meaningful manner, but yesterday gold joined them, making this asector-wide decline. Is this the groundbreaking decline that we have been writing about for so long? Time willtell, but the earth is already shaking.

Precious Metals’ Decline

Gold declined on a significantvolume and closed yesterday’ session below the 50-day moving average. The Stochastic indicator flashed a sellsignal. We previously saw something similar earlier this month, which wasfollowed by a short-term decline. This is a short-term sell signal also thistime, but…

It really doesn’tmatter. What matters is the combination of the powerfullong-term signals that have been in place for a long time and that have been pointing to much lower goldprices. It’s not a $10 decline in gold that is important here. It’s the $150slide that’s likely to follow shortly… And that will likely be followed by evenlower prices (to about $890) after a temporary corrective upswing.

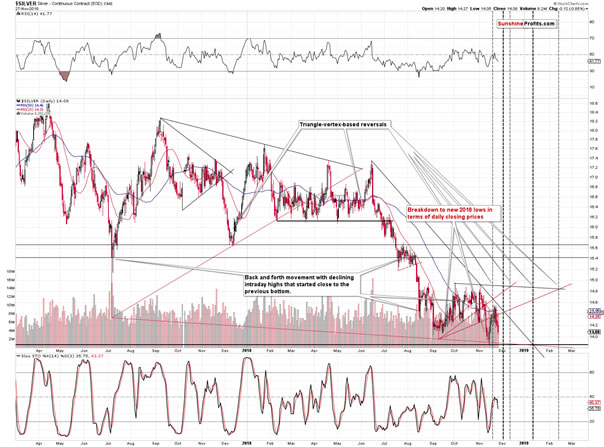

Silver moved lower onceagain after topping out practically exactly as the triangle-vertex-basedreversal had suggested and as we had described it earlier. Silver invalidatedthe previous breakdown below the $14 level, but will it manage to invalidatethe upcoming breakdown as well? It may not be strong enough to do so, since itdidn’t even manage to get back to its previous high earlier this month.

Miners’ Breakdown

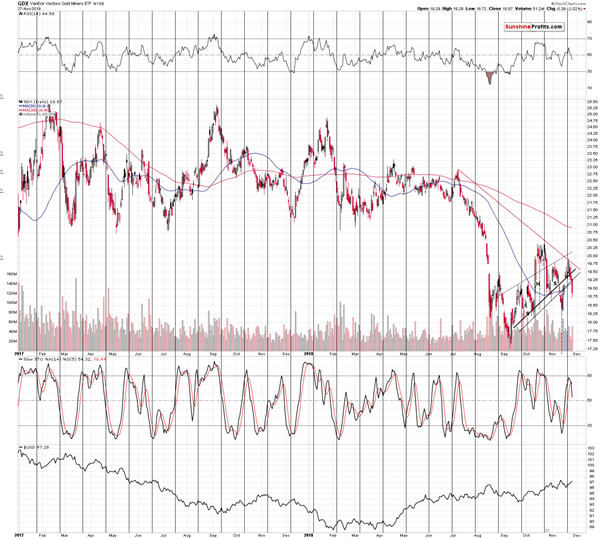

The gold and silvermining stocks declined on strongvolume and once again closed the session below the rising neck levels of thebearish head-and-shoulders pattern. The current pattern is a bit different thanwhat we usually see as a head and shoulders pattern. It usually has one head andtwo shoulders. In this case, we have a pattern that had two left shoulders andtwo right shoulders. It seems odd, but it’s within the definition of what couldbe viewed as the H&S pattern. The implications are just as bearish as theywould be if the pattern had a regular shape.

But, to be 100%objective, this pattern is not fully completed. The two neck lines that we haveon the above chart are not the only way that such line can be created. Anotherway would be to create it based on the mid-October and mid-November bottoms.Such line would have not been reached, let alone broken. The decline is stilllikely based on multiple other reasons, but let’s keep in mind that the finalbearish confirmation will be when the GDX ETF confirms the breakdown below approximately$18.30 – the above-mentioned hypothetical neck level.

This breakdown is likelyto happen shortly and lead to a move to new 2018 lows. Confirmed breakdown below the September bottom will open the way tomuch lower mining stock prices and volatile declines.

The Direct Trigger

The ultimate directtrigger for the huge decline in the precious metals market will likely comefrom the breakout above the neck level of the inverse head-and-shoulderspattern in the USD index. This will only be a “direct” reason, because thereare many other technical reasons for the big slide in the PMs that we outlinedin ourprevious analyses, and because theforemost reason for the entire decline is that gold and silver simply haven’tfallen enough in 2015. Back in 2015, the sentiment wasn’t bad enough to confirmthe final bottom and thus lower prices were likely to be seen eventually evendespite the early 2016 rally.

The USD Index is not yetabove the upper neckline that’s based on the intraday highs and once it getsthere it will be very close to the 61.8% Fibonacci retracement (approximately97.8) based on the entire 2017 – 2018 decline. Consequently, we may see a pauseclose to this level, but once the above is taken out and the USD confirms a breakoutabove 98, the following rally would likely be big and sharp. The corresponding decline in the PMs islikely to be big and sharp as well.

Summing up, the outlookfor the precious metals market remains very bearish for the following weeks andmonths and short position remains justified from the risk to reward pointof view, even if we see a few extra days of back and forth trading or even asmall brief upswing. It is a very high probability of a huge downswingthat makes the short position justified, not the outlook for the next few days.It seems that our big profits on this short position will become enormousin the future and that we will not have to wait much longer. Gold’s inabilityto rally on the increased geopolitical tensions regarding Ukraine confirmthis scenario. In other words, being fully in the market doesn’t seem to be agood goldinvestment idea.

Naturally,the above is up-to-date at the moment of publishing it and the situation may –and is likely to – change in the future. If you’d like to receive follow-ups tothe above analysis (including the intraday ones, when things get hot), weinvite you subscribe to our Gold &Silver Trading Alerts today.

Thank you.

Przemyslaw Radomski, CFA

Founder, Editor-in-chief

Toolsfor Effective Gold & Silver Investments - SunshineProfits.com

Tools für EffektivesGold- und Silber-Investment - SunshineProfits.DE

* * * * *

About Sunshine Profits

SunshineProfits enables anyone to forecast market changes with a level of accuracy thatwas once only available to closed-door institutions. It provides free trialaccess to its best investment tools (including lists of best gold stocks and best silver stocks),proprietary gold & silver indicators, buy & sell signals, weekly newsletter, and more. Seeing is believing.

Disclaimer

All essays, research and information found aboverepresent analyses and opinions of Przemyslaw Radomski, CFA and SunshineProfits' associates only. As such, it may prove wrong and be a subject tochange without notice. Opinions and analyses were based on data available toauthors of respective essays at the time of writing. Although the informationprovided above is based on careful research and sources that are believed to beaccurate, Przemyslaw Radomski, CFA and his associates do not guarantee theaccuracy or thoroughness of the data or information reported. The opinionspublished above are neither an offer nor a recommendation to purchase or sell anysecurities. Mr. Radomski is not a Registered Securities Advisor. By readingPrzemyslaw Radomski's, CFA reports you fully agree that he will not be heldresponsible or liable for any decisions you make regarding any informationprovided in these reports. Investing, trading and speculation in any financialmarkets may involve high risk of loss. Przemyslaw Radomski, CFA, SunshineProfits' employees and affiliates as well as members of their families may havea short or long position in any securities, including those mentioned in any ofthe reports or essays, and may make additional purchases and/or sales of thosesecurities without notice.

Przemyslaw Radomski Archive |

© 2005-2018 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.