Gold Jumps for Joy Only to Hit the Ceiling... Hard / Commodities / Gold and Silver 2021

Powell’s recent dovish remarks starteda sugar high among investors. However, it seems like the hangover has alreadybegun.

TheGold Miners

While gold, silver and mining stocksjumped for joy following Fed Chairman Jerome Powell’s dovish remarks on Jul. 28,their sugar high ended on Jul. 30. And while I warned that FOMC press conferences often elicit short-term bursts of optimism, it was likelyanother case of ‘been there, done that.’

I wrote priorto the announcement:

Whilethe PMs may record a short-term bounce – which often occurs following Powell’spressers – lower lows are still likely to materialize in the coming months.

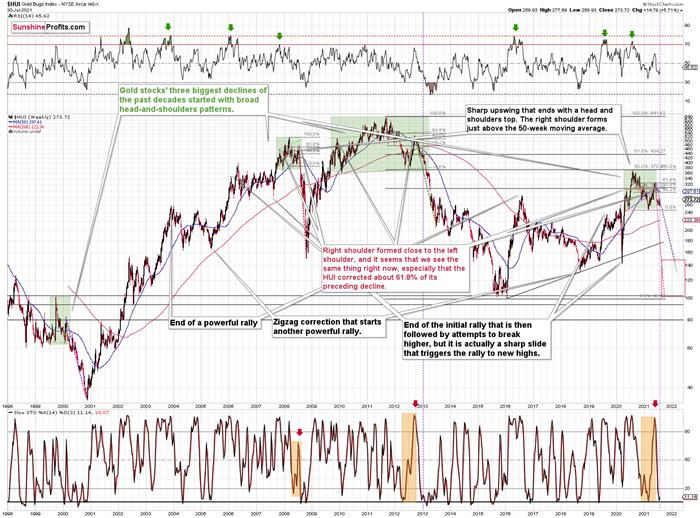

In the meantime, though, did you noticethe tiny buy signal from the HUIIndex’s stochastic indicator?And taking that into consideration, is it time to shift to the long side of thetrade? Well, for one, it seems very likely that gold miners are decliningsimilarly to how they declined in 2008 and 2012-2013. In both cases, there werelocal corrections within the decline. As a result, the recent strength does notjustify adjusting our short positions in the junior mining stocks, and Icontinue to view them as prudent from the risk to reward point of view.

Second, after the HUI Index recorded anidentical short-term buy signal in late 2012 – when the index’s stochasticindicator was already below the 20 level (around 10) and the index was in theprocess of forming the right shoulder of a huge, medium-term head-and-shoulderspattern – the HUI Index moved slightly higher, consolidated, and then fell off a cliff.

Please see below:

Can you see the HUI’s rally at the end of2012 that followed a small buy signal from the stochastic indicator? I markedit with a purple, dashed line.

No? That’s because it’s been practicallynonexistent. The HUI Index moved higher by so little that it’s impossible tosee it from the long-term point of view.

With the shape of gold’s recent priceaction, its RSI, and its MACD indicators all mirroring the bearish signals thatwe witnessed back in December 2012, the current setup signals that we’re likelyheaded for a similar swoon. Thus, with both gold and the HUI Index sounding thealarm, if the bullish momentum continues, it’s likely to be very limited interms of size and duration. Conversely, the following slide is likely to betruly profound.

For context, I warned previously that theminers’ drastic underperformance of gold was an extremely bearish sign. Iwrote the following about the week beginning on May 24:

(…) gold rallied by almost $30 ($28.60) and at the same time, the HUI – aflagship proxy for the gold stocks… Declined by 1.37. In other words, goldstocks completely ignored gold’s gains. That shows exceptional weakness on the weekly basis and is a verybearish sign for the following weeks.

Ifit wasn’t extreme enough, we saw this one more time. Precisely, something similar happened during the week beginning onJuly 6. The goldprice rallied by $27.40, and the HUI Index declined by 1.39.

Likewise, with the HUI Index’s ominoussignals still present, if history rhymes (as it tends to), medium-term supportwill likely materialize in the 100-to-150 range. For context, high-end 2020support implies a move back to 150, while low-end 2015 support implies a moveback to 100. And yes, it could really happen, even though such predictions seem unthinkable.

In addition, the drastic underperformance of the HUI Index also preceded thebloodbath in 2008. To explain, right before the huge slide in late Septemberand early October, gold was still moving to new intraday highs; the HUI Indexwas ignoring that, and then it declined despite gold’s rally. However, it wasalso the case that the general stock market suffered materially. If stocksdidn’t decline back then so profoundly, gold stocks’ underperformance relativeto gold would have likely been present but more moderate.

Nonetheless, bearish head & shoulderspatterns have often been precursors to monumental collapses. For example, whenthe HUI Index retraced a bit more than 61.8% of its downswing in 2008 and inbetween 50% and 61.8% of its downswing in 2012 before eventually rolling over,in both (2008 and 2012) cases, the finaltop – the right shoulder – formed close to the price where the left shouldertopped. And in early 2020, the left shoulder topped at 303.02. Thus, threeof the biggest declines in the goldmining stocks (I’m using the HUI Index as a proxy here) all started withbroad, multi-month head-and-shoulders patterns. And in all three cases, thesize of the declines exceeded the size of the head of the pattern.

Furthermore, when the HUI Index peaked onSep. 21, 2012, that was just the initial high in gold. At that time, theS&P 500 was moving back and forth with lower highs. And what was theeventual climax? Well, gold made a new high before peaking on Oct. 5. Inconjunction, the S&P 500 almost (!) moved to new highs, and despite bullishtailwinds from both parties, the HUI Index didn’t reach new heights. Thebottom line? The similarity to how the final counter-trend rally ended in 2012(and to a smaller extent in 2008) remains uncanny.

As a result, we’re confronted with twobearish scenarios:If things develop as they didin 2000 and 2012-2013, gold stocks are likely to bottom close to theirearly-2020 low.If things develop like in 2008(which might be the case, given the extremely high participation of theinvestment public in the stock market and other markets), gold stocks couldre-test (or break slightly below) their 2016 low.

In both cases, the forecastfor silver, gold, and mining stocks is extremely bearish for the nextseveral months.

As further evidence, let’s compare thebehavior of the GDX ETF and the GDXJ ETF. Regarding the former, the seniorminers’ (GDX) RSI rose above 50 last week. However, the milestone preceded severalcorrective tops in 2020 and 2021. Thus, last week’s Fed-induced strength hasonly broadened the right shoulder of its bearish H&S pattern, and ifcompleted, the size of the head implies a drawdown to roughly $28.

Please see below:

Meanwhile, the GDXJ ETF invalidated thebreakdown below the neckline of its bearish H&S pattern last week. However,with the milestone likely a speed bump along the junior miners’ bearishjourney, a mosaic of indications signal that their medium-term outlook remainsquite somber. For context, with the junior miners’ RSI at 48.35, severalflirtations with 50 coincided with the short-term peaks in 2021 and werefollowed by material declines. I marked these cases with red ellipses. And yes,it was also the case during the final corrective pre-slide upswing in March2020.

The bottom line?

If gold repeats its June slide, it willdecline by about $150. Taking the entire decline into account (since August 2020),for every $1 that gold fell, on average, the GDX was down by about 4 cents(3.945 cents) and GDXJ was down by about 6.5 cents (6.504 cents).

Thismeans that if gold was to fall by about $150 and miners declined just asthey did in the past year (no special out- or underperformance), they would belikely to fall by $5.92 (GDX) and $9.76 (GDXJ). This would imply price moves to$27.76 (GDX) and $35.78 (GDXJ).

In conclusion, gold, silver, and miningstocks received a helping hand from the Fed last week, as the charitablecontribution uplifted the precious metals. However, while the central bankachieved its objective and talked down the U.S. dollar, prior bouts ofshort-term optimism faded once reality reemerged. As a result, with the USDIndex now in season and the 2012 analogue looking more prescient by the day,gold, silver, and mining stocks will likely suffer profound declines in thecoming months. However, with their long-term fundamentals still extremelybullish, new highs will likely dominate the headlines in the coming years.

Thank you for reading our free analysistoday. Please note that the above is just a small fraction of today’sall-encompassing Gold & Silver Trading Alert. The latter includes multiplepremium details such as the targets for gold and mining stocks that could be reached in the next few weeks. If you’dlike to read those premium details, we have good news for you. As soon as yousign up for our free gold newsletter, you’ll get a free 7-day no-obligationtrial access to our premium Gold & Silver Trading Alerts. It’s really free– sign up today.

Thank you.

Przemyslaw Radomski, CFA

Founder, Editor-in-chief

Toolsfor Effective Gold & Silver Investments - SunshineProfits.com

Tools für EffektivesGold- und Silber-Investment - SunshineProfits.DE

* * * * *

About Sunshine Profits

SunshineProfits enables anyone to forecast market changes with a level of accuracy thatwas once only available to closed-door institutions. It provides free trialaccess to its best investment tools (including lists of best gold stocks and best silver stocks),proprietary gold & silver indicators, buy & sell signals, weekly newsletter, and more. Seeing is believing.

Disclaimer

All essays, research and information found aboverepresent analyses and opinions of Przemyslaw Radomski, CFA and SunshineProfits' associates only. As such, it may prove wrong and be a subject tochange without notice. Opinions and analyses were based on data available toauthors of respective essays at the time of writing. Although the informationprovided above is based on careful research and sources that are believed to beaccurate, Przemyslaw Radomski, CFA and his associates do not guarantee theaccuracy or thoroughness of the data or information reported. The opinionspublished above are neither an offer nor a recommendation to purchase or sell anysecurities. Mr. Radomski is not a Registered Securities Advisor. By readingPrzemyslaw Radomski's, CFA reports you fully agree that he will not be heldresponsible or liable for any decisions you make regarding any informationprovided in these reports. Investing, trading and speculation in any financialmarkets may involve high risk of loss. Przemyslaw Radomski, CFA, SunshineProfits' employees and affiliates as well as members of their families may havea short or long position in any securities, including those mentioned in any ofthe reports or essays, and may make additional purchases and/or sales of thosesecurities without notice.

Przemyslaw Radomski Archive |

© 2005-2019 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.