Gold Juniors Index: How The Barkerville Buy-Out Stacks Up Against Prior Takeovers

Barkerville Gold Mines was acquired this week for $257 million US by Osisko Gold Royalties.

The company delivered a Preliminary Economic Assessment just last month, with an after-tax NPV (5%) of $310 million.

This articles discusses how this acquisition stacks up against other takeovers over the past five years.

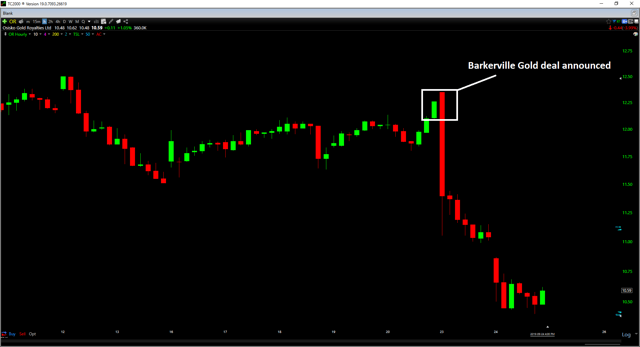

Barkerville Gold Mines (OTCPK:BGMZF) was acquired this week by Osisko Gold Royalties (OR), in the second acquisition of this new bull market, and the third acquisition this year. The prior two buy-outs in the gold space were Atlantic Gold (OTCPK:SPVEF) by St. Barbara Mines in May, and N-Mining by Kinross Gold (KGC). Despite a much higher gold (GLD) price, Barkerville Gold Mines was acquired for below the average enterprise value per ounce of acquisitions the past four years. This suggests that while gold producers (GDX) are getting higher premiums in acquisitions with a higher gold price, we have not seen this translate to gold juniors (GDXJ) yet. Based on the most recent two takeovers, there is no reason for investors to expect acquisitions to occur above the $100/oz level in the junior sector.

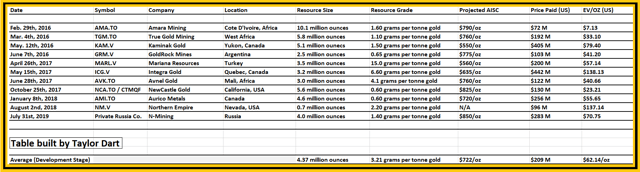

Over the past couple of weeks, there's been lots of commentary on what suitors will pay for gold juniors in a takeover scenario. This has stemmed from the recent discovery by Great Bear Resources (OTCPK:GTBDF), and many commenters on different stock boards have discussed how ounces in the ground are worth over $200/oz US. This $200/oz figure is what has led some to assign $20.00 price targets on Great Bear Resources, triple its current share price. Based on my research of all takeovers in the past four years, the real figure is significantly lower and sat at $62/oz on an enterprise value per ounce basis as of last week. Interestingly, the most recent Barkerville acquisition at the highest gold prices of the past four years has occurred at the lower end of this average. Osisko Gold Royalties' acquisition of Barkerville Gold Mines at a valuation of $61~/oz is 2% below the current average of $62.14/oz, despite Barkerville Gold being in a premier jurisdiction; British Columbia, Canada. This suggests that the recent rise in the gold price has not yet translated to higher premiums for gold juniors. We can take a closer look at the table below:

As we can see from the above table, we have seen 11 gold juniors acquired in the past four years in their development stage. Producing assets like Newmarket Gold, Atlantic Gold (OTCPK:SPVEF), Richmont Mines and Lakeshore Gold have not been included in the above table, as their takeover prices skew the averages significantly. The reason for this deviation between developers and producers is that suitors are willing to pay substantially more for producers than they are for development stage juniors. This is because not only is there significantly less capital expenditures required when acquiring a producing asset, but the asset is significantly de-risked. It is much less risky for a suitor to buy when they've had a good look at how the mine is running vs. the mine plan.

If we look at the above table of gold juniors, we can see that the majority of juniors acquired had a total resource of 4.3 million ounces on average, with median grades above 3.0 grams per tonne gold. Barkerville Gold Mines fit right into these averages from a resource standpoint, with 4.2 million ounces of gold at the time of its acquisition. From a grade standpoint, the company was 50% higher than the 3.2 gram per tonne gold average of past takeovers, as Barkerville's grades are 5.4 grams per tonne gold. Despite Barkerville being in a tier-1 jurisdiction, having a resource in line with the average and higher grades, it was taken out at the low end of the average over the past four years. This has put a minor dent in the trend of the enterprise value per ounce for takeovers over the past four years that I continually monitor. The idea behind watching this is to get a feel for what suitors are paying for development stage juniors, and if recent acquisitions are above or below the mean. By doing this, it becomes straightforward to see which juniors are undervalued and overvalued based on their current resources.

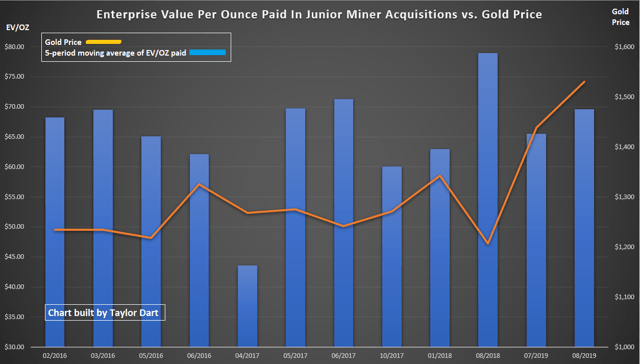

Looking at the above chart I've built, the 5-period moving average enterprise value/ounce paid for juniors has remained relatively stagnant since 2016. This has occurred even though the price of gold has trended higher (gold line) during the same period. We would assume that this moving average would trend higher over time to reflect the 25% higher gold price, but this is not the case. Meanwhile, with the producers that have been bought out, this is the case. Atlantic Gold's buy-out at an enterprise value per ounce of $239.13 US marked the highest price paid in the past four years, above the prior high set in the buy-out of Newmarket Gold by Kirkland Lake Gold (KL). This acquisition was completed at $162.62/oz.

Basically, what the above chart is suggesting is that there is no reason to expect juniors to fetch a higher premium due to a higher gold price. Common sense would suggest this is the case, but the facts are suggesting otherwise, at least for the time being. Based on this, while fair value an ounce for acquisitions may seem like it is $100 - $200/oz in takeover scenarios, the reality is that it's $62.14/oz. One is a fact; the other is only an opinion.

(Source: Company Presentation)

Let's dig a little deeper into the Barkerville acquisition:

Barkerville's recent Preliminary Economic Assessment has projected production of 185,000 ounces per year at all-in sustaining costs of $796/oz US at their Cariboo Gold Mine. The project sports an 11-year mine life, and capital costs to build the mine are $230 million US, a very modest amount of capital. This acquisition was significant as it is the second time that a streamer has come in to buy out a junior, even though this is generally not their business model. Instead, streamers look to provide some financing in exchange for a small portion of the production. The first occurrence of this was the purchase of Mariana Resources (OTC:MRLDF) by Sandstorm Gold (SAND) in 2017. The fact that this seems to be becoming more frequent is a positive sign for the juniors space, as it opens up juniors to a range of new potential suitors.

In digging into Barkerville closer, the company has all the attributes of previous takeovers in the mining space but received a relatively luke-warm valuation to be acquired. While it was only 2% below the average, we would have expected the average to have drifted higher given the move in gold the past three months. Ultimately, Osisko Gold Royalties has done an excellent job acquiring Cariboo if the deal closes at a very reasonable price. While investors are selling off Osisko Gold Royalties on the news as it's a deviation from their business model, I think it was a bold move that should pay off long-term. Any time a company can acquire another at a valuation of $70/oz or less with modest initial capex is a great deal.

So how is any of this relevant to the Gold Juniors sector?

The takeaway here is that while world-class producing assets like Atlantic Gold can expect to fetch $150/oz or higher for ounces in the ground, juniors are a completely different story. The market itself is telling us that the price paid for ounces in the ground for juniors has not changed since Q1 2016 despite a much higher gold price than the $1,250/oz levels in Q1 2016. Based on this, buying junior mining companies at an enterprise value per ounce above $62/oz is unlikely to pay off very handsomely in a takeover scenario. If the average price juniors are getting is $62/oz, and this figure is not trending higher, investors need to temper their expectations until these facts change.

For Marathon Gold (OTCQX:MGDPF) investors, this revelation should not put a damper on their day. Marathon Gold continues to trade at an enterprise value per ounce of $37/oz despite its recent rally, and this assumes a resource of only 4.2 million ounces of gold. As I've discussed in previous articles, I believe Valentine Lake ultimately can prove up a resource 4.9 - 5.2 million ounces or more across all categories by the end of 2020.

The junior mining space is a sector that is known for its rampant speculation, and figures are often thrown around without any facts to back them up. Hopefully, this article sheds some light on what suitors are actually willing to pay for non-producing assets in a hope to temper the numbers circulating on some boards which are entirely off base. While the best juniors with world-class assets will likely fetch a valuation per ounce above the $62.14 average, calls for $150 - $200/oz for non-producing assets are insane. While anything is possible, the odds are highly against any takeovers occurring at these prices. I think it's likely that this $62.14/oz figure trends higher over the next two years as new acquisitions arise, but for now, we don't have any evidence of this.

Disclosure: I am/we are long MGDPF. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Editor's Note: This article covers one or more microcap stocks. Please be aware of the risks associated with these stocks.

Follow Taylor Dart and get email alerts