Gold Just Got A New Safe-Haven Support

Conflict with Syria should bolster gold's safe-haven demand.

Silver has lagged, but is not a major factor for gold right now.

Oil price strength is pointing to higher gold prices intermediate term.

As if investors don't have enough incentives for safety purchases of the yellow metal, they just got another one over the weekend. The U.S.-led air strike on Syria in retaliation for the apparent use of chemical weapons by that country was the latest event which should stimulate additional interest in gold. In today's report, we'll examine gold's improving psychological backdrop in light of the latest geopolitical uncertainties as we see that gold's immediate-term uptrend remains intact.

Spot gold was up 0.6 percent at $1,345 on Friday and registered its second weekly gain after hitting an 11-week high of $1,365 on Apr. 11. June gold futures closed $6/oz. higher on Friday at $1,348. The upside move, which was subdued, was partly attributable to investors' concerns over Syria. Now that those fears have been intensified after Saturday's missile attack, however, gold has the potential to ride a renewed safety bid as the bulls try to break the metal out of a 3-month lateral range.

Gold has benefited from safety-related buying recently in the wake of a U.S.-China trade dispute and the growing conflict in Syria. The crude oil price has also risen to a yearly high as it approaches the $70/barrel level due to concerns about a spike in Middle Eastern tensions. Safe-haven assets like U.S. Treasuries and gold have seen only modest increases in value since investors' fears first became elevated, however. For this reason, it should be emphasized that fear alone won't be sufficient to push gold above its 3-month trading range ceiling. Investor fear coupled with the gradual return of commodity price inflation, however, should suffice to buoy the gold price.

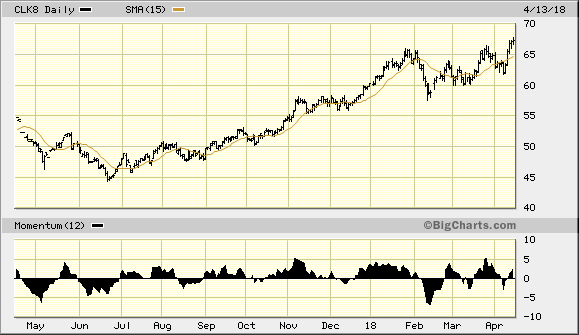

Shown here is the June crude oil futures graph. As I've emphasized in recent reports, a sustained rise in the oil price tends to anticipate gold price rallies and also typically bolsters gold's intermediate-term (3-6 month) outlook. Money managers tend to see rising oil as a barometer for inflation more than any other commodity. For this reason, continued impressive strength in the crude oil market gives them an incentive to buy gold due to its extreme sensitivity to changes in the inflation rate. As long as the oil price is trending higher - and especially when it's above the 15-day moving average - the intermediate-term outlook for gold should be considered bullish.

Source: BigCharts

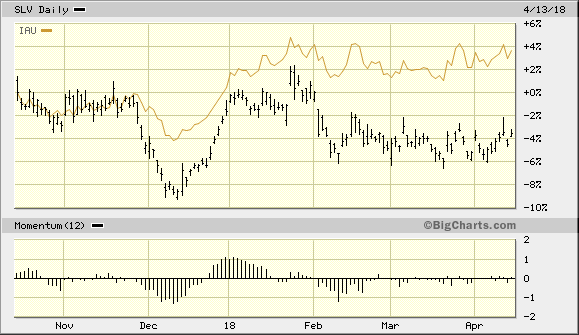

It has been a while since we've talked about silver in this commentary. Silver's price hasn't kept pace with gold in recent months and has shown a surprising degree of relative weakness compared to gold. Shown here is the daily graph of the iShares Silver Trust (SLV) which I use as a proxy for the silver price. As this chart clearly shows, SLV has under-performed the iShares Gold Trust (IAU) all year and hasn't been nearly as buoyant since it plunged in January. Many investors wonder if silver's under-performance compared to gold is a bearish omen for the yellow metal. I would argue no based simply on the persistence of safety-related concerns for the last few weeks. These concerns likely won't be allayed anytime soon which means gold should remain buoyant in the interim regardless of whether the silver price benefits from the safety-related buying.

Source: BigCharts

I would add that if inflation is indeed returning to the commodities complex, as I believe it is, then the silver price should sooner or later benefit from this as well as gold. Silver has often served as a leading indicator for the gold price when speculative interest in the metals is high. This isn't one of those times, however, as gold's recent demand increase is less speculation and more safety buying and, to a much lesser extent, inflation hedging.

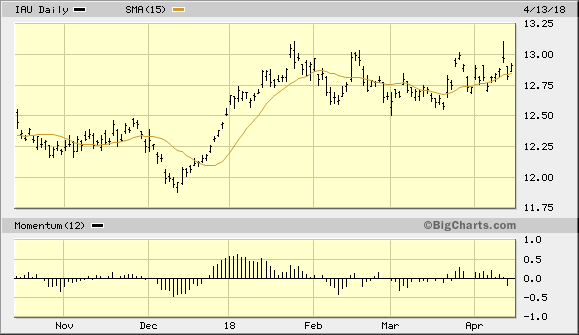

Turning our attention to the iShares Gold Trust, IAU has impressively managed to stay above its rising 15-day moving average for nine of the last 11 trading sessions. This speaks to the support it currently enjoys as it continues its consolidation process. My running assumption has been that IAU will recover enough energy during this consolidation phase to eventually break out of its range which has confined it since January. A decisive thrust above the $13.05 level, the Jan. 24 closing high which has served as IAU's benchmark resistance level, will confirm that the consolidation phase is finally over. It should subsequently be followed by additional gain as the bulls gain the initiative and the bears are forced to cover short positions. Until then, patience is still in order as the consolidation phase continues.

Source: BigCharts

On a strategic note, IAU confirmed an immediate-term buy signal per the rules of the 15-day MA trading method two weeks ago. This signal is predicated on a 2-day higher close above the rising 15-day moving average. I've purchased a conservative trading position in the iShares Gold Trust after it confirmed the immediate-term (1-4) breakout signal on Mar 23. I'm using the $12.55 level as the initial stop loss on an intraday basis for this trade. Meanwhile longer-term investment positions in gold should be maintained as the fundamentals underscoring gold's 2-year recovery effort are still favorable.

Disclosure: I am/we are long IAU.

I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Follow Clif Droke and get email alerts