Gold Key Change That Nobody Talks About / Commodities / Gold and Silver 2018

Last week, everyone focused on the stock marketsell-off. Reasonably enough, given the pace of the declines. But the analystsfailed to pay enough attention to the very important shift. That change may bemore important than Trump’s victory in the presidential election. Will thecritical switch make gold shine – or dull?

Last week, everyone focused on the stock marketsell-off. Reasonably enough, given the pace of the declines. But the analystsfailed to pay enough attention to the very important shift. That change may bemore important than Trump’s victory in the presidential election. Will thecritical switch make gold shine – or dull?

ThreeImportant Legacies of Yellen’s Fed Tenure

A crucial change is behind us. Powell is the new boss.Yellen is out. For better or worse, she doesn’t serve as the Fed Chair anylonger. Although economists rated Yellen’s tenure very highly, President Trumpdidn’t renominate her for the position. Rightly or not? We don’t care. Letjournalists debate endlessly – we will analyze the crucial Yellen’s imprints onthe Fed, whichcould affect the gold market in the future.

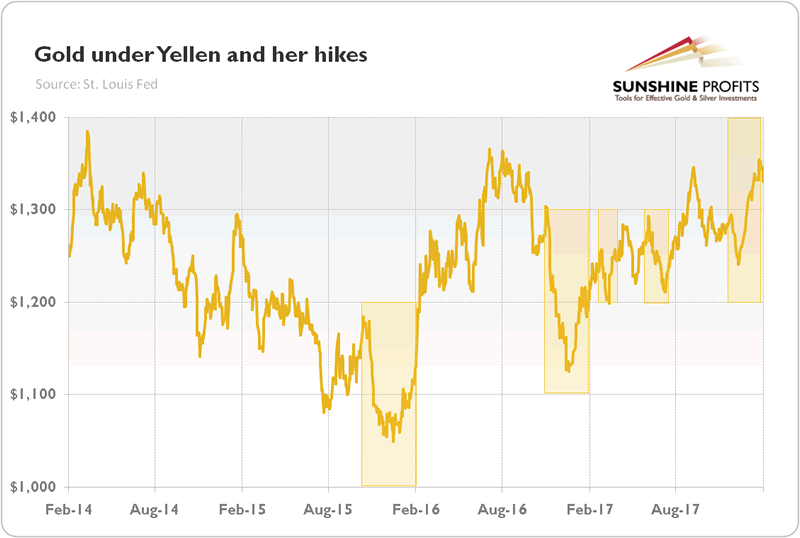

First, Yellen focused mostly on the labor market, notwithout some successes. We don’t attribute it solely to her, but theunemployment rate fell from 6.7 to 4.1 percent under her tenure. As a reminder,the Fed has a dual mandate: maximum employment and stable prices. Although manyFed officials used to worry about high inflation, she was different. Yellendidn’t fear the uptick in inflation as long asthere was a slack in the labor market. She, thus, believed that ultra lowinterest rates could and should stay near zero for far longer than previouslythought to combat unemployment. Yellen hiked them not earlier than in December2015. Since then, she gradually raised them to the range of 1.25 percent to 1.5percent, which is still very low. The gradual tightening was positive for gold, which wouldhave likely struggled more, had monetarypolicy been more aggressive.If Jerome Powell continues this cautious policy, gold may shine, despite rising interestrates.

Second, Yellen managed to start the unwinding of theFed’s massive balance sheet, without triggering stock market turmoil. Afterunconventional actions of Bernanke, she had to get back to normal monetarypolicy, but not too fast. She definitely succeeded. If anything, the Fed is behind the curve. This is why gold wasn’tstrongly hit by the Fed’s tightening. The U.S. central bank raised interestrates a few times, but the financial conditions remained easy.

Third, Yellen mastered communication with the public.She held quarterly news conferences and smoothly telegraphed the Fed’s moveswell in advance. Thanks to well-planned expectations guidance, Yellen –contrary to Bernanke who triggered a taper tantrum by his unexpected remarks in2013 – avoided any major stumbles. Theclear communication transformed gold’s reaction function. The yellow metal nowreacts more to the changes in the rate hike expectations than to real monetarypolicy decisions. Sell the rumor, buy the fact – as one can see in the chartbelow.

Chart 1: Gold prices under Yellen’s Fed tenure

JeromePowell – Great Continuator or Game Changer?

Jerome Powell is now the new Fed Chair. Analystsexpect that he will continue Yellen’s stance. But will he? How you play dependson your opponent. Yellen faced a sluggish recovery. But Powell sees tax cuts,higher economic growth, very low unemployment and perhaps finally rising wages.He will have to deal with the accelerating inflation, so Powell could movefaster on normalization. Actually, such a scenario scared some investors lastweek into deciding to sell their equities. As people weren’t sure what toexpect of Powell, good economic data turned out once again to be bad news forthe financial markets. Surprisingly strong payrolls maketraders to worry that the Fed will tighten its stance more. Hence, unless Powell convinces the marketsthat he will continue Yellen’s gradual approach, gold may react paradoxicallyfor a safe-haven: decline on bad news and rise ongood news.

But will he intervene to calm the financial markets?We don’t bet on that. Greenspan cut interest rates after the stock marketdeclined 35 percent in the three months after he became the Fed Chair, but the current downturn is much smaller.Actually, we have seen some rebound since Friday. Another paradox: the correction in stock prices may help Powell indoing his job, because lower equity prices could relieve concerns about theformation of dangerous asset bubbles.

Conclusions

The conclusion is clear: although the latest declineswere a tough welcome for Powell, they may actually be helpful for him. He isexpected to continue Yellen’s policy. It is generally true, but economicconditions changed as well as the composition of the FOMC in 2018. It is nowmore hawkish than last year.

Given these developments, the shift from Yellen toPowell may importantly strengthen the hawks among the Fed. Hence, unless the correction evolves into turmoil, we still expectthree (or even four) hikes this year. Indeed, according to CME data, the Fed remains on track to liftthe federal funds rate in March. The market odds of a hike are above 75percent. Higher interest rates shouldtheoretically be negative for gold. But the usual link seems to be broken now. The part of the answer is the U.S. dollar. Another issue is that we are in thelate stages of the economic cycle – as the cycle matures, volatility increasesand investors start to buy more gold as a hedge.

Tomorrow, we will see the newest CPI report, which mayaffect the markets, given that inflation worries were one of the key reasonsbehind the recent stock market volatility. Stay tuned!

Thank you.

If you enjoyed the above analysis and would you like to knowmore about the gold ETFs and their impact on gold price, we invite you to readthe April MarketOverview report. If you're interested in the detailed price analysis andprice projections with targets, we invite you to sign up for our Gold & SilverTrading Alerts . If you're not ready to subscribe at this time, we inviteyou to sign up for our goldnewsletter and stay up-to-date with our latest free articles. It's freeand you can unsubscribe anytime.

Arkadiusz Sieron

Sunshine Profits‘ MarketOverview Editor

Disclaimer

All essays, research and information found aboverepresent analyses and opinions of Przemyslaw Radomski, CFA and SunshineProfits' associates only. As such, it may prove wrong and be a subject tochange without notice. Opinions and analyses were based on data available toauthors of respective essays at the time of writing. Although the informationprovided above is based on careful research and sources that are believed to beaccurate, Przemyslaw Radomski, CFA and his associates do not guarantee theaccuracy or thoroughness of the data or information reported. The opinionspublished above are neither an offer nor a recommendation to purchase or sell anysecurities. Mr. Radomski is not a Registered Securities Advisor. By readingPrzemyslaw Radomski's, CFA reports you fully agree that he will not be heldresponsible or liable for any decisions you make regarding any informationprovided in these reports. Investing, trading and speculation in any financialmarkets may involve high risk of loss. Przemyslaw Radomski, CFA, SunshineProfits' employees and affiliates as well as members of their families may havea short or long position in any securities, including those mentioned in any ofthe reports or essays, and may make additional purchases and/or sales of thosesecurities without notice.

Arkadiusz Sieron Archive |

© 2005-2018 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.