Gold Market Mulling Blockchain for $200 Billion of Supply

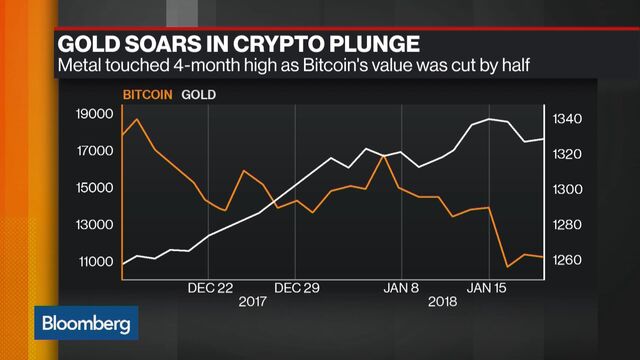

Gold Soars as Crypto Currencies Plunge

Gold Soars as Crypto Currencies PlungeGold is going digital.

Blockchain technology may help keep track of the roughly $200 billion of the precious metal dug from remote mines, traded by middlemen and melted down by recyclers that’s sold each year to buyers scattered around the world.

The London Bullion Market Association, which oversees the world’s biggest spot gold market, will seek proposals including the use of blockchain for tracing the origins of metal, partly to help prevent money laundering, terrorism funding and conflict minerals, according to Sakhila Mirza, an executive board director.

“Blockchain cannot be ignored,” Mirza, also general counsel of the LBMA, said in an interview Monday. “Let’s understand how it can help us today, and address the risks that impact the precious metals market.”

Where Gold Ends Up

Jewelry and investment are the biggest sources of gold demand, followed by central banks

Source: Metals Focus, 2016