Gold Medium-Term Downtrend: Gold Miners in the Lead / Commodities / Gold and Silver 2021

Gold, silver, and mining stocks don’tneed any help from the USDX or the stock market; they can decline all on theirown – the miners in particular.

Last week, mining stocks declined quitevisibly, and it happened without significant help from the USD Index and fromthe general stock market. Silver and gold were practically flat week-over-week,so was the USD Index, and the general stock market (S&P 500) was up by0.51%. This means that gold stocks and silver stocks should have closed theweek relatively unchanged (as gold and silver did), or move somewhat higher(similarly to other stocks, as sometimes miners take their lead).

Instead, all important proxies for themining stocks moved lower and closed the week at new daily and weekly 2021lows. The HUI Index and the GDX ETF were down by about 3%, the silverstocks (SIL ETF) were down by 3.6%, and the GDXJ ETF (proxy forjunior miners) was down by 3.83%, which means that our short position in thelatter just became even more profitable.

Most importantly, it means that miningstocks continue to show weakness relative to gold, which tells us that themedium-term downtrend remains well intact. It also tells us that what I wrotepreviously about the medium-term link between the general stock market andmining stocks was most likely correct. Namely, that miners can decline withouta decline in other stocks. A decline in the latter, will (as I still expect tosee it sooner or later) simply exacerbate the decline’s volatility.

Let’s take a look at the charts, startingwith the long-term HUIIndex chart – the flagship proxy for goldstocks.

The clearest and most important thingthat you can see on this chart is that gold miners continued their declineafter completing – and verifying – the breakdown below the broad head and shoulderspattern (marked in green). Just like in the case of the previous similarpatterns (also marked in green), mining stocks are likely to now declineprofoundly. The 3% decline that we saw last week is likely just a smallbeginning of the entire slide.

Yes, the Stochastic indicator is veryoversold, but please note that it was the same in 2013 during the powerfulpost-head-and-shoulders-breakdown slide. And it didn’t cause the decline to endor reverse.

The breakdown to yearly lows is alsocrystal-clear in case of the GDX ETF. The weekly close below the previous 2021lows is critical, but it’s worth noting that it was also a close below thepsychologically important (as its round) $30 level.

The next target for the GDX ETF is basedmainly on the 61.8% Fibonacci retracement level based on the entire 2020 rally.The previous retracements worked quite well, so it seems that this technique shouldn’tbe ignored.

The 38.2% retracement served as supportin November 2020. The decline below this level triggered a short-term rebound.

The 50% retracement served as support inMarch and August 2021. This level was particularly strong as it corresponded tothe previous – May and June 2020 – lows. Reaching this level triggeredrebounds. The first one was quite significant, and the second one was of onlyshort-term importance.

When the GDX ETF moves to its 61.8% it’slikely to rebound in the short term (and probably in the short term only), notonly because of the retracement itself, but also because two additionaltechniques confirm this level as a short-term target. One is the supportprovided by the late-March 2020 high, and the other is the previous head andshoulders pattern that formed between April and early August 2021. Based on thesize of the head (red, dashed lines), GDX is likely to decline to about $28.

And while the GDX is likely to decline,so is its counterpart focused on juniormining stocks – the GDXJ ETF.

In the case of the GDXJ, the downsidetarget is broader, as the 61.8% Fibonacci retracement, the late-March 2020high, and the head-and-shoulders-based target are not so aligned.

A decline to the 61.8% Fibonacciretracement here would more or less correspond to the analogous move in the GDXin percentage terms. However, if the junior miners underperform (as they’ve been underperforming seniors for months), they could move evenlower before rebounding.

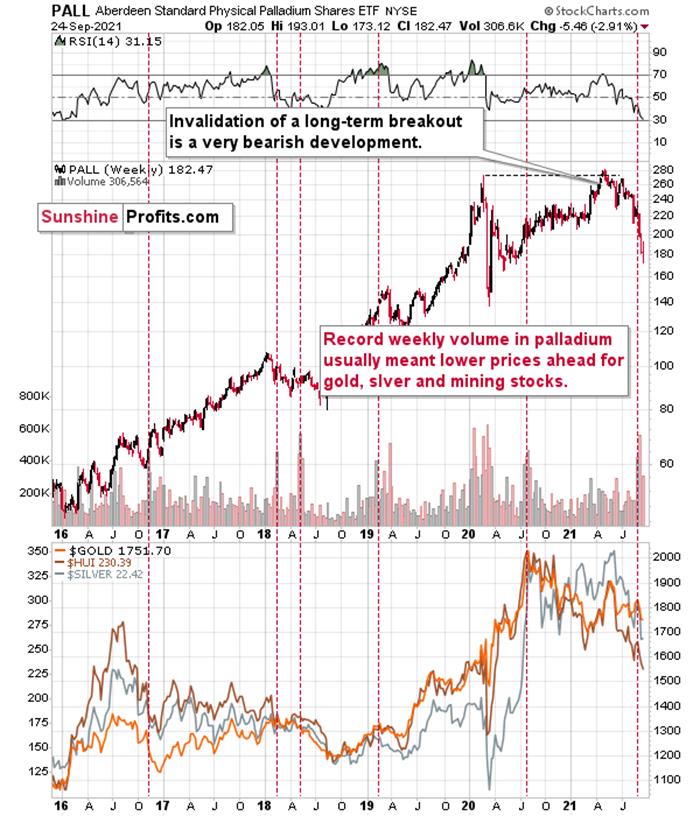

On a different note, let’s take a look atwhat’s happening in a less popular part of the precious metals sector – palladium.

OnSep. 7, I wrote the following:

Alsoadding credibility to the conclusions drawn from the volume spikes in the GDXETF and the GDXJ ETF, last week, the Aberdeen Standard Physical PalladiumShares (PALL) ETF recorded a new2021 high for weekly volume. And with abnormal volume offering a windowinto investor sentiment, historical euphoria preceded minor-to-massive declinesin gold and silver (the red vertical dashed lines below). As a result, severalareas of the precious metals market are sounding the alarm.

Lastweek’s volume spike was an anomaly, and whenever we see one on a given market,it’s useful to check what happened when we saw it previously. At times, you cannotice some regularities – a pattern. And such a pattern could have importanttrading implications. That’s the case with palladium volume spikes, which –while rather inconsequential for palladium itself – were practically alwaysfollowed by lower gold, silver,and mining stock prices. The implications for the said markets for thefollowing weeks are thus bearish.

And indeed, the precious metals sector declinedright after that volume spike. So far, the decline was only modest from thelong-term point of view. Since some of the declines that followed the previoushuge-volume signals from palladium were much bigger (especially the onefollowing the 2020 top), we might see even lower prices of PMs and miners inthe next weeks and months as well.

Thank you for reading our free analysistoday. Please note that the above is just a small fraction of today’sall-encompassing Gold & Silver Trading Alert. The latter includes multiplepremium details such as the targets for gold and mining stocks that could be reached in the next few weeks. If you’dlike to read those premium details, we have good news for you. As soon as yousign up for our free gold newsletter, you’ll get a free 7-day no-obligationtrial access to our premium Gold & Silver Trading Alerts. It’s really free– sign up today.

Thank you.

Przemyslaw Radomski, CFA

Founder, Editor-in-chief

Toolsfor Effective Gold & Silver Investments - SunshineProfits.com

Tools für EffektivesGold- und Silber-Investment - SunshineProfits.DE

* * * * *

About Sunshine Profits

SunshineProfits enables anyone to forecast market changes with a level of accuracy thatwas once only available to closed-door institutions. It provides free trialaccess to its best investment tools (including lists of best gold stocks and best silver stocks),proprietary gold & silver indicators, buy & sell signals, weekly newsletter, and more. Seeing is believing.

Disclaimer

All essays, research and information found aboverepresent analyses and opinions of Przemyslaw Radomski, CFA and SunshineProfits' associates only. As such, it may prove wrong and be a subject tochange without notice. Opinions and analyses were based on data available toauthors of respective essays at the time of writing. Although the informationprovided above is based on careful research and sources that are believed to beaccurate, Przemyslaw Radomski, CFA and his associates do not guarantee theaccuracy or thoroughness of the data or information reported. The opinionspublished above are neither an offer nor a recommendation to purchase or sell anysecurities. Mr. Radomski is not a Registered Securities Advisor. By readingPrzemyslaw Radomski's, CFA reports you fully agree that he will not be heldresponsible or liable for any decisions you make regarding any informationprovided in these reports. Investing, trading and speculation in any financialmarkets may involve high risk of loss. Przemyslaw Radomski, CFA, SunshineProfits' employees and affiliates as well as members of their families may havea short or long position in any securities, including those mentioned in any ofthe reports or essays, and may make additional purchases and/or sales of thosesecurities without notice.

Przemyslaw Radomski Archive |

© 2005-2019 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.