Gold Miners - Biggest Losers? That's What Oil Says / Commodities / Gold and Silver Stocks 2022

After the war-driven gold rally, oilis starting to outperform. History between these two has already shown thatsomeone may suffer. Many suggest: gold miners.

The precious metals corrected some oftheir gains yesterday, but overall, not much changed in them. However, quite a lothappened in crude oil, and in today’s analysis we’ll focus on whatit implies for the precious metals market and, in particular – for miningstocks.

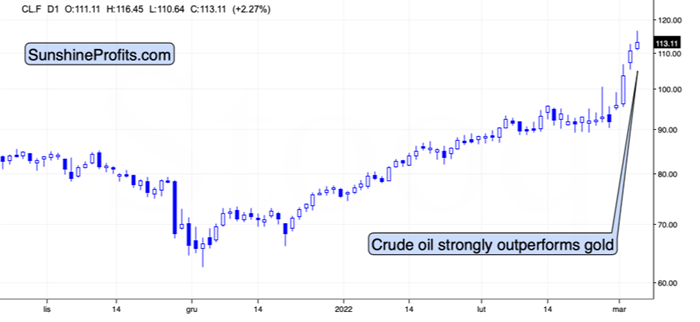

As you may have noticed, crude oil shotup recently in a spectacular manner. This seems normal, as it’s a market withrather inflexible supply and demand, so disruptions in supply or threatsthereof can impact the price in a substantial way. With Russia as one of thebiggest crude oil producers, its invasion of Ukraine, and a number of sanctionsimposed on the attacking country (some of them involving oil directly), it’snatural that crude oil reacts in a certain manner. The concern-based rally ingold is also understandable.

However, the relationship between wars,concerns, and prices of assets is not as straightforward as “there’s a war, sogold and crude oil will go up.” In order to learn more about this relationship,let’s examine the most similar situation in recent history to the current one, whenoil supplies were at stake.

The war that I’m mentioning is the onebetween Iraq and the U.S. that started almost 20 years ago. Let’s see whathappened in gold, oil, and gold stocks at that time.

The most interesting thing is that whenthe war officially started, the above-mentioned markets were already after adecline. However, that’s not that odd, when one considers the fact that backthen, the tensions were building for a long time, and it was relatively clearin advance that the U.S. attack was going to happen. This time, Russia claimedthat it wouldn’t attack until the very last minute before the invasion.

The point here, however, is that themarkets rallied while the uncertainty and concerns were building up, and thendeclined when the situation was known and “stable.” I don’t mean that “war” wasseen as stable, but rather that the outcome and how it affected the markets wasrather obvious.

The other point is the specific way inwhich all three markets reacted to the war and the timing thereof.

Goldstocks rallied initially, but then were notthat eager to follow gold higher, but that’s something that’s universal in thefinal stages of most rallies in the precious metals market. What’s mostinteresting here is that there was a time when crude oil rallied substantially,while gold was already declining.

Let me emphasize that once again: goldtopped first, and then it underperformed while crude oil continuedto soar substantially.

Fast forward to the current situation.What has happened recently?

Gold moved above $1,970 (crude oil peakedat $100.54 at that time), and then it declined heavily. It’s now trying to moveback to this intraday high, but it was not able to do so. At the moment ofwriting these words, gold istrading at about $1,930, while crude oil is trading at about $114.

Inother words, while gold declined by $30, crude oil rallied by about $14. That’sa repeat of what we saw in 2003!

What happened next in 2003? Golddeclined, and the moment when crude oilstarted to visibly outperform gold was also the beginning of a big decline ingold stocks.

That makes perfect sense on thefundamental level too. Gold miners’ share prices depend on their profits (justlike it’s the case with any other company). Crude oil at higher levels meanshigher costs for the miners (the machinery has to be fueled, the equipment hasto be transported, etc.). When costs (crude oil could be viewed as a proxy forthem) are rising faster than revenues (gold could be viewed as a proxy forthem), miners’ profits appear to be in danger; and investors don’t like thiskind of danger, so they sell shares. Of course, there are many more factorsthat need to be taken into account, but I just wanted to emphasize one way inwhich the above-mentioned technical phenomenon is justified. The above doesn’tapply to silver as it’s a commodity, but it does apply tosilver stocks.

Back in 2004, gold stocks wiped out theirentire war-concern-based rally, and the biggest part of the decline took just abit more than a month. Let’s remember that back then, gold stocks were in avery strong medium- and long-term uptrend. Right now, mining stocks remain in amedium-term downtrend, so their decline could be bigger – they could give awaytheir war-concern-based gains and then decline much more.

Mining stocks are not decliningprofoundly yet, but let’s keep in mind that history rhymes – it doesn’t repeatto the letter. As I emphasized previously today, back in 2003 and 2002, thetensions were building for a longer time and it was relatively clear in advancethat the U.S. attack was going to happen. This time, Russia claimed that itwouldn’t attack until the very last minute before the invasion. Consequently,the “we have to act now” is still likely to be present, and the dust hasn’tsettled yet – everything appears to be unclear, and thus the markets are notreturning to their previous trends. Yet.

However, as history shows, that is likelyto happen. Either immediately, or shortly, as crude oil is already outperforminggold.

Investing and trading are difficult. Ifit was easy, most people would be making money – and they’re not. Right now,it’s most difficult to ignore the urge to “run for cover” if you physicallydon’t have to. The markets move on “buy the rumor and sell the fact.” Thisrepeats over and over again in many (all?) markets, and we have directanalogies to similar situations in gold itself. Junior miners are likely todecline the most, also based on the massive declines that are likely to takeplace (in fact, they have already started) in the stock markets.

Thank you for reading our free analysistoday. Please note that the above is just a small fraction of today’sall-encompassing Gold & Silver Trading Alert. The latter includes multiplepremium details such as the targets for gold and mining stocks that could be reached in the next few weeks. If you’dlike to read those premium details, we have good news for you. As soon as yousign up for our free gold newsletter, you’ll get a free 7-day no-obligationtrial access to our premium Gold & Silver Trading Alerts. It’s really free– sign up today.

Thank you.

Przemyslaw Radomski, CFA

Founder, Editor-in-chief

Toolsfor Effective Gold & Silver Investments - SunshineProfits.com

Tools für EffektivesGold- und Silber-Investment - SunshineProfits.DE

* * * * *

About Sunshine Profits

SunshineProfits enables anyone to forecast market changes with a level of accuracy thatwas once only available to closed-door institutions. It provides free trialaccess to its best investment tools (including lists of best gold stocks and best silver stocks),proprietary gold & silver indicators, buy & sell signals, weekly newsletter, and more. Seeing is believing.

Disclaimer

All essays, research and information found aboverepresent analyses and opinions of Przemyslaw Radomski, CFA and SunshineProfits' associates only. As such, it may prove wrong and be a subject tochange without notice. Opinions and analyses were based on data available toauthors of respective essays at the time of writing. Although the informationprovided above is based on careful research and sources that are believed to beaccurate, Przemyslaw Radomski, CFA and his associates do not guarantee theaccuracy or thoroughness of the data or information reported. The opinionspublished above are neither an offer nor a recommendation to purchase or sell anysecurities. Mr. Radomski is not a Registered Securities Advisor. By readingPrzemyslaw Radomski's, CFA reports you fully agree that he will not be heldresponsible or liable for any decisions you make regarding any informationprovided in these reports. Investing, trading and speculation in any financialmarkets may involve high risk of loss. Przemyslaw Radomski, CFA, SunshineProfits' employees and affiliates as well as members of their families may havea short or long position in any securities, including those mentioned in any ofthe reports or essays, and may make additional purchases and/or sales of thosesecurities without notice.

Przemyslaw Radomski Archive |

© 2005-2019 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.