Gold Miners Earnings Season: A Sluggish Start To Q3

Earnings season has kicked off for the gold miners, with about one third of the index reporting thus far.

Early results aren't terribly encouraging, with mixed results across most of the group.

Most of the big names are still left to report, but investors will want to see more traction from the majors.

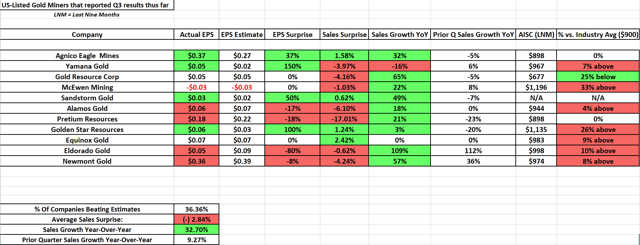

It's been a busy couple of weeks for investors in the metals markets, with the second last Fed Meeting of 2019, and earnings season has kicked off on the 24th. Thus far, early results haven't been all that impressive, with two massive misses and two moderate misses. Out of the eleven US-listed gold companies to report thus far, less than 40% have beaten their earnings estimates, and the average sales surprise is negative. While we still have half of the group left to report, this isn't the start that most gold investors were looking for. There was no doubt that this would be a strong quarter for the miners given the move in the price of gold (GLD), but it was just as crucial that the miners fired on all cylinders from an operational standpoint. Ideally, for the health of the Gold Miners Index (NYSEARCA:GDX) medium-term (1-2 months), we're going to want to see some stronger reports in the back half of earnings season.

While the Q2 earnings season gave us a glimpse of what a higher gold price might look like for the miners, Q3 has been heavily anticipated, with the gold price averaging well over $1,400/oz. Unfortunately, for investors, there hasn't been a ton of reports to be excited about thus far. The two stand-out reports came from Agnico Eagle Mines (AEM) and Sandstorm Gold (SAND) with beats on both the top and bottom line, but otherwise, there's been little to write home about. As we can see from the below table I've built, only 4 of 11 companies have beaten estimates, and those four are Golden Star Resources (GSS), Agnico Eagle Mines, Yamana Gold (AUY), and Sandstorm Gold. However, this is offset by the misses we've seen from Pretium Resources (PVG), McEwen Mining (MUX), and a few other non-US listed names: TMAC Resources (OTC:TMMFF), Guyana Goldfields (OTCPK:GUYFF), and Centerra Gold (OTCPK:CAGDF). To avoid any confusion, I am classifying non-US listed names as names that do not trade on the big boards and are solely OTC tickers.

Moving over to sales surprise, which is the most important metric as it can't be tinkered with by moving certain line items, the average beat vs. revenue estimates has been quite pathetic. The average sales reported vs. sales estimated is (-) 2.84%, and this has given us a negative average sales price for the first third of companies that have reported. The biggest loser in this column is Pretium Resources, as the company managed to come in 17% below estimates with their abominable quarter. The second worst company in this category was Alamos Gold (NYSE:AGI), which missed by 6.10% with just $172.9 million in revenues.

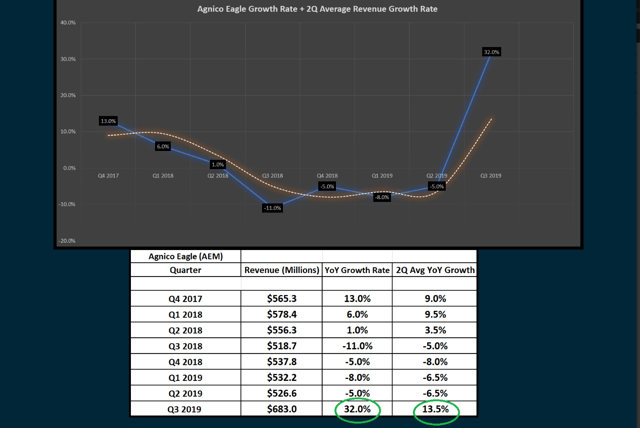

As for the winners in the sales surprise group, Agnico Eagle Mines had a blow-out quarter. The company beat only slightly on revenue estimates, coming in at $683.0 million, but earnings per share beat by $0.10, coming in at $0.37. This translated to 32% sales growth year-over-year for the company, a significant acceleration sequentially from the (-) 5% reported in Q2. The most impressive part about the report was the company's decision to raise its dividend from $0.50 on an annual basis to $0.70. At current prices, this represents a roughly 1.2% annual dividend yield.

(Source: YCharts.com, Author's Chart)

(Source: YCharts.com, Author's Chart)

The other winner in this category was Equinox Gold (OTC:EQX) with a 2.42% beat and $91.3 million in revenue reported for Q3. This massive sequential jump in growth was attributed to the company's Aurizona Gold Mine in Brazil coming online in July. All-in sustaining costs for Aurizona came in just above guidance at $1,053/oz.

(Source: Equinox Gold Company Presentation)

(Source: Equinox Gold Company Presentation)

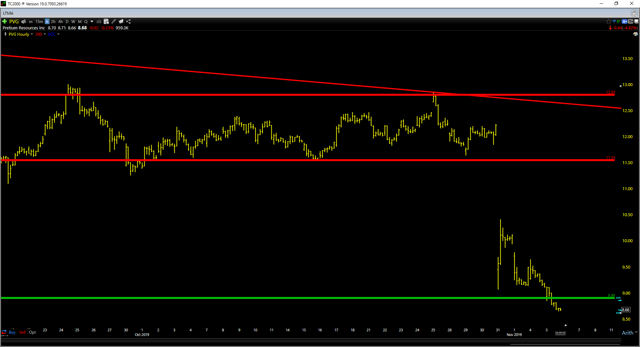

As for the losers, they all share one thing in common, massive misses on cost guidance. Pretium Resources is down 30% since its Q3 report after reiterating a cost guidance mid-point on the Q2 earnings call of $825/oz, and now revising that guidance 12% higher in their Q3 earnings call to $925/oz at the mid-point. This isn't a 1-2% miss on guidance and splitting hairs; it's a 12% miss and a material miscalculation by the company. This is not the first time the company has been far too ambitious with estimates and missed significantly, and therefore the beating the stock has taken is not surprising. For the Pretium bulls to prevent long-term technical damage to the chart, they are going to need to defend $8.90 on a weekly close. Currently, we're sitting 3% below that level as we head into the second half of the week.

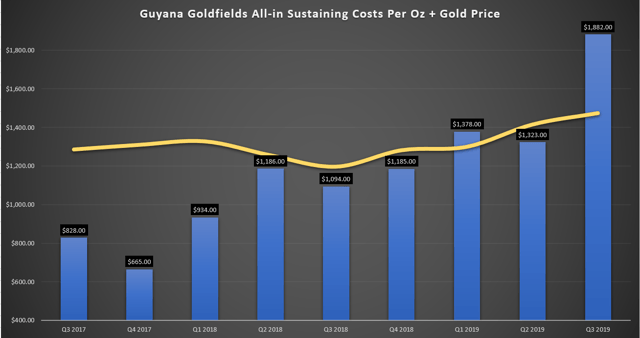

If you thought the Pretium Resources report was bad, you likely missed the disaster of a Q3 report provided by Guyana Goldfields. The company's all-in sustaining costs came in at $1,882/oz for the quarter, and are tracking at $1,465/oz for the first nine months of the year. These are appalling all-in sustaining costs, and it's no surprise that the company is set up for more net losses this year. The worst part of the report is the revelation that financing may be necessary as the company has been unable to produce any meaningful cash-flow, given its high costs. Many value investors have been swarming the name the past year suggesting it was a buy, but likely didn't factor in the possibility that financing might be needed. The company had just paid down its remaining debt as of Q2, but will probably need a debt facility or to dilute with an equity raise, to further bolster its balance sheet. The company currently has $24.8 million in cash, which should last a few quarters at most, before the company is sitting at alarmingly low levels in the treasury.

As the above chart shows, the company had been putting up all-in sustaining costs (blue bars) just below the gold price (yellow line) for seven of the past eight quarters. The most recent quarter, however, has seen a massive jump above the gold price. Any company that cannot make money at current gold prices is an Avoid, plain and simple, and there are zero excuses to go bottom-fishing for producers with non-existent operating margins.

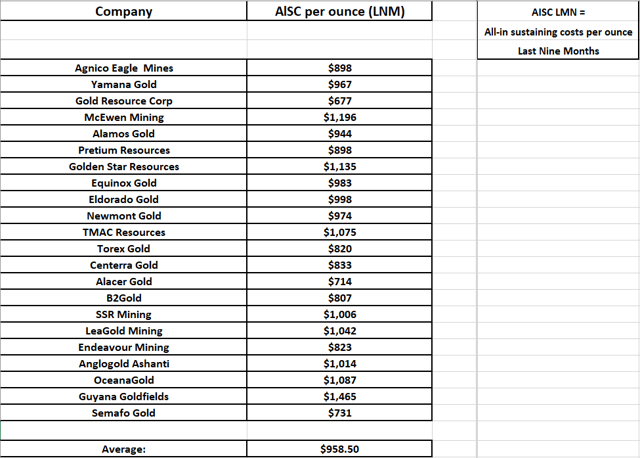

Finally, moving over to all-in sustaining costs for all gold miners, we can see that they're trending up slightly from the prior average closer to $905/oz. It's worth noting that we still have some cost-leaders in the industry left to report that will drag this average down. Kirkland Lake Gold (KL) is set to report earnings this week, and Barrick Gold (GOLD) should also help to pull the average down slightly. However, on the flip side, we have cost losers New Gold (NGD) and IAMGOLD (IAG) also left to report.

The clear-cut cost leaders in the group are mostly from tier-2 jurisdictions and are Semafo Gold (OTCPK:SEMFF), B2Gold (BTG), Alacer Gold (OTCPK:ALIAF), and Torex Gold (OTCPK:TORXF). However, the one cost-leader that is in a tier-1 jurisdiction is Gold Resource Corporation (GORO). While the company's costs are impressive, it's also the smallest producer by ounces produced on the list and benefits a lot from by-products of other metals. The company's costs are quite volatile, given the by-product benefit and can swing wildly from year to year. Generally, I avoid cost-leaders in tier-2 or tier-3 jurisdictions as they carry higher risk due to the potential for unforeseen events.

The cost losers are Guyana Goldfields at $1,465/oz for the first nine months, OceanaGold (OTCPK:OCANF) at $1,087/oz, McEwen Mining at $1,196/oz, TMAC Resources at $1,075/oz, and Golden Star Resources at $1,135/oz. Not surprisingly, all of these stocks are on my Avoid list, as I'm not interested in any companies where costs are trending higher on a year-over-year basis and that have less than 25% margins vs. the gold price. While I am more lenient with this ratio near swing lows for gold, a less than 25% margin after a 20% jump in the price of gold this year is unacceptable.

(Source: Kirkland Lake Company Presentation)

(Source: Kirkland Lake Company Presentation)

To summarize, we've seen a sluggish start to Q3 earnings season for the miners and will need the remaining miners left to report to pick up the slack. While current average all-in sustaining costs for reported miners aren't terrible given the nearly $500/oz margin using $1,450/oz gold prices, they could be better. Based on average all-in sustaining costs trending higher and two massive misses from Pretium Resources and Centerra Gold, it's not surprising that the Gold Miners Index has just treaded water thus far into earnings season.

The Gold Miners had a tremendous opportunity to see a surge in the index heading into an earnings season with the best average gold price in nearly seven years. However, it's looking like some names are ruining that opportunity for others, with names like Pretium Resources that make up 2% of the index down 30%. However, the majority of miners can all shoulder some blame, with no real outstanding reports thus far. The two exceptions, as mentioned, were Agnico Eagle Mines and Sandstorm Gold with record results, and we'll need a few more of these as earnings season comes to a close, ideally.

Disclosure: I/we have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Follow Taylor Dart and get email alerts