Gold Miners Message for the Precious Metals Rally / Commodities / Gold & Silver 2020

TheFed kept rates unchanged and while it was not immediately preceded by majorprice moves in the PMs, the no-change decision was followed by bullish priceaction in the following hours. This action extends into today’s pre-markettrading.

Mostinterestingly, however, the USD Index repeated its daily reversal confirming that lower values are to be expected. This confirms our yesterday’sanalysis.

The News in the USDIndex

Thismeans that the breakout in the greenback is likely to be invalidated shortly,and once that happens, the PMs are likely to move higher once again.

Thebreakout itself was neither huge, nor decisive, but it did take place. The USDXrallied above the rising red resistance line and reversed before the end of theday. Still, even taking into account the late decline, it ended the sessionhigher – above the resistance line.

Theimportant thing about this breakout is that – since it was relatively small –it would need to be confirmed for it to really matter. Based on the sizes ofthe previous rallies in the USD Index and the times when it corrected (bluelines on the above chart) it seems that the USD Index is about to start acorrective decline. Even the start of the decline would likely cause the USD toinvalidate its breakdown, thus giving way to a much bigger decline.

Tobe clear, we continue to think that the USD Index is headed much higher in thefollowing months and perhaps years, but this doesn’t mean that it will rally ina straight line.

Thevertical dashed line on the above chart shows what happened when the USDXentered such corrective downswings in the recent past. In almost all cases,gold and silver declined (usually relatively sharply) prior to USD’s declines.The July 2019 case may seem to be an exception, but it really isn’t one. Backthen, the USD formed two tops and the first top was indeed immediately precededby a quick dip in both precious metals. The true exception is what happened inDecember 2019 – in this case, gold and silver paused a bit before rallyingagain.

Allin all, in most cases the quick decline in metals right at the USD top wasnormal. While in most cases, it is the USD Index that can tell us somethingabout gold and silver, this time it might be the other way around first. ThePMs might have declined indicating that this was indeed the final part of theUSD’s rally, which in turn could imply a quick comeback of the PMs along with ashort-term correction in the USDX.

Meanwhile in PreciousMetals

Minerssoared back with vengeance, while gold and silver moved up just a little. Thismove might be accidental – after all, it was just one session – but it couldindicate that the precious metals market will be making another short-term runup instead of being done with the previous one. Theoretically it shouldn’tmatter because after all, PMs are likely to move higher in the short run,but it does matter in relative terms. It means that silver’s outperformanceis still ahead of us.

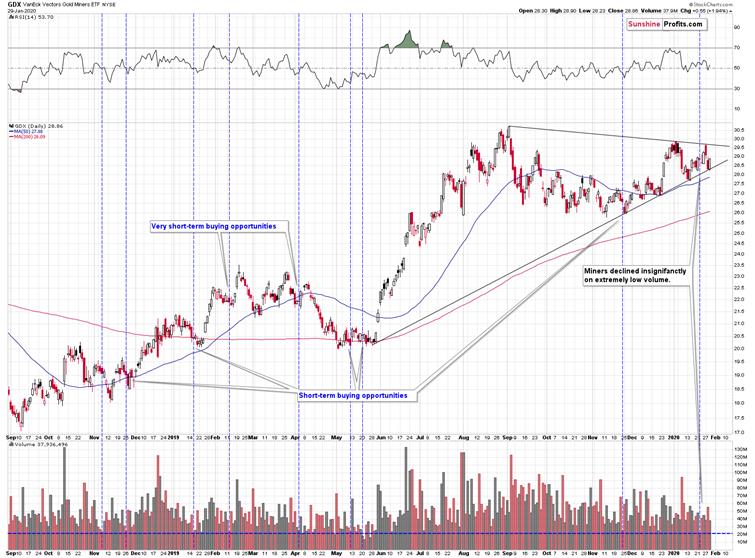

TheGDX ETF confirms the bullish outlook for the next several days.

Inyesterday’s analysis, we wrote that the GDX ETF reached its rising supportline without breaking below it, and that it was likely to trigger anotherrally, just like it did in mid-December and in early January. That’sexactly what happened.

Summary

Summingup, it seems that the USD Index has yet to decline and thus that the rally inthe precious metals sector is not over yet. Miners led the way yesterday, butsilver is likely to take up the baton shortly.

Theway in which the markets react to news in the first 24 hours is likely to bethe way that they move in the next several days as they continue to discountnew information. Yesterday’s and today’s (so far) price moves suggest that PMsare likely to move higher in the next several days.

Naturally,the medium-term outlook for the precious metals market remains very bearish andonce the short-term correction is over, the declines are likely to resume.

Today's article is asmall sample of what our subscribers enjoy on a daily basis. Check more of our free articles on our website, including this one – justdrop by and have a look. Weencourage you to sign up for our daily newsletter, too - it's free and if youdon't like it, you can unsubscribe with just 2 clicks. You'll also get 7 daysof free access to our premium daily Gold & Silver Trading Alerts to get ataste of all our care. On top, you’ll also get 7 days of instant email notifications the momenta new Signal is posted, bringing our Day Trading Signals at your fingertips. Sign up for the free newsletter today!

Thank you.

Przemyslaw Radomski, CFA

Founder, Editor-in-chief

Toolsfor Effective Gold & Silver Investments - SunshineProfits.com

Tools für EffektivesGold- und Silber-Investment - SunshineProfits.DE

* * * * *

About Sunshine Profits

SunshineProfits enables anyone to forecast market changes with a level of accuracy thatwas once only available to closed-door institutions. It provides free trialaccess to its best investment tools (including lists of best gold stocks and best silver stocks),proprietary gold & silver indicators, buy & sell signals, weekly newsletter, and more. Seeing is believing.

Disclaimer

All essays, research and information found aboverepresent analyses and opinions of Przemyslaw Radomski, CFA and SunshineProfits' associates only. As such, it may prove wrong and be a subject tochange without notice. Opinions and analyses were based on data available toauthors of respective essays at the time of writing. Although the informationprovided above is based on careful research and sources that are believed to beaccurate, Przemyslaw Radomski, CFA and his associates do not guarantee theaccuracy or thoroughness of the data or information reported. The opinionspublished above are neither an offer nor a recommendation to purchase or sell anysecurities. Mr. Radomski is not a Registered Securities Advisor. By readingPrzemyslaw Radomski's, CFA reports you fully agree that he will not be heldresponsible or liable for any decisions you make regarding any informationprovided in these reports. Investing, trading and speculation in any financialmarkets may involve high risk of loss. Przemyslaw Radomski, CFA, SunshineProfits' employees and affiliates as well as members of their families may havea short or long position in any securities, including those mentioned in any ofthe reports or essays, and may make additional purchases and/or sales of thosesecurities without notice.

Przemyslaw Radomski Archive |

© 2005-2019 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.