Gold Miners' Rally? What Rally? Watch Out for More Fake Moves! / Commodities / Gold and Silver Stocks 2018

Rememberhow mining stocks soared on Valentine’s Day and how we wrote that a rally isnot necessarily bullish? Guess what – this rally has been more than erased.Miners not only closed below the February 14th opening price, butalso below the February 13th and 12th closing prices.Mining stocks big rally turned out to be nothing more than just a regular 50%retracement during a decline – something that we saw many times in the past andthat we described as likely. But, since the rally was rather inconsequential,then perhaps the decline is inconsequential as well?

Rememberhow mining stocks soared on Valentine’s Day and how we wrote that a rally isnot necessarily bullish? Guess what – this rally has been more than erased.Miners not only closed below the February 14th opening price, butalso below the February 13th and 12th closing prices.Mining stocks big rally turned out to be nothing more than just a regular 50%retracement during a decline – something that we saw many times in the past andthat we described as likely. But, since the rally was rather inconsequential,then perhaps the decline is inconsequential as well?

Notlikely.

It’snot likely because of the context. Gold is still relatively close to its recenthigh, but mining stocks are very close to their recent low. The latter are underperforming,and Valentine’s Day rally was just a verification of the breakdown in the HUIto gold ratio. Let’s take a look at the details, starting with the currencymarket (charts courtesy of http://stockcharts.com).

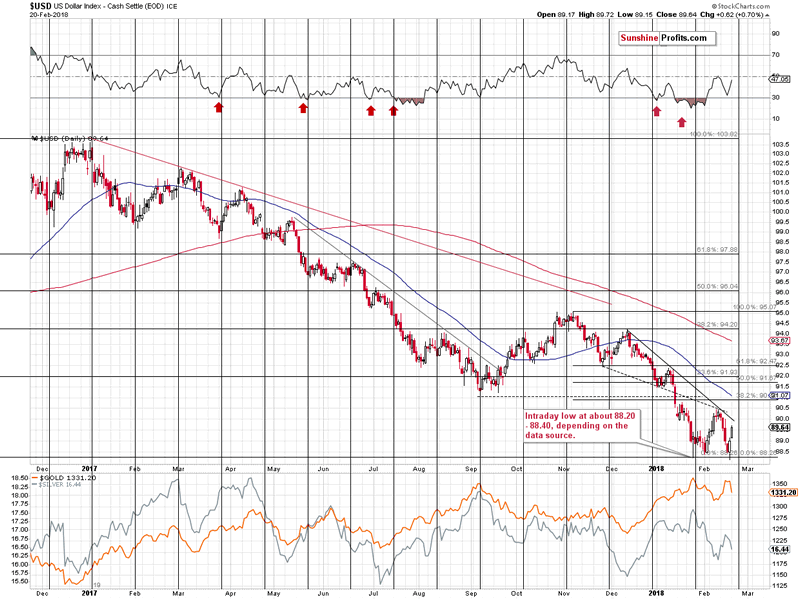

DuringFriday’s trading, The USD Index moved very insignificantly below the previous2018 low and rallied back up, invalidating almost all breakdowns belowimportant support levels. The remaining breakdown was invalidated yesterday ina clear way, so the outlook improved further.

Thechart above shows how significant the mentioned support levels actually are.Key tops and key Fibonacci retracements based on the key price extremes. Eachof them is important and their combination is even more important. The samegoes for the invalidation of breakdowns – the implications are bullish.

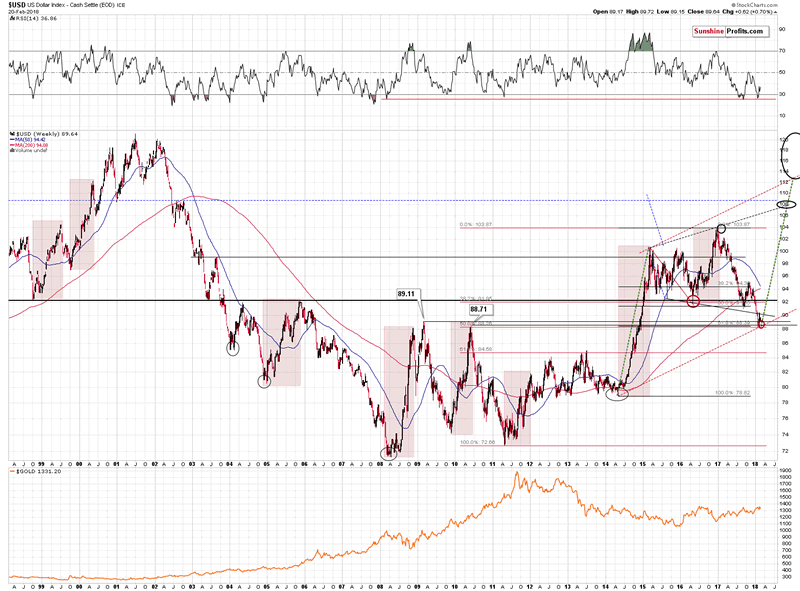

Pleasenote that earlier this year the USD Index broke below the declining support /resistance line based on the mid-2015 and 2016 lows and this breakdown wasverified recently. This is a bearish technical development, however, thecombination of the 2009 and 2010 tops along with 2 major retracements based onmajor extremes (marked with red and black on the above chart) is much strongerthan the above-mentioned declining line. The reason is that the mid-2015 and2016 lows are less prominent than the 2009 and 2010 tops and the line based onthe former is not strengthened by key Fibonacci retracements, while the latteris.

Consequently,the invalidation of breakdowns below thekey, long-term support levels is far more important than the decliningshorter-term line. That’s why all in all the outlook is bullish, but notbearish. At the moment of writing these words, the USD Index is trading at89.82, so it’s very close to the above-mentioned line – it could even be thecase that USD breaks decisively above 90 (the above-mentioned line is currentlya bit above 90) later today. Actually, we hope that the 90 level doesn’t giveup without a fight, but we expect that whether it happens shortly or in a weekor so, the decisive breakout above 90 will be seen followed by a bigger rally.

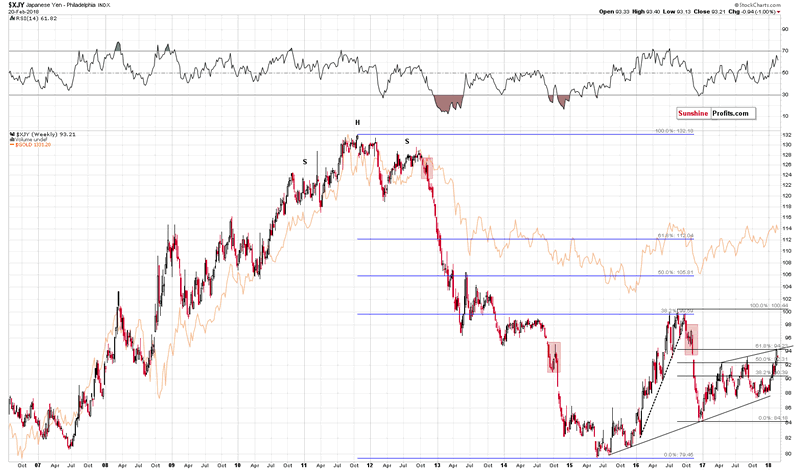

Aswe had indicated previously, it’s not just the entire USD Index’s picture thatpoints to a reversal – one of its most important (the second most important)components is pointing to a reversal as well.

TheJapanese yen reached a combination of strong resistance levels (risingmedium-term resistance line and the 61.8% Fibonacci retracement level), whichis quite likely to trigger a reversal. Knowing that the Japanese yen and gold very often move intandem suggests that precious metals have just formed a major top – just likethe yen probably did.

Speakingof precious metals, let’s take a look at gold.

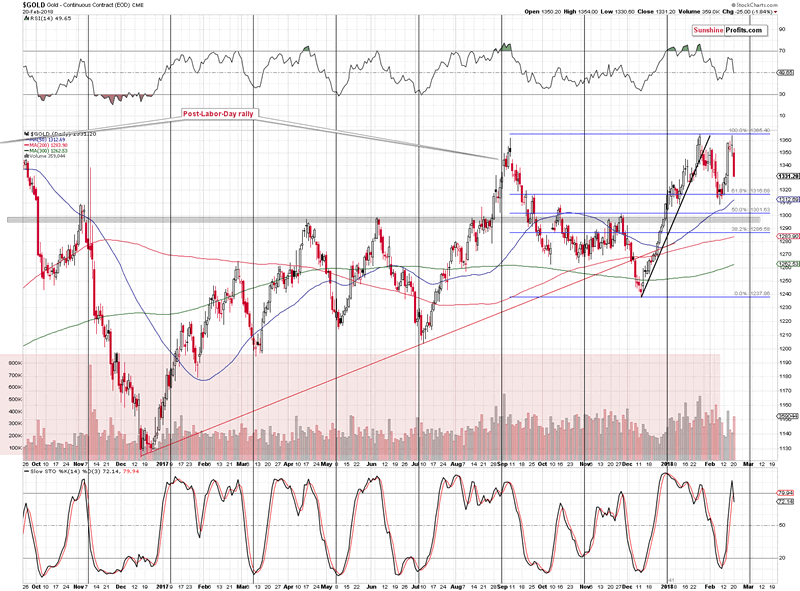

Inthe previous alerts, we warned that theprevious move higher was not to be trusted. We also wrote that during the previousdeclines (the ones that started in September 2017 and January 2018), there wassome back and forth movement close to the $1,335 in both cases, so we mightalso see the same here. If we indeed see such price movement, then we might alsosee additional signs from other markets that are necessary to strengthen orinvalidate the bearish outlook.

Yesterday’sdecline was much more volatile than the initial declines that followed theJanuary 2018 and September 2017 tops, but this doesn’t change the possibilityof seeing higher prices very temporarily before the slide continues. FromSeptember 14 to 15, gold rallied almost $20 before taking a plunge and fromFebruary 2 to 6, gold also rallied almost $20 before declining below $1,320. Ifwe’re lucky, we could see the same kind of pattern shortly. At the moment ofwriting these words, the pre-market low is $1,325, so an analogous rally mighttake gold to about $1,345. This doesn’t make it a very likely upside target,but something that’s worth keeping in mind. If gold moves to this level, itwill not be a bullish sign, but something in tune with the past – bearish –patterns.

But why do you hope for a fightfor 90 in the USD Index and a temporary rebound in gold? Aren’t you guysbearish for the medium term after all?

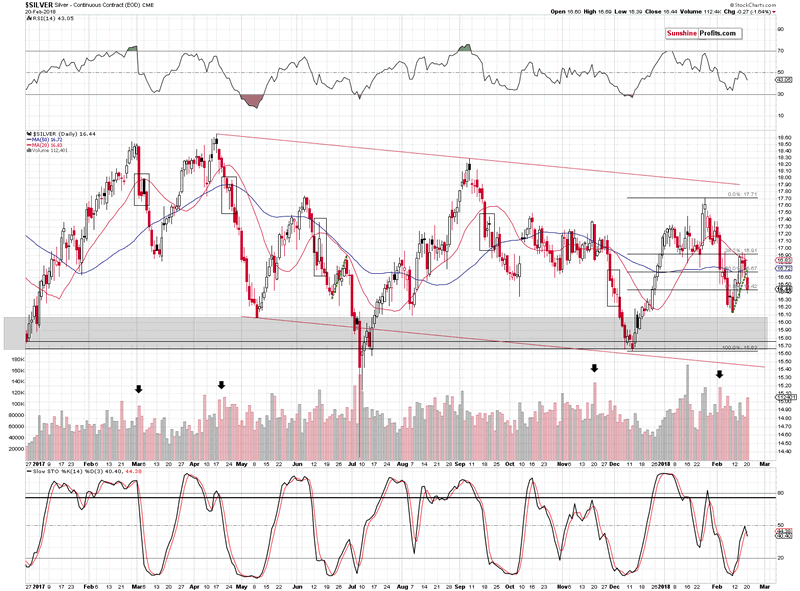

Wehope for the above, because if the above takes place, we might see a veryspecific sign from the silver market and if we do, the probability for adecline in the entire precious metals sector will greatly increase.

We’llleave details of the above-mentioned confirmation signal to our subscribers,but we can say that for now, we have a new sell signal from the Stochasticindicator, which already serves as a bearish sign. It’s not enough to changethe outlook in a dramatic way, though.

Havingsaid the above, let’s turn to mining stocks.

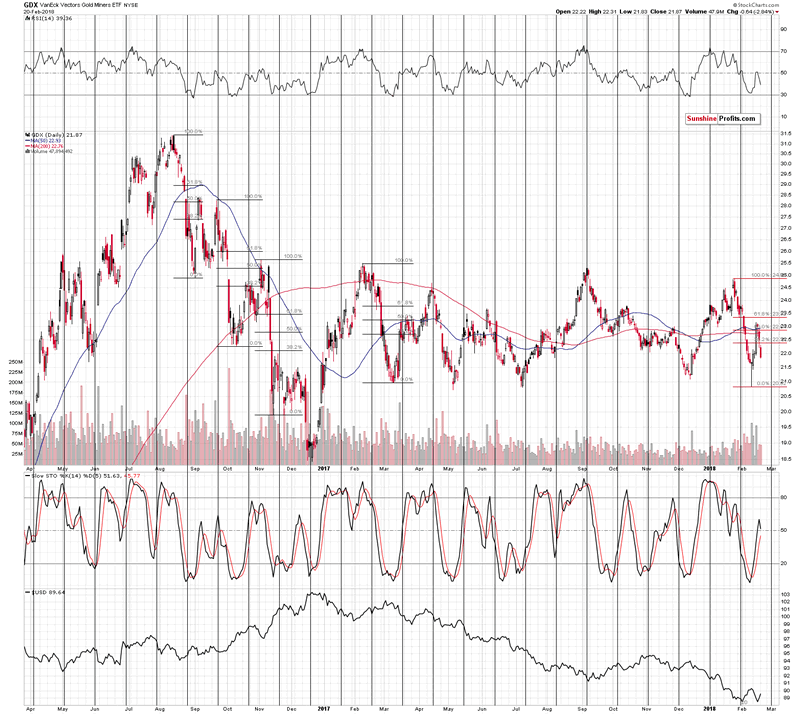

TheValentine’s Day rally is officially erased. And more. Not only did miningstocks erase the entire daily upswing that got everyone and their brotherexcited, but they also declined below the previous two trading days’ closingprices. In fact, yesterday’s closing price is the 4th lowest closeof the year.

Theabove is a sign of underperformance of mining stocks relatively to gold, whichis a bearish factor.

The50% retracement along with the 50- and 200-day moving averages seem to havestopped the rally. During the day of the rally we informed our subscribers thatthe miners are not likely to move much above the above-mentioned retracement asthat’s what happened during previous major declines.

Thelast big and volatile downswing that was followed by a sharp upswing in GDX wasseen in February and March 2017. The upswing took miners to about 50% Fibonacciretracement, before stopping. The preceding similar situations took place inthe second half of 2016. When GDX declined sharply in August, it rallied backup just a little above the 50% Fibonacci retracement. The decline that startedin September corrected initially to the 38.2% retracement, but ended only afterminers moved a bit above the 50% retracement. The November decline wascorrected to the 38.2% retracement.

Wejust saw something very similar to the above cases. Consequently, the recentrally was not a game-changer - it was a quite normal part of a decline.

Basedon the above and on the signs from USD and gold, we have most likely indeedseen a topping pattern.

But why did the mining stocksdecline so far and then rallied back up in the first place?

That’smost likely the impact of the price action in the main stock indices. Stocks’decline was very volatile, and it sank miners as well. The subsequent rebound contributedto miners’ revival. Then, once the volatility decreased, the impact that thegeneral stock market had on the miners decreased substantially as well. Inother words, things are now back to normal.

Whatis normal for mining stocks at this time? Most signs point to decline’scontinuation, but we should also take into account the possibility that thedecline could continue according to the pattern that is already in place. Ifyou examine the Fibonacci retracements that we marked on the above chart,you’ll see that it was usually the case (September 2016, November 2016,December 2016) that the initial rally in the miners was not the final onebefore the big slide. Consequently, ifwe see another short-term upswing here, it will not necessarily be a bullishfactor. In fact, it may – depending on the way it takes place and theaction in silver – even serve as a bearish sign.

MeasuringMiners’ Relative Performance

Beforesummarizing, we will feature our reply to a question that we received aboutout- and underperformance of mining stocks. The question was how to check it,since mining stocks generally multiple daily swings in gold in both directions.

Thereare couple of ways, in which one can compare the performance of mining stocksto the performance of gold.

Firstly,you can look at the percentage change on each day. This will not detect anysubtle out- and underperformance cases, but it's enough for the big ones. Forinstance, if gold is up by $4 or so and gold stocks are down 1% - it's clearthat the mining stocks are underperforming on that day. If the case is not thatobvious, we look at what was the usual way in which miners recently performedrelative to gold. Did it change and how significantly? If gold's rallies usedto be magnified 2x during a certain rally, but now it quickly declined to 1.5x,the 1x, then 0.5x and then to just 0.1x - it's a clear case of underperformanceand a bearish signal.

Secondly,you can look at the daily price moves as compared to most recent price swings.For instance, gold erases last month's decline, but miners erase only half oflast month's decline - that's a bearish sign.

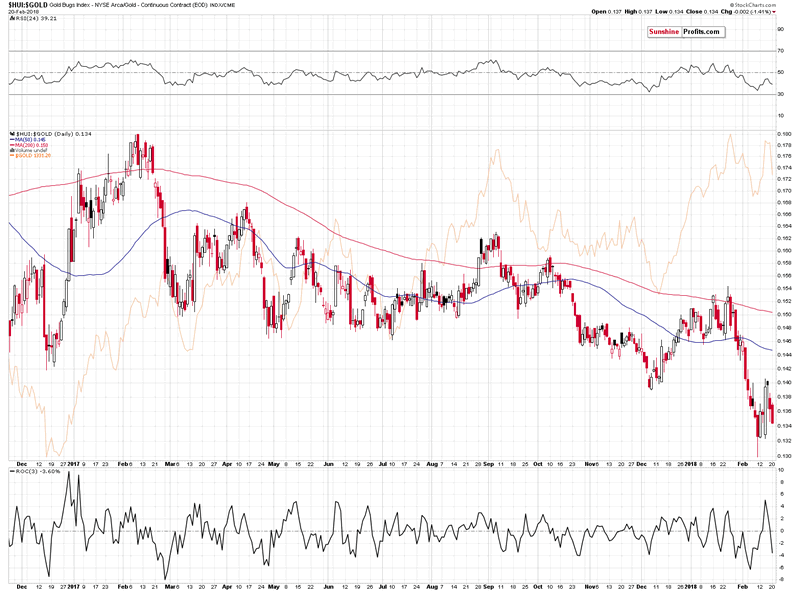

Thirdly,you can look at the GDX to GLD or HUI to gold ratios. If the ratio breaks belowa certain level or is in a clear short-term downtrend despite a move higher ingold, then it suggests that something is wrong with the rally and that it'sabout to end.

Forinstance, the breakdowns below the 2016 and 2017 lows in the HUI to gold ratioserved as a very bearish indication. The bearish implications remain in place asthe breakdown was recently verified by a correction back to it that wasfollowed by further declines.

Summingup, the top in gold, silver and mining stocks is most likely in and the underperformanceof mining stocks confirms it. Moreover, since the USD Index just invalidatedbreakdowns below its key support levels, it’s likely to rally, which is likelyto contribute to lower precious metals prices in the coming weeks. We might –and we hope that we do – see another small upswing in the PMs and this mightserve as an opportunity to add to our short positions or to close them.

If you enjoyed the above analysis and would like toreceive free follow-ups, we encourage you to sign up for our gold newsletter –it’s free and if you don’t like it, you can unsubscribe with just 2 clicks. Ifyou sign up today, you’ll also get 7 days of free access to our premium dailyGold & Silver Trading Alerts. Signup now.

Thank you.

Przemyslaw Radomski, CFA

Founder, Editor-in-chief

Toolsfor Effective Gold & Silver Investments - SunshineProfits.com

Tools für EffektivesGold- und Silber-Investment - SunshineProfits.DE

* * * * *

About Sunshine Profits

SunshineProfits enables anyone to forecast market changes with a level of accuracy thatwas once only available to closed-door institutions. It provides free trialaccess to its best investment tools (including lists of best gold stocks and best silver stocks),proprietary gold & silver indicators, buy & sell signals, weekly newsletter, and more. Seeing is believing.

Disclaimer

All essays, research and information found aboverepresent analyses and opinions of Przemyslaw Radomski, CFA and SunshineProfits' associates only. As such, it may prove wrong and be a subject tochange without notice. Opinions and analyses were based on data available toauthors of respective essays at the time of writing. Although the informationprovided above is based on careful research and sources that are believed to beaccurate, Przemyslaw Radomski, CFA and his associates do not guarantee theaccuracy or thoroughness of the data or information reported. The opinionspublished above are neither an offer nor a recommendation to purchase or sell anysecurities. Mr. Radomski is not a Registered Securities Advisor. By readingPrzemyslaw Radomski's, CFA reports you fully agree that he will not be heldresponsible or liable for any decisions you make regarding any informationprovided in these reports. Investing, trading and speculation in any financialmarkets may involve high risk of loss. Przemyslaw Radomski, CFA, SunshineProfits' employees and affiliates as well as members of their families may havea short or long position in any securities, including those mentioned in any ofthe reports or essays, and may make additional purchases and/or sales of thosesecurities without notice.

Przemyslaw Radomski Archive |

© 2005-2018 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.